From left to right: Economist Dinh The Hien, Mr. Pham Trong Phu, Mr. Tran Lam Binh, and Mr. Le Dinh Toan. Photo: TM

|

Which investment channels have been profitable since the beginning of 2024?

According to economist Dr. Dinh The Hien, in recent years, depositing money in banks has been a safe choice for investors who are unsure about profitable investments. Depositing money in one of the Big Four banks in Vietnam is as safe as investing in US government bonds, with almost no risk of bankruptcy. With the current interest rates, after accounting for inflation, investors still earn a positive interest rate of 0.5-1% per year, averaging 2.5% in the first six months of 2024. This is a good interest rate for this safe investment channel. Therefore, depositing money in the bank remains a safe and secure investment option.

An investment channel that offers higher returns than depositing money in the bank is buying USD, and this is the first year that buying USD has been more profitable than bank deposits. Specifically, buying USD at the beginning of 2024 and selling it at the end of June would result in a profit of approximately 3.3%.

As for gold investment in Vietnam, if we apply a similar method as the USD investment channel, the profit is only 0.63%. Thus, gold investment is not extremely profitable, even though gold prices have increased significantly this year.

For the investment channel of purchasing apartments for rent, the average profit in the first six months in Binh Thanh and Thu Duc City, Ho Chi Minh City, is about 2.2%. This is higher than the national average, as statistics from the VFA show that apartment investments nationwide only reached 3.8%.

The stock market has been quite outstanding with an 11% return, although there have been cases of “green on the outside, red on the inside.” If you buy open-end fund certificates, the yield will be equal to or higher than the VN-Index.

What are the real estate investment tips?

According to Mr. Pham Trong Phu, Head of Communications of the District 2 Business Association in Ho Chi Minh City, in Thu Duc City, the highest number of transactions were recorded in the Thanh My Loi area, with significant price fluctuations.

Specifically, after the Tet holiday, land prices on Truong Van Bang Street increased from 200-250 million VND to 400 million VND per square meter; branch roads also increased from 120-130 million VND to 230-240 million VND per square meter; especially, land by the river is sold at up to 700 million VND per square meter, and almost no one is selling. The An Phu, An Khanh, and Thao Dien areas have also seen increases of about 30-40%.

Another notable area is Nhon Trach, as it is the focal point connecting Ho Chi Minh City with Ba Ria – Vung Tau and Dong Nai, especially with the upcoming Long Thanh International Airport. Therefore, this area is being focused on for infrastructure development, and in the future, the Ben Luc expressway (Long An) will also go through Nhon Trach. However, the prices in this area are quite low, at about 3-3.5 million VND per square meter, while residential land is priced at 10 million VND per square meter and above, with the Ben Cam area being an exception, with prices ranging from 40-50 million VND per square meter.

Mr. Phu believes that the new laws have had a significant impact on the real estate market, but investors are still waiting to see how things unfold. It is expected that after August, when things stabilize, the market will see a slight increase. One of the bright spots of the new laws is Decree 102, Article 99, which regulates the guidance on the use of multi-purpose land, allowing construction without the need to convert it to residential land.

Regarding personal investment stories, Mr. Phu thinks that with 1-2 billion VND at present, investing in real estate is very difficult without financial leverage. In Ho Chi Minh City, an apartment of about 50 square meters costs more than 2 billion VND. Moreover, buying an apartment in Ho Chi Minh City for short-term profit will be challenging, as this segment has already been priced quite high. If one still wants to invest in real estate, they must look to outlying and underdeveloped areas.

Meanwhile, investing in land is quite promising, as the new laws that took effect on August 1 have changed the market reality, causing residential land prices to increase by 30-40%.

Mr. Phu concludes that the key to successful real estate investment is to buy where we know, close to home, or where our parents live. Secondly, don’t borrow more than 50%. Thirdly, don’t buy somewhere that feels like it has increased in price far beyond its actual value. As for where to buy, it depends on the investor’s acumen, but it is essential to research the laws, planning, and prices thoroughly to avoid overpaying.

Retail stock prices are at a reasonable level

According to Mr. Tran Lam Binh, CEO of Viet My Touris Travel Company and Investment Consultant of VPS Securities Joint Stock Company, from the beginning of the year until now, GDP has continued to grow and is higher than inflation, indicating a healthy economy. However, this growth has not been evenly distributed across industries.

Looking at the GDP, export-oriented industries such as textiles and seafood face certain challenges, resulting in a lower contribution compared to the previous year. Although Vietnam still has an $11 billion trade surplus, there is a stark contrast between the domestic economic bloc and FDI enterprises. Specifically, the domestic economic bloc still has a trade deficit of $12 billion, while the FDI bloc has a trade surplus of $26 billion.

The real estate industry is also facing difficulties, as liquidity has been very low since the beginning of the year and has only started to recover since August 1, after the new laws took effect. Construction companies and building materials suppliers are also facing many challenges due to their connection to the real estate industry.

On the other hand, technology and telecommunications industries benefit from the world’s AI trends, and the transportation industry, especially aviation, has grown by 190% compared to the end of 2023.

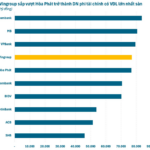

Assessing the prospects of the retail industry from now until the end of the year, Mr. Binh believes that there are not many choices for retail company stocks on the stock market, with DGW, MWG, and FRT being the three prominent representatives of this group. This industry started to recover from May to July 2024, and from now until the end of the year, it will continue to grow, creating a positive impact on these stocks. Moreover, the stock prices of retail businesses are currently at a reasonable level.

Foreign capital will flow into blue-chip stocks when the market is upgraded

According to stock market expert Le Dinh Toan, the prospects for the stock market from now until the end of the year will be a mix of positive and negative factors.

The positive aspect of Vietnam’s macroeconomy in the first six months is that GDP growth exceeded forecasts, and PMI, foreign investment, and international visitor numbers all increased compared to the previous year. Corporate profits increased by an average of 26%, interest rates stabilized at 5.5%, and inflation was moderate. In addition, there is the story of the stock market upgrade.

In the coming time, interest rates may continue to fall, and if they rise, it will be slight. From now until the end of the year, the FED is expected to cut interest rates three more times and may extend this into early 2025. However, it is important to note that if the US economy shows signs of recession, then interest rate cuts may still cause the stock market to decline.

Mr. Toan assesses that the stock market has many risks but has the strength of quick liquidity. Vietnam’s economy is very positive, and all indicators are good. Overall, the stock market will be favorable from now until the end of the year. However, if asked whether to buy now or wait, Mr. Toan advises investors to wait, as there will be more reasonable buying opportunities in September. Still, investors need to choose the right companies and manage their leverage well.

When the Vietnamese stock market is upgraded, Mr. Toan believes that blue-chip stocks will “run” first. Mr. Binh adds that investors should pay attention to the stocks of securities companies within the blue-chip group, as they directly benefit from the upgrade story and are sensitive to market news.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.