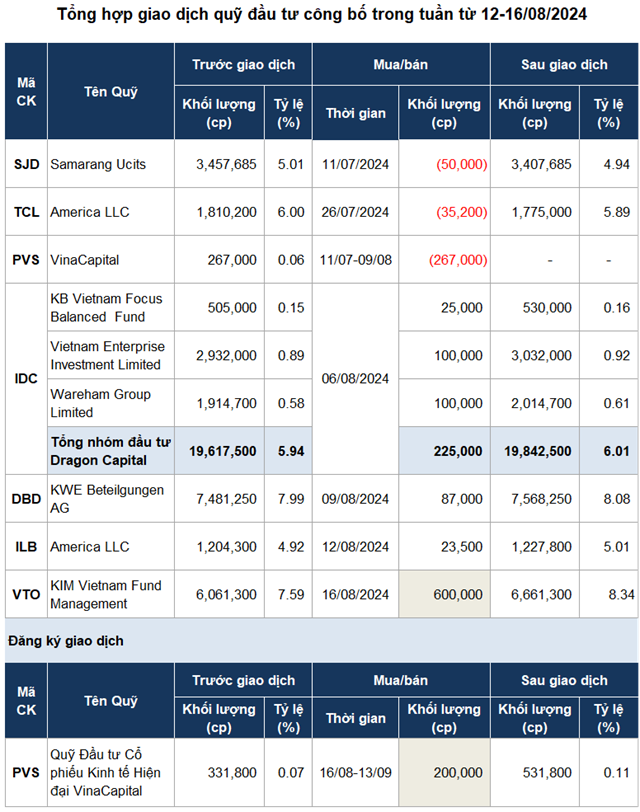

In a recent development, foreign fund America LLC purchased 23,500 shares of ILB (Joint Stock Company ICD Tan Cang – Long Binh) during the August 12 session, thereby increasing its ownership stake in the company to 5.01%, equivalent to 1.23 million shares.

At the close of trading, ILB’s share price stood at the reference price of VND 34,600 per share. Based on this price, it is estimated that America LLC invested approximately VND 800 million to become a major shareholder.

America LLC’s additional purchase of ILB shares comes after the company finalized the dividend payout ratio for 2023 at 21.07% (VND 2,107 per share), the highest ratio since its listing on HOSE in 2019. The ex-dividend date is set as August 29.

With 24.5 million shares currently in circulation, ILB will distribute nearly VND 52 billion in dividends. The payment date is scheduled for September 16, 2024.

| ILB’s Financial Performance for the First Half of 2024 |

Regarding business performance, in the first half of 2023, ILB recorded VND 232 billion in net revenue and VND 44 billion in net profit, representing decreases of 13% and 12%, respectively, compared to the same period last year. These results account for 42-43% of the company’s full-year plan.

The company attributed the revenue decline to challenges in its warehouse service operations, a decrease in warehouse rental demand, and particularly, low storage needs for some key commodities. Additionally, some major customers reduced their rented warehouse space due to business difficulties and opted for direct exports at the port to cut costs.

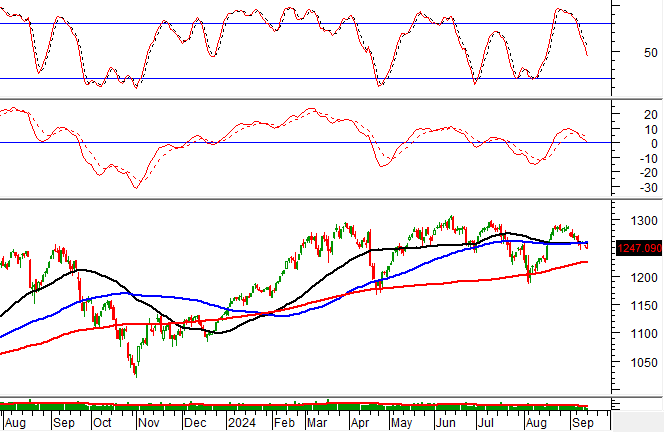

| ILB Share Price Movement from the Beginning of 2024 to August 16 |

In the market, ILB’s share price witnessed an increase of nearly 17% in the last quarter, reaching a historical peak of VND 37,000 per share on July 16. Subsequently, the share price gradually declined and is currently trading around VND 34,500 per share. The average trading volume from the beginning of the year stands at 7,510 shares per day, indicating low liquidity.

Following a similar investment strategy, the South Korean fund KIM Vietnam Fund Management also increased its stake in VTO (Vitaco Petroleum Transport Joint Stock Company) by purchasing an additional 600,000 shares during the August 16 session. This move brings their total ownership in VTO to 8.34%, equivalent to nearly 6.7 million shares.

Prior to this recent purchase, KIM had acquired 546,400 shares on July 25, becoming a major shareholder of VTO as of July 29, 2024. They further added to their holdings with the purchase of 600,000 shares on July 26 and another 600,000 shares on August 1.

Within a span of less than one month, KIM has accumulated over 2.3 million VTO shares, increasing their ownership stake from 4.78% to 8.34%.

| VTO Share Price Movement from the Beginning of 2024 to August 16 |

Since the session when KIM started accumulating VTO shares to become a major shareholder (July 25), the share price of VTO has experienced significant volatility, even dropping by 13% to the VND 13,000 level during the August 5 session. However, by the close of the August 16 session, VTO’s share price was down only 6% compared to the VND 15,000 level on July 25. Nevertheless, compared to the beginning of the year, the share price has surged by nearly 55%.

Source: VietstockFinance

|

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.