The State Securities Commission of [country/region] has recently released information regarding mandatory delisting of stocks and provided some notes for investors.

According to the regulatory body, the mandatory delisting regulations contribute to creating a fair and transparent investment environment. Only well-performing businesses that comply with legal requirements can maintain their securities listing in the long run.

To early warn investors of potential risks, the Vietnam Stock Exchange has outlined cases where stocks are subject to warning, control, limitation, and trading suspension.

For instance, a stock will be delisted if the company incurs losses in production and business operations for three consecutive years. Prior to delisting, the exchange will place the stock under warning or control if the company’s after-tax profit is negative. These decisions are publicly announced across the market.

“International experience shows that most developed stock markets worldwide have screening and delisting criteria for underperforming companies that fail to meet the continued listing requirements. In South Korea, Thailand, and Japan, in addition to companies delisted due to liquidation or bankruptcy, there are also delisting criteria related to revenue, market capitalization, auditors’ opinions, trading volume, information disclosure violations, and corporate governance breaches,” stated the State Securities Commission.

If a stock is delisted but the company still meets the criteria for a public company, it will be required to register for trading on UPCoM.

To prevent capital loss when stocks are mandatorily delisted, the authority advises investors to be well-versed in the regulations pertaining to mandatory delisting, and to equip themselves with knowledge about the market, the financial foundation, and the reputation and prospects of the listed companies.

Investors are cautioned to be prudent in their stock selection, considering the company’s compliance with legal provisions, the credentials of its management, and the company’s corporate governance and reputation.

“Investors should also pay attention to keeping abreast of stock-related information and financial reports, enabling them to swiftly assess the stock quality and make more informed investment decisions,” the State Securities Commission recommended.

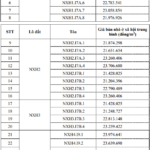

Recently, the market has witnessed several mandatory delistings, including notable stocks such as HBC of Hoa Binh Construction and HNG of HAGL Agrico.

Starting September 6, HBC and HNG will be officially delisted. HBC’s departure from the stock exchange is attributed to the company’s cumulative losses surpassing its paid-up capital. HNG, on the other hand, incurred losses for three consecutive years from 2021 to 2023, making them both subject to mandatory delisting.

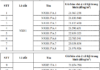

Additionally, the “FLC family” of stocks, consisting of seven codes—FLC, ROS, HAI, ART, KLF, GAB, and AMD—has completely disappeared from the stock market. Except for KLF, the remaining stocks were manipulated by Trinh Van Quyet.