In recent news, the Binh Son Refinery and Petrochemical Joint Stock Company (BSR) has released its audited semi-annual financial statements. According to the auditor’s conclusion, on May 27, 2024, the Court issued Decision No. 01/2024/QD-MTTPS to initiate bankruptcy proceedings against BSR-BF, thereby terminating BSR’s control over BSR-BF. As a result, BSR-BF’s financial statements are no longer consolidated into BSR’s consolidated mid-year financial statements as of that date.

Previously, at the 2024 Annual General Meeting, the management shared that BSR had missed its deadline to switch stock exchanges due to non-compliance with one of the criteria related to overdue debts. This was attributed to the Company’s subsidiary, Central Petroleum Biofuel Joint Stock Company (BSR-BF), which had overdue debts of nearly VND 1,100 billion (equivalent to 1.5% of BSR’s total assets) at the end of 2023, affecting the company’s consolidated financial statements.

With the Court’s decision to initiate bankruptcy proceedings against BSR-BF, BSR has now met the listing requirements of the Ho Chi Minh City Stock Exchange (HoSE) regarding overdue debts.

Recently, BSR also announced the Board of Directors’ resolution on the listing of BSR shares on HoSE. Accordingly, the Board will work on finalizing the list of shareholders to establish a shareholder registry with the Vietnam Securities Depository and Clearing Corporation (VSDC) and prepare to submit the necessary documents and complete related procedures for listing in 2024.

In terms of business results for the first six months, BSR recorded VND 55,113 billion in revenue and VND 1,884 billion in after-tax profit, down 19% and 36%, respectively, compared to the same period in 2023. With these results, the company has surpassed its full-year profit plan by 64% (VND 1,148 billion) just halfway through the year.

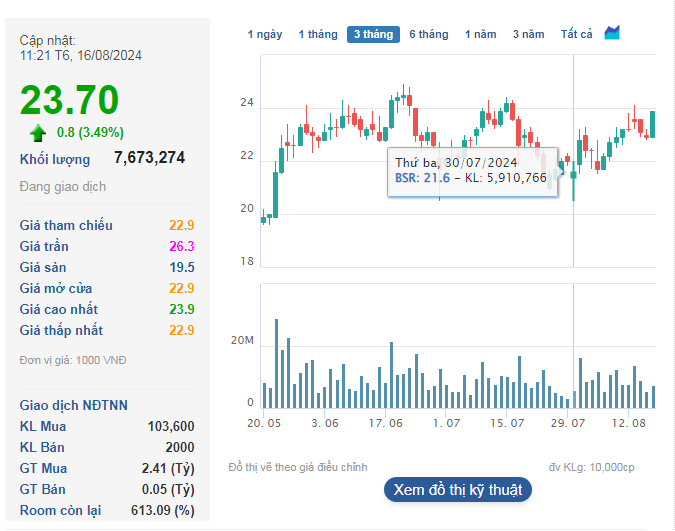

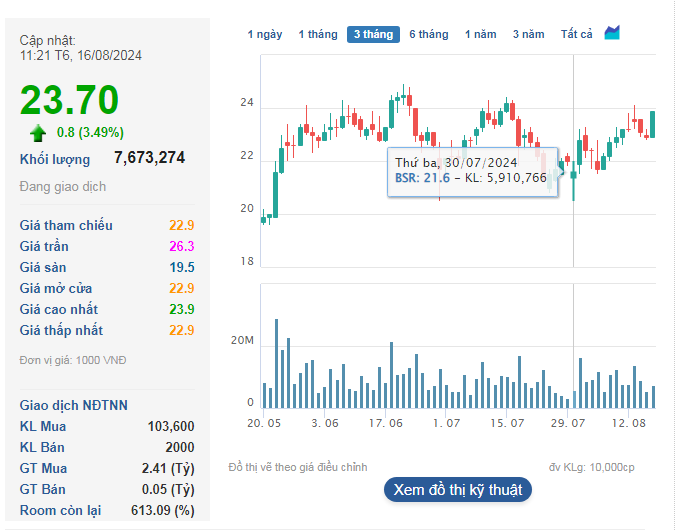

As of the morning trading session on August 16, BSR shares were trading at VND 23,200 per share, up nearly 28% since the beginning of 2024.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.