In November last year, when MWG shares of The Gioi Di Dong plunged to a 3-year low, few investors dared to put their faith in the retail “giant.” This was especially true as buying power was weak and mobile retailers were caught up in a price war that was “costly and wasteful.”

However, things changed dramatically soon after. MWG shares recovered strongly to reach 69,000 VND/share, the highest in almost 2 years since September 2022. But the journey upward was not without its bumps and dips. While the upward trend was preserved, this stock also went through many shakes and even deep corrections, especially in the past few months as it approached the long-term peak.

MWG share price movement in the past year

After overcoming countless obstacles, MWG shares finally had an impressive “break” that reassured shareholders. Market capitalization also surpassed VND 100 trillion, up more than 60% since the beginning of the year and only about 12% lower than the peak reached in mid-April 2022.

The comeback of MWG can be considered spectacular, as the stock disappointed shareholders a year ago. Mr. Nguyen Duc Tai, Chairman of the Board of Directors, even apologized to shareholders for the company’s poor performance in 2023, as profits plummeted to a record low and shares declined sharply.

“MWG shares did not deliver returns to investors in 2023, but many investors still held on to the shares and believed in the future. This is valuable to the corporation. We will strive to improve our business performance in 2024 and expect this efficiency to be reflected in the company’s value and shareholder returns,” Mr. Tai shared.

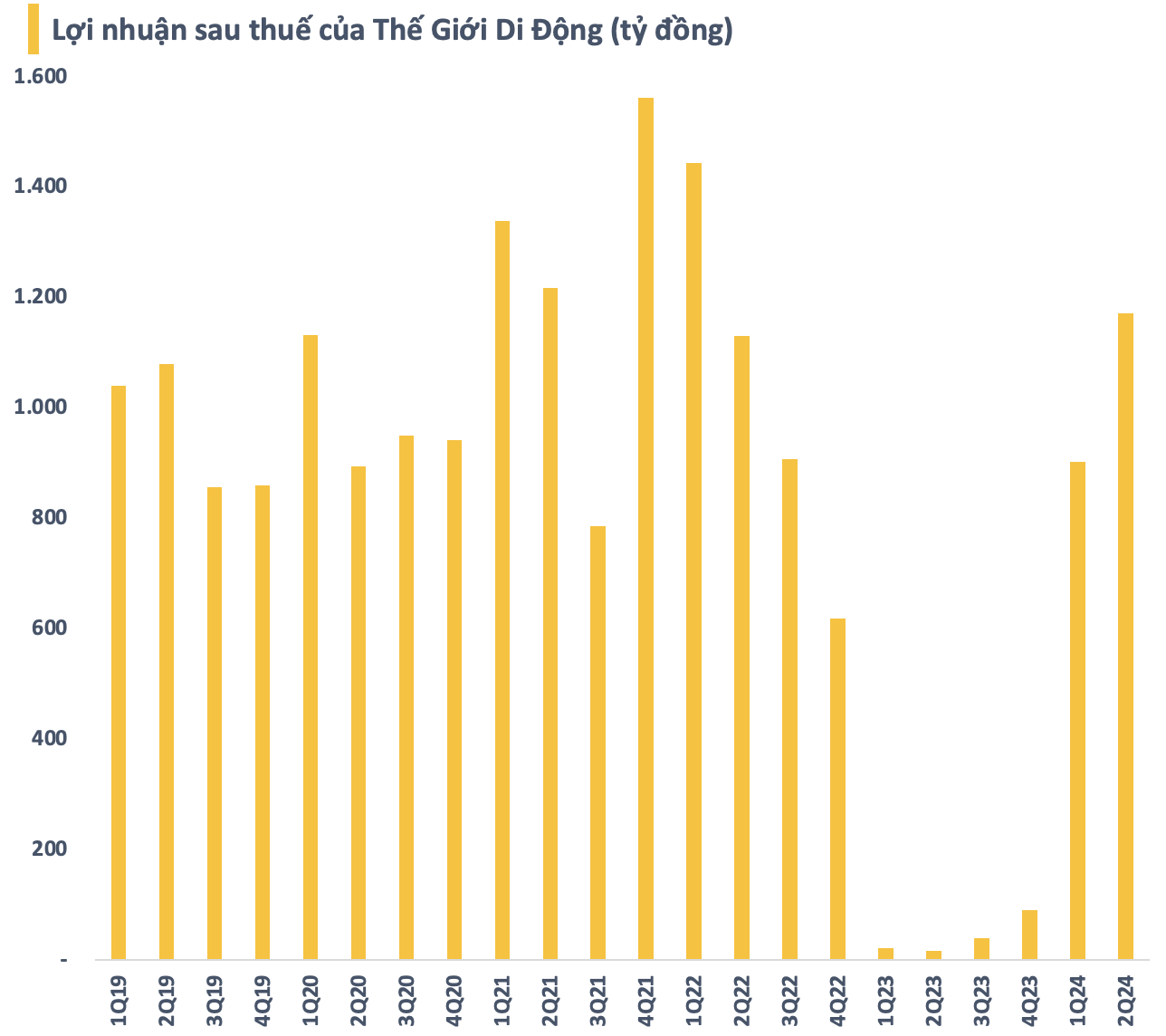

In fact, Mr. Tai did not make empty promises. MWG has just had two consecutive profitable quarters with a remarkable growth rate compared to the same period in 2023. In the first 6 months of the year, MWG recorded net revenue of VND 65,621 billion and net profit of VND 2,075 billion, up 16% and 5,200%, respectively, compared to the first half of 2023.

MWG’s business results in the first half of 2024

In 2024, MWG set a target of VND 125,000 billion in revenue, up 5% compared to the same period, and a net profit of VND 2,400 billion, more than 14 times the figure achieved in 2023. With the results achieved in the first half, this retailer has completed 52.5% of the revenue plan and 86.5% of the profit target for the whole year.

According to MWG’s management, consumer spending will generally stagnate or even decrease compared to 2023 for some non-essential items. However, with a healthy financial foundation and a streamlined “body” after restructuring, MWG’s Chairman said the company is ready to cope with market fluctuations and has the capacity and determination to realize its goals in 2024.

Along with the recovery of the ICT&CE segment, MWG’s two strategic moves, the Bach Hoa Xanh (BHX) chain in Vietnam and the EraBlue chain in Indonesia, are also bearing fruit.

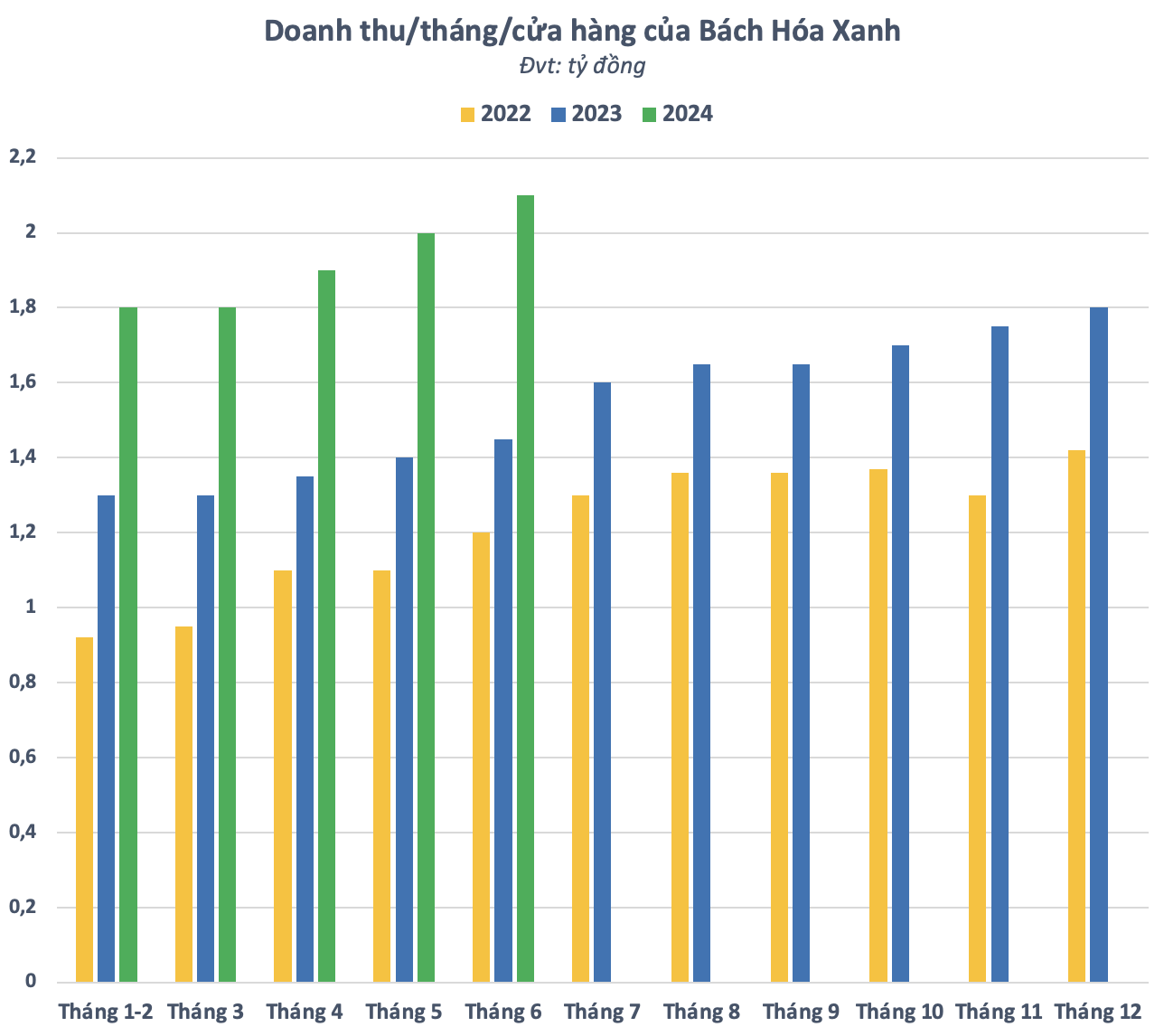

After 8 long years of waiting, BHX finally turned a profit in the second quarter, although the number was still modest (estimated at about VND 7 billion). In June 2024, BHX’s revenue exceeded VND 3,600 billion, the highest in 3 years. The average revenue reached VND 2.1 billion/store/month, the highest ever, equivalent to the period in July 2021.

BHX’s business results in June 2024

BHX is expected to be a key growth driver for MWG, according to the company’s leadership. Mr. Pham Van Trong, CEO of BHX, also confidently stated that a four-digit profit (VND thousand billion) for this chain is achievable within the next 1-2 years.

Mr. Nguyen Duc Tai also shared that the BHX chain will develop to a large enough scale and be listed on the stock exchange, as promised to investors and as expected by shareholders. “When the scale is large enough, and a profit of thousands of billions appears, that is when BHX will be ready to go public,” MWG’s Chairman emphasized.

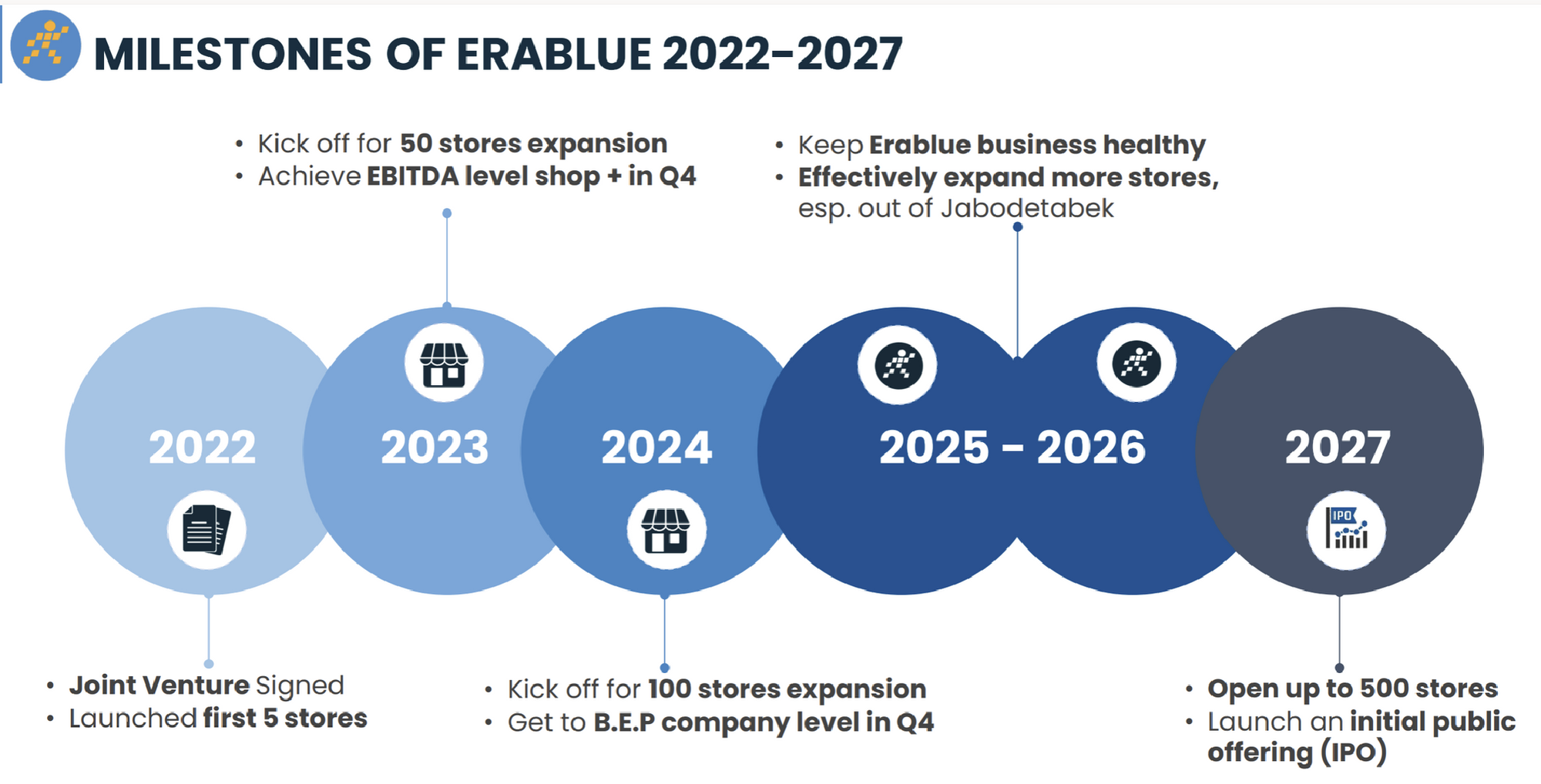

Meanwhile, EraBlue is also getting closer to system-level profitability after three consecutive months of making a profit. In early August, the two parties in the EraBlue joint venture, MWG and Erajaya, agreed to target a profit at the company level before the fourth quarter of 2024. This will be the basis for accelerating the expansion of EraBlue in 2024 and the following years.

Profitability at the company level will be a stepping stone for EraBlue to expand aggressively. The number of stores is expected to reach nearly 100 by the end of 2024 and 500 by 2027. Thus, on average, at least 10 EraBlue stores will be opened each month during the period from 2025 to 2027. When they reach the target of 500 stores, both parties do not rule out the possibility of an IPO and listing on the Indonesian stock exchange after 2027.

EraBlue’s development plan

In the future, if BHX and EraBlue succeed, they will have a significant impact on MWG’s prospects. With the current situation, it is likely that these two “powerhouses” of Mr. Nguyen Duc Tai will go public and be listed on the stock exchange in 2027. When that happens, these two “blockbusters” could trigger a strong re-rating for MWG.