A good credit score can get your loan application approved quickly, while a low score can lead to rejection. Therefore, it’s crucial to pay attention to personal financial management and take necessary measures to improve your CIC score.

What is the CIC Credit Score?

CIC, or the Credit Information Center, is an organization under the State Bank of Vietnam that functions as a repository of individuals’ and enterprises’ credit history information. It provides banks and credit institutions with information on an individual’s or enterprise’s creditworthiness, credit activity, and bad debt status across the country’s banking system.

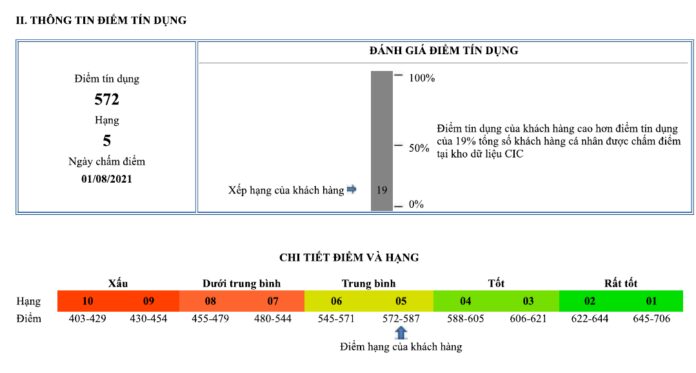

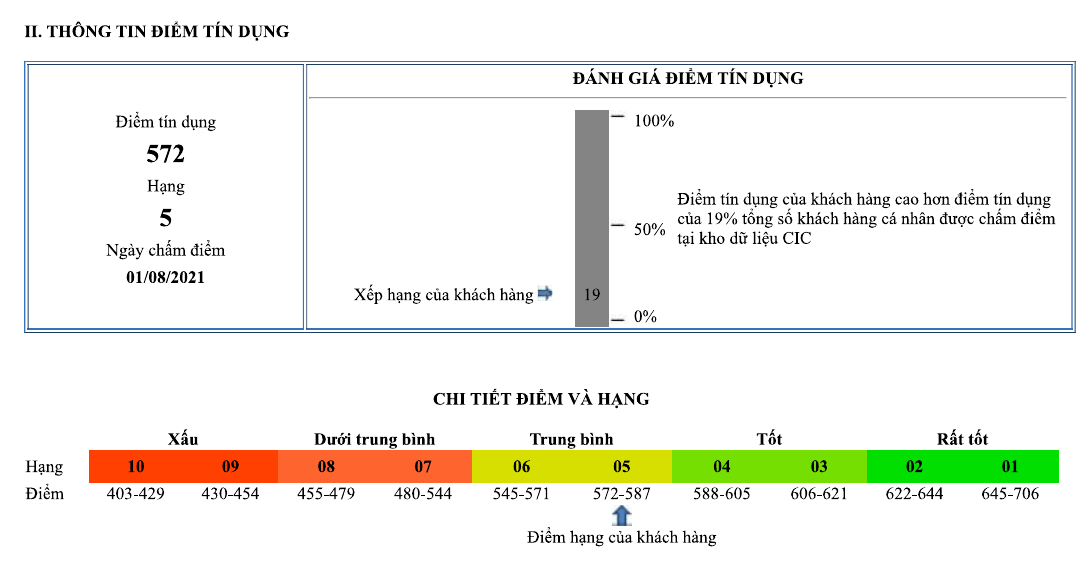

A higher credit score corresponds to a lower risk of non-payment and better access to credit. Note that the risk category in the credit report is distinct from the bad debt group. The risk category is assigned by CIC based on the customer’s credit score (10 categories), while the bad debt group is assigned by the credit institution with which the customer has a relationship, according to the State Bank’s regulations (5 debt groups).

How is the CIC Score Calculated?

According to CIC’s personal credit scoring model, customers’ credit scores are assigned based on the principle of “Low Category, High Score – Low Risk; High Category, Low Score – High Risk.” Specifically, the credit scores of borrowers (ranging from 403 to 706) are divided into 5 levels:

- – Poor (Category 9, Category 10): Score 403-454

- – Below Average (Category 7, Category 8): Score 455-544

- – Average (Category 5, Category 6): Score 545-587

- – Good (Category 3, Category 4): Score 588-621

- – Excellent (Category 1, Category 2): Score 622-706

Why Do Customers Need to Improve Their Credit Score?

Neglecting personal financial management and failing to repay loans on time can lead to late payments, bad debts, and a low CIC score. This not only affects one’s financial situation and credibility but also has a negative impact on future borrowing and creditworthiness.

On the other hand, customers with high credit scores are more likely to be approved for loans with preferential interest rates and faster credit card approvals with higher limits.

Thus, customers should focus on personal financial management, regularly monitor their CIC credit score, and take necessary steps to improve it if needed.

Measures to Improve Your CIC Credit Score:

Here are some measures to enhance your CIC score:

Borrow or Apply for Credit Only When Necessary

Borrow or apply for credit only when you truly need it, and make sure to calculate your repayment ability based on your actual income to avoid exceeding the recommended maximum debt.

Develop a Suitable Debt Repayment Plan

To maintain a positive credit history with CIC, create a plan to repay your debts in full and on time. Always consider your financial situation when planning your expenses, and make debt repayment a priority, even for small amounts. Use debt reminder tools, such as phone memo apps, to avoid being classified into bad debt groups (groups 3, 4, and 5).

Regularly Check Your Credit History

Regularly review your credit information to monitor your creditworthiness and prevent identity theft. Contact your credit institution if you find any inaccuracies in your credit report to resolve the issue promptly.

Focus on Repaying Existing Debts and Avoid New Ones

If you have multiple debts, prioritize repaying your current balances and avoid taking on new debts, especially unsecured or consumer loans.

Make Full and Timely Payments if You Have Bad Debts

If you are on the bad debt list and your information is stored in CIC, the only way to clear your bad debt is to repay the full principal and interest on your credit card debt.

CIC will not provide bad debt history information once customers have fully repaid debts below VND 10 million. However, for debts exceeding VND 10 million, the bad debt history and late payment information will be stored for a maximum of 5 years, and customers will have to wait for 5 years to be eligible for loan approval again.

Additionally, according to CIC, there is no mechanism to erase debts at CIC, and no organization or individual can do so. Therefore, customers must pay the debt, including principal and interest, to avoid late payment charges. After settling the debt, customers should proactively inform the credit officer to close the debt and verify if necessary.

By following these principles, customers can establish a reliable credit history and increase their chances of receiving better financial benefits.

Saigon Glory Bond Scandal: Bitexco Chairman’s Plea for Payment Extension

Mr. Vu Quang Hoi, Chairman of Bitexco Group, has recently sent a heartfelt letter to the bond investors of Saigon Glory Company requesting an extension for the payment deadline.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.

Bring charges and arrest NHNN Inspector for forging documents to deceive

Phạm Trọng Cường, an expert in the field of State Bank Inspection and Supervision – Ho Chi Minh City branch, has recently been arrested by the Ho Chi Minh City Police for investigation into fraudulent activities involving misappropriation of assets and the use of counterfeit official stamps and documents.

Mounting debt forces businesses to sell off assets for financial stability.

Faced with the overwhelming burden of mounting debts, especially the pressure from billions of dong worth of bonds, many businesses are forced to liquidate assets or transfer subsidiary companies to balance their finances.