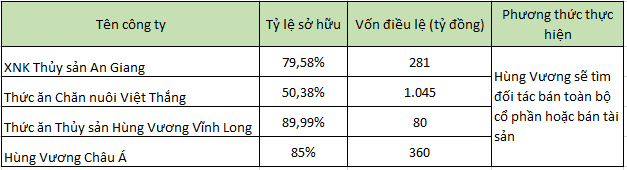

CTCP Hùng Vương has recently announced a document seeking shareholder opinions on the divestment of its stake in certain member companies in order to raise funds for debt payment and address the company’s outstanding loans. Among them, Viet Thang Feed JSC (VTF) is the largest enterprise with a charter capital of 1,045 billion VND. Hùng Vương currently holds 50.38% of the company’s capital.

In its latest consolidated financial statements released in 2019, Hùng Vương had 9 subsidiaries. At the end of 2019, the company had total outstanding debts of over 7,134 billion VND, of which bank loans (short-term and long-term) accounted for over 3,000 billion VND. At that time, the accumulated losses for Hùng Vương Aquatic Products amounted to 1,743 billion VND.

Prior to the current challenges, Hùng Vương was once among the largest seafood companies listed on the Vietnam Stock Exchange. Hùng Vương was initially established and started its production activities at the My Tho Industrial Park, Tien Giang province in 2003. Its main business was the processing of frozen pangasius fillets for export.

In January 2007, Hùng Vương officially became a joint stock company with a charter capital of 120 billion VND, which was later increased to 250 billion VND to consolidate its subsidiaries and invest in cold storage facilities at the Tan Tao Industrial Park, Ho Chi Minh City, with a capacity of 12,000 tons.

Just 5 years into its operation, by 2009, Hùng Vương’s charter capital had increased to nearly 600 billion VND, making it the leading processed and exported pangasius factory in Vietnam in terms of scale, export turnover, and product quality. Also in 2009, the company was officially listed on the Ho Chi Minh City Stock Exchange with the stock code HVG.

Since 2009, the company has owned 7 EU-approved processing plants for exporting to 27 European countries and continuously expanded its export market to the US, Eastern Europe, China, etc. Hùng Vương also owned the largest cold storage system in Vietnam (at that time) with a capacity of 42,000 tons at the Tan Tao Industrial Park, as well as over 150 hectares of farming area to ensure 50% of the raw material supply for Hùng Vương’s production activities.

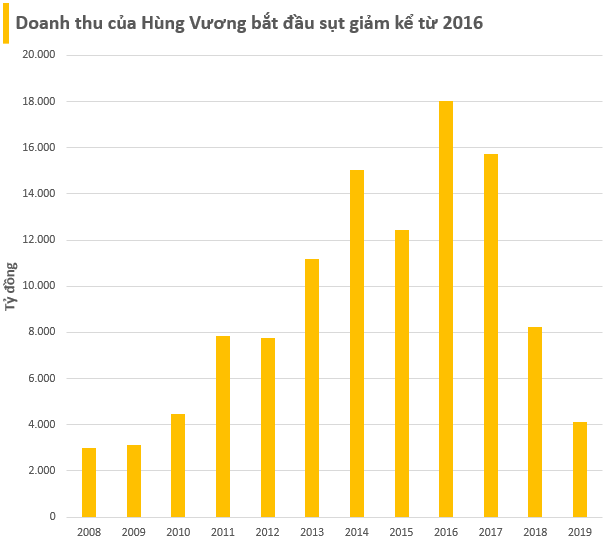

Thanks to these advantages, Hùng Vương became a major player in the seafood industry. Hùng Vương’s revenue exceeded 10,000 billion VND since 2013, with an annual net profit of over 200 billion VND.

According to Vietnam Customs data, Vietnam’s total pangasius export turnover in 2013 was 1,761 million USD. Hùng Vương, with an export turnover of 205 million USD, accounted for 11.6% of the total trade turnover and was 1.2 times higher than the second-ranked company, Vinh Hoan (VHC) that year.

During the period of prosperity, Hùng Vương stood out as a notorious M&A player in the market. Hùng Vương carried out a series of M&A deals to complete its integrated supply chain, from farming and processing to seafood distribution, aiming to become a leading company in this industry.

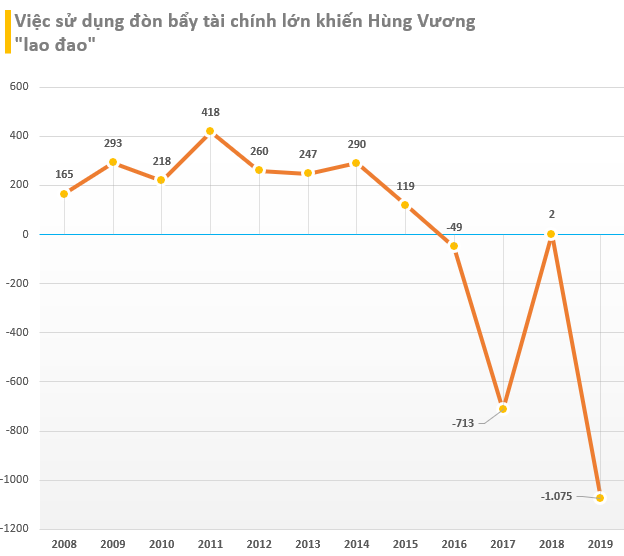

By December 31, 2016, Hùng Vương Group had expanded to 27 subsidiaries and affiliates. At the same time, the total short-term and long-term borrowings of Hùng Vương amounted to over 8,600 billion VND, out of a total capital of 16,603 billion VND, not including the payables to suppliers, …

Due to the excessive use of financial leverage and inefficient investments, HVG’s financial costs ballooned and became uncontrollable, while its core business was not performing well. Hùng Vương began facing difficulties since June 2016. The high financial costs pressured the company’s consolidated net profit to only a few hundred billion VND per year, despite achieving record sales of 17,884 billion VND in 2016.

In its 2019 annual report, Hùng Vương’s Chairman of the Board of Directors, Mr. Duong Ngoc Minh, admitted that the use of short-term capital to invest in long-term assets had created a heavy burden, and blamed the banks for not providing adequate support for the company’s investment projects.

From 2017 onwards, HVG faced losses in its business operations and was rejected by banks for debt rescheduling. HVG carried out a series of divestments of its subsidiaries and affiliates to maintain its operations.

At the beginning of 2020, the news of Thaco’s plan to “rescue” Hùng Vương caused a stir. Specifically, on January 9, 2020, Hùng Vương Corporation and Thadi Agricultural Production, Processing and Distribution Company (a subsidiary of Thaco) signed a strategic cooperation agreement. According to the agreement, Thadi would own 35% of the capital in Hùng Vương Aquatic Products and contribute 65% of the capital to a joint venture for pig breeding with the company. This joint venture had an initial investment of 2,000 billion VND.

However, this rescue attempt only lasted 1.5 years. On July 2, 2021, Tran Oanh Manufacturing and Trading Limited Company and the Chairman of the BOD, Mr. Tran Ba Duong, simultaneously sold more than 19.8 million HVG shares in Hùng Vương Aquatic Products.

This move by Thaco’s owner can be seen as an unofficial announcement of the unsuccessful outcome of the rescue plan. On December 15, 2023, Hùng Vương’s HVG shares were officially suspended from trading on UPCoM because the company failed to publish audited financial statements for three consecutive fiscal years.