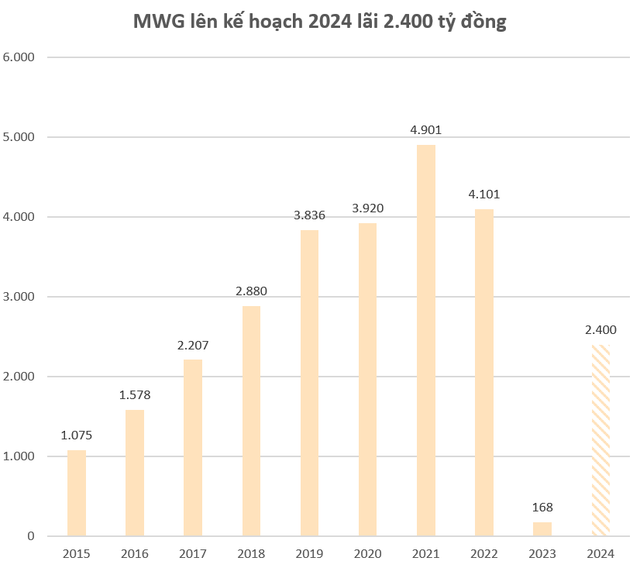

Mobile World Investment Corporation (stock code: MWG) has just announced its business plan for 2024 with a revenue of 125,000 billion VND and a post-tax profit of 2,400 billion VND, an increase of 5% and 14 times compared to the same period last year.

According to the leadership of MWG, in 2024 the Vietnamese economy still faces many challenges due to unpredictable macro fluctuations globally. The company chooses to proactively adapt to the changing business context, not having high expectations for a favorable recovery of purchasing power at this stage.

The overall consumer shopping demand remains flat, or even may decrease compared to 2023 for some non-essential products. However, after a comprehensive restructuring starting from Q4/2023, MWG believes that the company has room to continuously strengthen revenue and improve profit indicators.

Regarding specific plans for next year, for the operating retail chains, MWG may reduce the number of stores if they do not bring efficiency. In addition, the company will enhance service quality by focusing on improving employee productivity, diversifying product investments, and implementing promotional programs.

The Gioi Di Dong chain including Topzone and Dien May Xanh – retailing technology and electronics products will be the main pillar contributing about 65% of revenue and the main profit for MWG in 2024. These two chains will make efforts to maintain total revenue through optimizing store networks and exploiting opportunities to increase market share in potential industries/brands/segments. At the same time, the chains will improve business performance and absolute profitability.

Bach Hoa Xanh – a retail store for food and consumer goods is expected to contribute about 30% of MWG’s revenue, achieving double-digit revenue growth, increasing market share, and starting to generate profits from 2024. This year, MWG plans to open new Bach Hoa Xanh stores selectively to ensure effectiveness, continue to grow revenue at existing stores, and optimize costs, especially warehouse costs to achieve annual profitability at the company level.

As for Nha Thuoc An Khang – a retail store for pharmaceuticals, it is expected to achieve double-digit revenue growth, increase market share, and achieve break-even before 31/12/2024. MWG said that in 2024, An Khang may enter an expansion phase if it operates steadily, effectively, and builds a successful business model.

Regarding the AVA Kids chain – a retail store for mother and baby products, it is expected to achieve double-digit revenue growth, increase market share, and achieve break-even before 31/12/2024. This chain will not focus on expanding point of sales; stores will serve as display and product introduction points, while resources will be concentrated on boosting online sales.

Lastly, the EraBlue chain – retailing technology products and electronics in Indonesia is expected to achieve double-digit revenue growth, increase market share, and become the number one electronics retailer in Indonesia in 2024. This year, EraBlue will refine its business model to be ready for expansion, may open new selectively-located stores to ensure effectiveness, continue growth in revenue at existing stores. In addition, the chain will seek opportunities to increase profitability through diversifying product portfolios and boosting sales volume, building a competitive advantage in superior services.

MWG expects to continue growing online sales and estimates the contribution of online to revenue of the company’s business sectors from 5% to 30% depending on the characteristics of each sector.