A surge from global stocks propelled the index to explosive heights during Friday’s trading session, with a deluge of capital inflows not seen in three months. The index soared to a staggering 1,252 points at closing, marking a substantial increase of 28.67 points, or 2.34%. The number of advancing stocks far outpaced declining ones at a ratio of 10 to 1, leaving no industry sector in the red.

Among the large-cap sectors, Real Estate and Banking witnessed increases of 2.71% and 1.74%, respectively. The Securities sector led the charge with a remarkable 5.6% gain, followed by Telecommunications at 4.74%, Construction Materials at 3.33%, Information Technology at 1.65%, and Transportation at 2.33%. The top 10 stocks contributing the most to the market’s performance were led by GVR, which added 1.84 points, followed by BID with 1.17 points, MWG with 1.10 points, and MBB with 1.03 points. LPB, CTG, MSN, GAS, and others also made significant contributions.

As investor sentiment improved, the market witnessed a torrent of capital inflows, with total trading volume across the three exchanges reaching a three-month high of over VND26,000 billion. Foreign investors sold a negligible amount, amounting to just VND84.2 billion, while their matched orders resulted in a net buy value of VND146.5 billion.

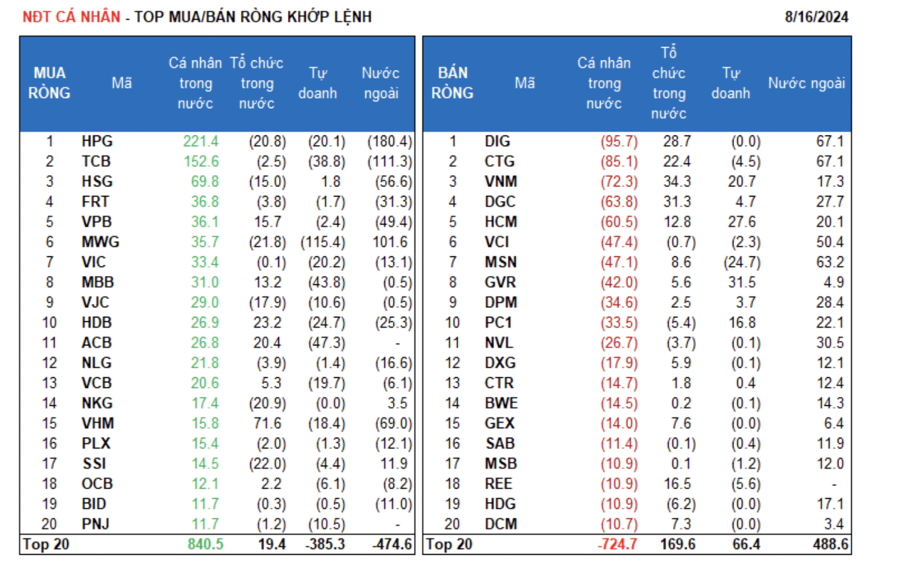

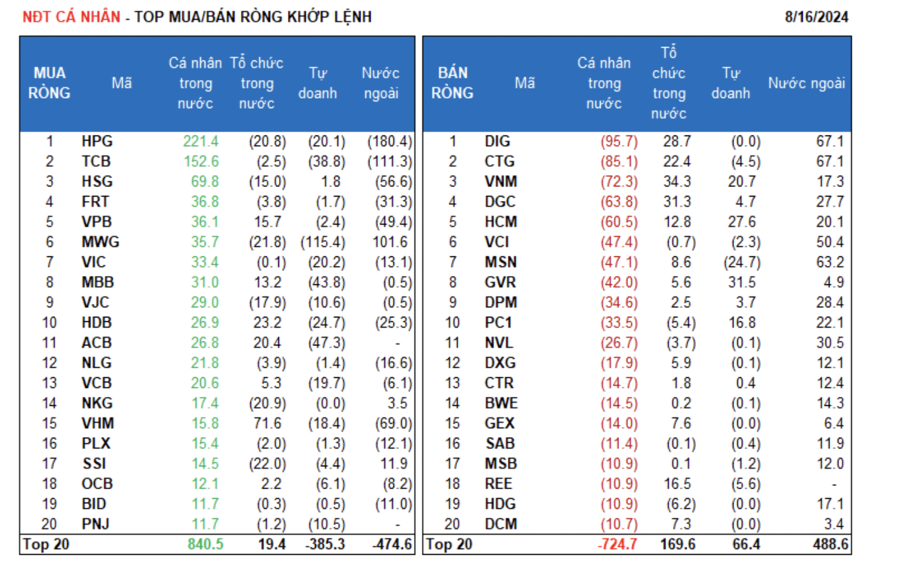

Foreign investors’ net buy orders on a matched basis were focused on the Food & Beverage and Retail sectors. The top stocks purchased by foreign investors on a matched basis included MWG, CTG, DIG, MSN, VCI, VND, NVL, DPM, DGC, and FPT.

On the selling side, foreign investors offloaded Basic Materials stocks on a matched basis. The top stocks sold by foreign investors on a matched basis were HPG, TCB, VHM, HSG, VPB, FRT, HDB, NLG, and LPB.

Individual investors net bought VND317.4 billion worth of shares, while their net sell value on a matched basis stood at VND60.4 billion. On a matched basis, they net bought 8 out of 18 sectors, primarily focusing on Basic Materials. The top stocks purchased by individual investors included HPG, TCB, HSG, FRT, VPB, MWG, VIC, MBB, VJC, and HDB.

On the selling side, on a matched basis, they offloaded stocks in 10 out of 18 sectors, mainly in the Chemicals, Food & Beverage, and Consumer Staples sectors. The top stocks sold by individual investors on a matched basis included DIG, CTG, VNM, DGC, HCM, VCI, GVR, DPM, and PC1.

Proprietary traders net sold VND438.1 billion worth of shares, with a net sell value of VND409.8 billion on a matched basis.

On a matched basis, proprietary traders net bought 4 out of 18 sectors, with Chemicals and Financial Services leading the way. The top stocks purchased by proprietary traders on a matched basis included GVR, HCM, VNM, PC1, TCH, LPB, E1VFVN30, DGC, DPM, and HSG.

The top stocks sold by proprietary traders on a matched basis were from the Banking sector, including MWG, ACB, MBB, TCB, MSN, HDB, STB, VIC, HPG, and VCB.

Domestic institutional investors net bought VND194.0 billion worth of shares, with a net buy value of VND323.7 billion on a matched basis. On a matched basis, domestic institutions net sold 9 out of 18 sectors, with Basic Materials leading the way. The top stocks sold by domestic institutions on a matched basis included SSI, MWG, VND, NKG, HPG, VJC, HSG, PVP, HDG, and PC1.

On the buying side, they focused on the Banking sector, with the top net buys on a matched basis including VHM, FUEVFVND, VNM, DGC, DIG, HDB, CTG, STB, ACB, and REE.

Block trades today amounted to VND1,713.7 billion, a slight increase of 4.7% from the previous session, contributing 6.6% to the total trading value.

Today’s block trades mainly involved individual investors in the Banking sector (EIB, SSB, TCB, ACB, MSB) and some other familiar stocks (VJC, VIC, KOS, FPT).

The allocation of capital flow ratios witnessed a decrease in Banking, Consumer Staples, Construction, Steel, Agriculture & Seafood, Utilities, and Oil & Gas Equipment. Meanwhile, there was an increase in Securities, Retail, and Construction Materials, while Real Estate remained unchanged. Specifically, for matched orders, the capital flow ratio increased for mid-cap stocks (VNMID) and decreased for large-cap and small-cap stocks (VN30 and VNSML, respectively)