State-Owned Enterprise Invests in Electric Vehicle Charging Stations

Following the trend of green development, the use of environmentally friendly electric vehicles is becoming a popular choice for many consumers. According to S&P Global, electric vehicle sales are expected to reach 16.2% of total vehicle sales by 2024, a significant increase from the 12% predicted for 2023.

As electric vehicle manufacturers introduce new products and penetrate deeper into the market, the demand for electric vehicle charging infrastructure also grows. Scoopmarket’s research predicts a surge in the global electric vehicle charging infrastructure market from $25.2 billion in 2023 to a notable $224.8 billion in 2032. Additionally, the compound annual growth rate (CAGR) during this period is expected to be 27.5%.

Vietnam is no exception to this trend. Currently, VinFast is the only domestic automaker in Vietnam that has developed a large-scale electric vehicle charging system, with an impressive 150,000 charging ports across 63 provinces and cities. VinFast has also partnered with major petroleum companies, Petrolimex and PV Oil, to install electric charging stations at their gas stations nationwide.

PV Power’s Pilot Charging Station

However, the market is becoming more vibrant with the entry of the Vietnam Petroleum Power Joint Stock Company (PV Power – stock code: POW). According to information from POW, the enterprise is researching and investing in the construction of a pilot electric vehicle charging station. POW has signed a cooperation agreement with EN Technologies Inc. to develop and establish a charging system in Vietnam.

The first pilot charging station will be located on Huynh Thuc Khang Street in Hanoi, with a total investment cost of over VND 1.8 billion. The fast-charging station will have a total capacity of 100-120kW and will occupy an area of 30-35 square meters. It will consist of two charging cabinets, each equipped with two charging ports capable of delivering 50-60kW of power per port. The average charging rate is expected to be VND 3,858 per kWh, similar to VinFast’s charging stations and lower than some other providers like EverCharge and EV One.

According to PV Power, the construction of these pilot stations is the first step towards more ambitious goals of expanding the number, location, and capacity of charging stations nationwide.

What is PV Power and What is its Business Focus?

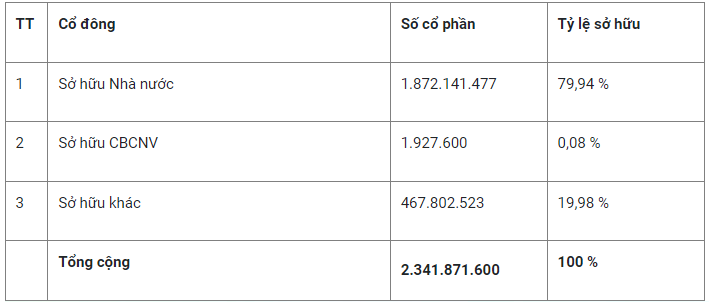

The Vietnam Electricity and Petroleum Joint Stock Company (POW) was established in 2007 as a subsidiary of the Vietnam National Oil and Gas Group (PetroVietnam). POW underwent privatization at the end of 2017 and was subsequently listed on the UPCOM stock exchange in 2018 before moving up to the HOSE exchange in 2019. According to its official website, nearly 80% of the company’s shares are currently owned by the State.

POW’s Shareholder Structure

POW owns eight power plants across the country, with a total installed capacity of 4,205 MW, accounting for approximately 5.4% of Vietnam’s total installed power capacity. The company ranks second in terms of maximum capacity among listed companies, just behind GENCO3 (PGV) with a total capacity of 7,000 MW.

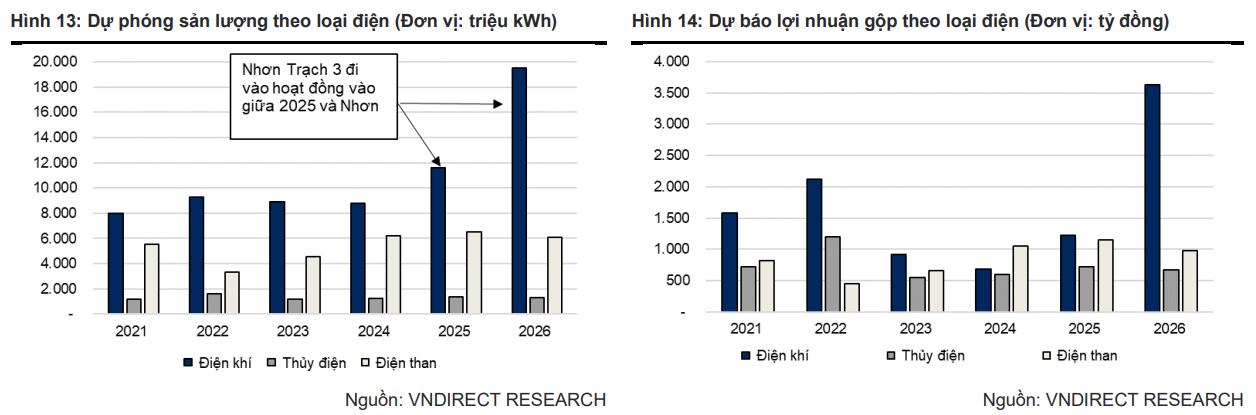

POW primarily focuses on gas-fired power generation, with a gas-fired capacity of 2,700 MW, representing 64% of POW’s total capacity and 38% of the country’s gas-fired power market share. Coal-fired and hydroelectric power contribute 29% and 7% to the company’s total capacity, respectively. POW utilizes modern gas turbines in its power plants, resulting in a high capacity utilization rate of 62.9%.

The company is currently executing two key projects, Nhon Trach 3 & 4, with a total investment of $1.4 billion, expected to be operational in the 2025-2026 period. These new units will have a combined capacity of 1.5 GW and will be equipped with General Electric’s 9HA.02 gas turbines, one of the most advanced gas turbine models in the world. Nhon Trach 3 & 4 will be the first power projects in Vietnam to utilize liquefied natural gas (LNG), contributing to the country’s carbon emission reduction commitments.

Ca Mau 1&2 Power Plants

In terms of financial performance, POW’s second-quarter financial report showed a 12% year-on-year increase in net revenue, reaching VND 9,400 billion. Cost of goods sold increased at a lower rate of 9%, resulting in a 54% surge in gross profit to VND 724 billion.

Financial income for the period rose by 8% to VND 131 billion, while financial expenses increased by 69% to VND 229 billion, mainly due to foreign exchange losses. A 13% reduction in selling and administrative expenses resulted in a decrease to VND 181 billion. POW’s net profit for the quarter was VND 401 billion, triple that of the previous year.

For the first six months of the year, POW recorded nearly VND 15,700 billion in net revenue and a net profit of VND 678 billion. The company has set targets for 2024, aiming for a net revenue of VND 31,700 billion (an 11.9% increase year-on-year) and a net profit of VND 824 billion (a 35.7% decrease year-on-year). Compared to the plans approved by the 2024 Annual General Meeting of Shareholders, the company has achieved 49.5% of its net revenue target and 82% of its net profit goal.

As of the end of June, POW’s total assets amounted to nearly VND 81,000 billion, with over VND 32,500 billion in short-term assets (a 12% increase). Of this, over VND 12,500 billion was in cash, an increase of 16%, held in the form of cash or savings deposits.

Due to the need to invest in large-scale projects, POW currently has insufficient charter capital. The company is in the process of formulating plans to increase capital in 2024, including paying dividends in shares.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.