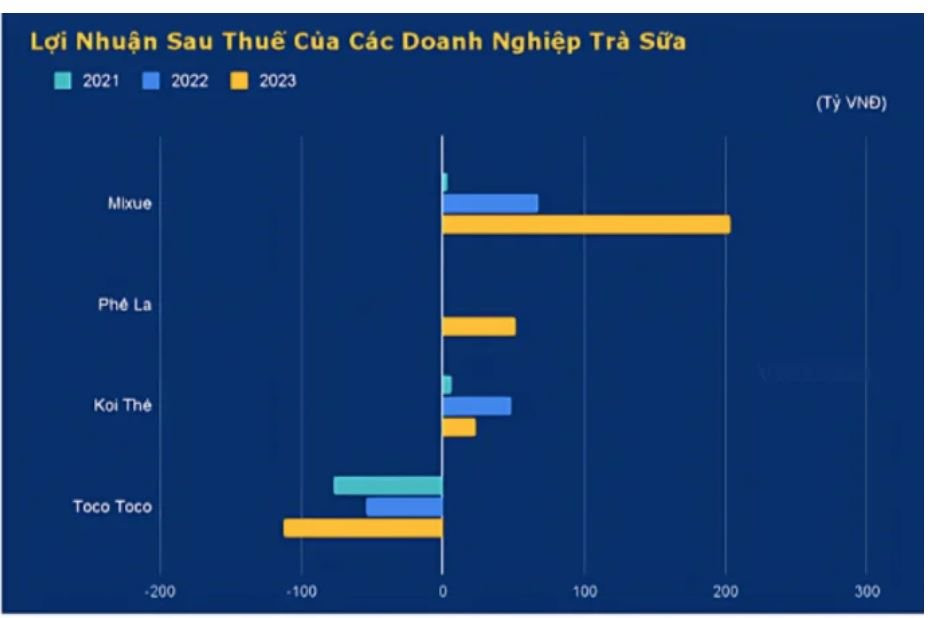

Two leading bubble tea brands in the market, but while Mixue experiences robust growth in revenue and profits, TocoToco has been facing consecutive years of deepening losses.

Originating in the 1980s, bubble tea was initially just a beverage, but it gradually spread globally and became popular even during economically challenging times.

Bubble tea, which hails from Taiwan, began making its way to Vietnam around the early 2000s and quickly gained popularity among the youth. It’s not just in Vietnam that bubble tea has become famous; it has also made its mark in many other parts of the world.

The year 2013 marked a significant milestone for bubble tea, as it experienced robust growth through franchise expansion from Hong Kong and Taiwan, coupled with eye-catching packaging designs and product diversity.

According to Vietdata, by 2023, the frequency of Vietnamese people going to cafes or drinking bubble tea had slightly increased compared to 2022, as indicated in the iPOS.vn report on the Vietnamese Food and Beverage Business Market. This report was compiled through primary research across 63 provinces, expert interviews, and industry sources.

Specifically, 42.6% of respondents shared that they visited cafes or drank bubble tea approximately 1-2 times per month. There was also an increase in the number of patrons visiting cafes or drinking bubble tea 1-2 times per week, with 30.4% of respondents choosing this option, compared to 22.6% in 2022.

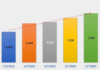

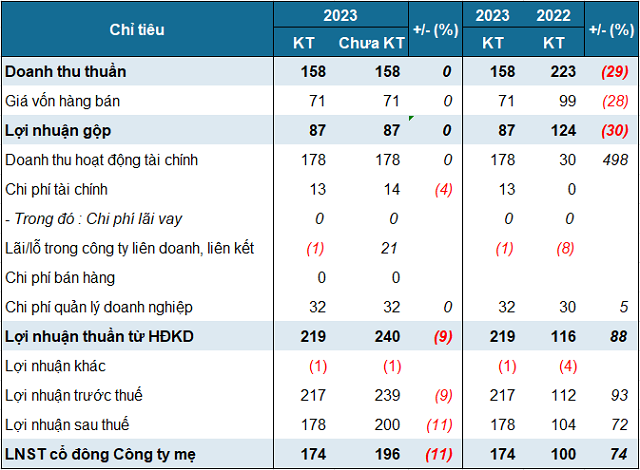

Vietdata’s recently published 2023 Bubble Tea Chain Market report reveals a contrasting picture for the two leading enterprises in the Vietnamese market. While Mixue experiences skyrocketing growth in both revenue and profits, TocoToco has been dealing with consecutive years of deepening losses.

Data source: Vietdata

Mixue’s Rapid Growth

Mixue, a well-known chain from China, was founded in 1997 by Zhang Hongchao. It entered the Vietnamese market in 2008 under the name Snow King Global Company Limited, with its headquarters in Thanh Xuan, Hanoi. As of April 2023, Mixue has reached the impressive milestone of 1,000 stores in Vietnam in less than five years.

The company’s main products are bubble tea and ice cream, offering a competitive advantage with affordable prices ranging from VND 25,000 to VND 35,000 on average. This pricing strategy is considered quite inexpensive compared to similar products in the market.

Mixue has demonstrated tremendous adaptability in the Vietnamese market. As the bubble tea market reached saturation, Mixue swiftly shifted its focus to make ice cream its flagship product, streamlining its bubble tea menu and targeting students with competitive pricing.

In terms of business performance, according to Vietdata, Mixue achieved an impressive growth rate in 2023, with revenue reaching nearly VND 1,260 billion, an increase of over 160% compared to 2022. The company’s after-tax profit also surged, increasing by more than 200% compared to the previous year.

The growth rate of after-tax profit exceeded the growth rate of gross revenue, indicating that revenue from franchise licensing significantly contributes to the company’s financial performance.

Data source: Vietdata

Toco Toco’s Consecutive Years of Losses

Tocotoco, which opened its first store in 2013, took a unique approach by not emphasizing foreign origins and instead committed to using Vietnamese agricultural produce for its beverages from the outset. Positioning itself as “bubble tea made in Vietnam,” TocoToco rapidly expanded its presence with over 700 stores nationwide and a presence in international markets such as the US, Australia, and Japan.

TocoToco’s promotions are diverse and offer customers numerous opportunities to enjoy delicious drinks at discounted prices. They frequently offer deals such as buy-one-get-one-free, free tapioca pearls, discounts on total bills, and vouchers.

In addition to its pricing strategy, TocoToco constantly reinvents itself with eye-catching designs and festive-themed patterns that excite bubble tea enthusiasts when they visit the stores.

Regarding business performance, according to Vietdata, although TocoToco achieved impressive growth from 2021 to 2022 (nearly 50%), the revenue decline in 2023 is a warning sign that warrants careful consideration.

Gross revenue for 2023 reached nearly VND 380 billion, a 17% decrease compared to 2022. The company has incurred after-tax losses for the last three years, with 2023 being the peak.

Given the less-than-ideal business performance, Toco Toco is now aiming for 1,500 stores by 2024, aiming for a nationwide presence and expansion into the US, Japan, South Korea, Canada, and other countries.

Creating Hundreds of Utilities in the Regal Legend’s Mission: 2024-2027

After nearly 2 years of being established in Quang Binh, the coastal city of Regal Legend has proved its stature as the largest coastal city in Central Vietnam. It is currently on a mission to create a new global destination with hundreds of international amenities during the period of 2024-2027.