Illustration

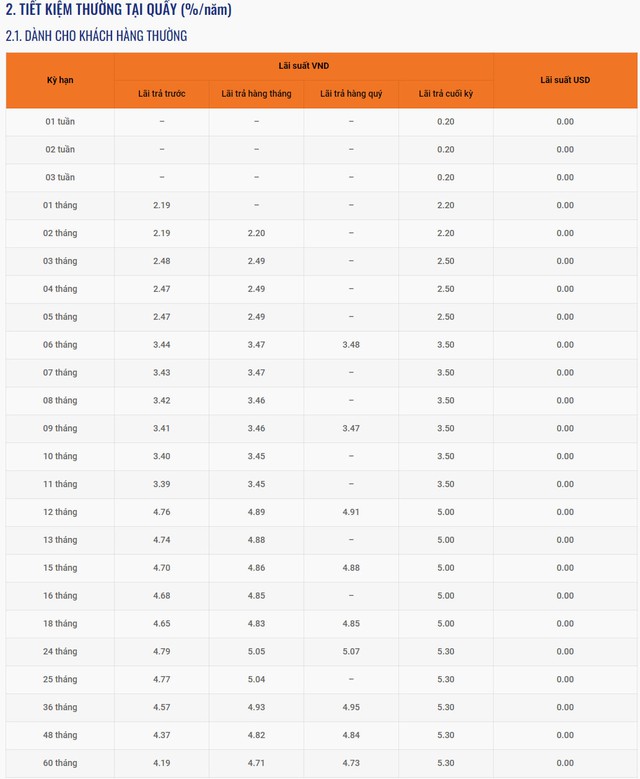

LPBank’s Over-the-Counter Savings Interest Rates for Individual Customers in August 2024

A mid-August survey revealed that the State Commercial Joint Stock Bank of Loc Phat (LPBank) offers savings interest rates ranging from 0.2% to 5.3% per annum for deposits made at the counter, with interest paid at maturity.

Specifically, short-term deposits with tenors of less than one month earn an interest rate of 0.2% per annum. Deposits with a tenor of one or two months earn an interest rate of 2.2% per annum, while those with a tenor of three to five months earn 2.5% per annum. Deposits with a tenor of six to eleven months earn an interest rate of 3.5% per annum, and those with a tenor of twelve to eighteen months earn a rate of 5% per annum.

The highest interest rate offered to regular customers making deposits at the counter is 5.3% per annum, applicable to tenors of 24 to 60 months.

In addition to the option of receiving interest at maturity, LPBank also offers alternative interest payment frequencies for customers to choose from, including: receiving interest in advance, monthly interest payments, and quarterly interest payments.

Notably, for new or renewed deposits with a tenor of thirteen months and a minimum amount of 300 billion VND, customers will be eligible for a preferential interest rate of 6.5% per annum.

LPBank’s Over-the-Counter Deposit Interest Rates for Regular Individual Customers in August 2024

Source: LPBank

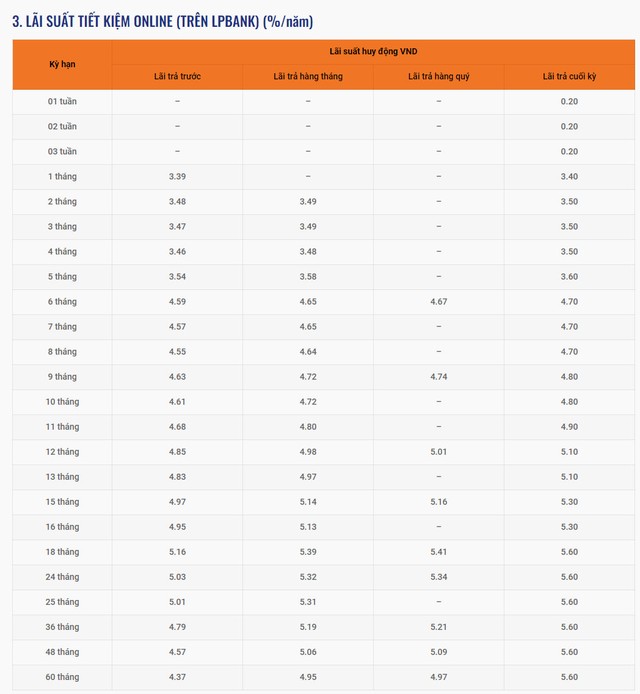

LPBank’s Online Savings Interest Rates for Individual Customers in August 2024

For online deposits, LPBank offers interest rates ranging from 0.2% to 5.6% per annum, which is 0.3% to 0.8% higher per annum for many tenors compared to over-the-counter deposits.

Specifically, short-term deposits with tenors of less than one month earn an interest rate of 0.2% per annum. Deposits with a tenor of one month earn an interest rate of 3.4% per annum, while those with tenors of two to four months earn 3.5% per annum. Deposits with a tenor of five months earn an interest rate of 3.6% per annum, and those with tenors of six to eight months earn 4.7% per annum. Deposits with a tenor of nine to ten months earn an interest rate of 4.8% per annum, while those with an eleven-month tenor earn 4.9% per annum. Deposits with tenors of twelve to thirteen months earn an interest rate of 5.1% per annum, and those with tenors of fifteen to sixteen months earn 5.3% per annum.

The highest interest rate offered for individual customers’ online deposits is 5.6% per annum, applicable to tenors of 18 to 60 months.

In addition to the option of receiving interest at maturity, LPBank also offers alternative interest payment frequencies for online deposits, including: interest paid in advance, monthly interest payments, and quarterly interest payments.

LPBank’s Online Deposit Interest Rates for Individual Customers in August 2024

Source: LPBank

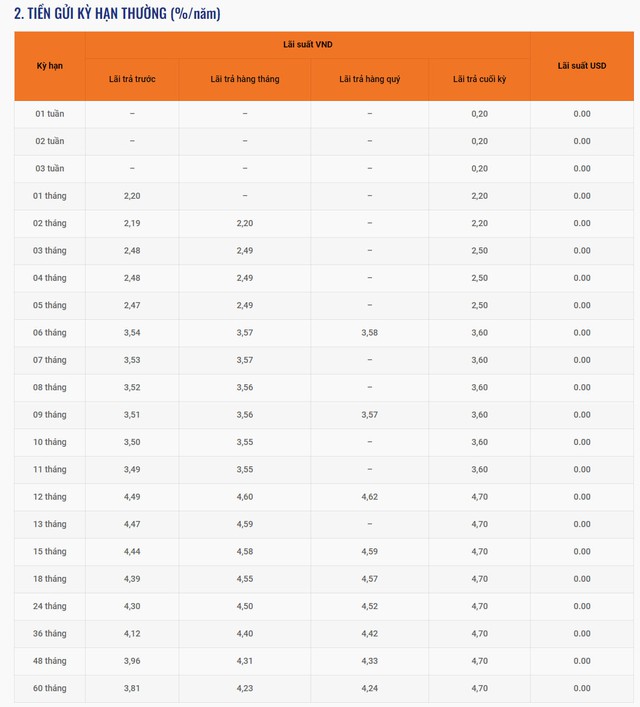

LPBank’s Savings Interest Rates for Business Customers in August 2024

During August, interest rates for business customer deposits at LPBank range from 0.2% to 4.7% per annum, with interest paid at maturity.

Accordingly, deposits with tenors of one week, two weeks, and three weeks earn an interest rate of 0.2% per annum. Deposits with a tenor of one to two months earn an interest rate of 2.2% per annum, while those with a tenor of three to five months earn 2.5% per annum, and those with a tenor of six to eleven months earn 3.6% per annum.

Currently, the highest interest rate offered to business customers at LPBank is 4.7% per annum, applicable to tenors of 12 to 60 months.

In addition to the option of receiving interest at maturity, LPBank also offers alternative interest payment frequencies for business customers, including: interest paid in advance, monthly interest payments, and quarterly interest payments.

LPBank’s Over-the-Counter Deposit Interest Rates for Regular Business Customers in August 2024

Source: LPBank