The Vietnamese stock market witnessed a booming session on Friday, with the VN-Index surging by nearly 29 points to close at 1,252. This positive momentum can be attributed to the spillover effect from global stock markets. The trading value on HOSE exceeded 23 trillion VND, indicating improved liquidity. However, foreign investors turned net sellers, offloading nearly 87 billion VND worth of shares across the market, ending a five-day net buying streak.

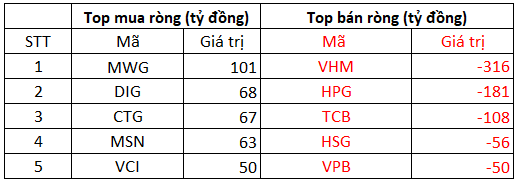

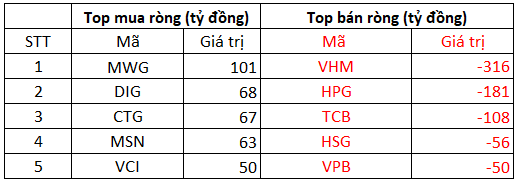

On HOSE, foreign investors sold a net amount of 76 billion VND.

In terms of buying activity, MWG topped the list with over 101 billion VND in negotiated purchases. DIG and CTG followed suit, with net purchases of 68 billion VND and 67 billion VND, respectively. Additionally, MSN and VCI attracted buying interest, with net purchases of 63 billion VND and 50 billion VND, respectively.

On the other hand, VHM faced the strongest selling pressure from foreign investors, witnessing net selling of nearly 316 billion VND. HPG and TCB also experienced net selling of 181 billion VND and 108 billion VND, respectively.

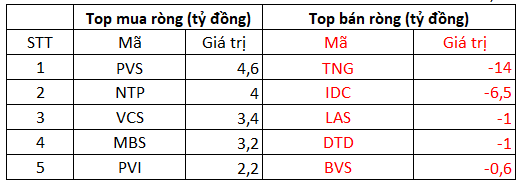

On HNX, foreign investors bought a net amount of 1 billion VND

PVS led the net buying on HNX, with a net purchase value of 4.6 billion VND. NTP followed closely, with net buying of 4 billion VND. Additionally, foreign investors also net bought a few billion VND worth of VCS, MBS, and PVI shares.

On the selling side, TNG faced the highest net selling pressure, with foreign investors offloading nearly 14 billion VND worth of shares. IDC, LAS, and DTD also witnessed net selling in the range of a few billion VND.

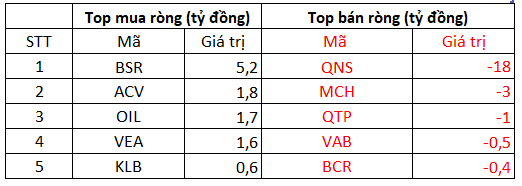

On UPCOM, foreign investors sold a net amount of 12 billion VND

Conversely, QNS faced net selling pressure, with foreign investors offloading nearly 18 billion VND worth of shares. Additionally, MCH and QTP were among the stocks that experienced net selling by foreign investors.