The market maintained its upward momentum today, building on last week’s strong performance. Optimism prevailed, with the index surging by 9.39 points to close just shy of the 1,261 mark.

The breadth was positive, with 267 gainers outnumbering 152 decliners. The financial and real estate sectors, which hold significant sway over the market, rose 0.75% and 0.37%, respectively. Telecommunications led the gainers with a 2.13% jump, followed by energy at 1.56%, materials at 0.94%, transportation at 1.69%, and food, beverage, and tobacco at 1.22%.

Heavyweights VNM, GAS, VCB, TCB, BID, SAB, and LPB propelled the market higher, contributing 5.86 points to the index. On the flip side, HVN and SSI were the only stocks that dragged the index lower, but their impact was negligible.

Aggressive buying intensified, with total matched transactions across the three exchanges reaching nearly VND19 trillion. Foreign investors, however, offloaded VND308.1 billion net, including VND303.5 billion net sold via matched orders.

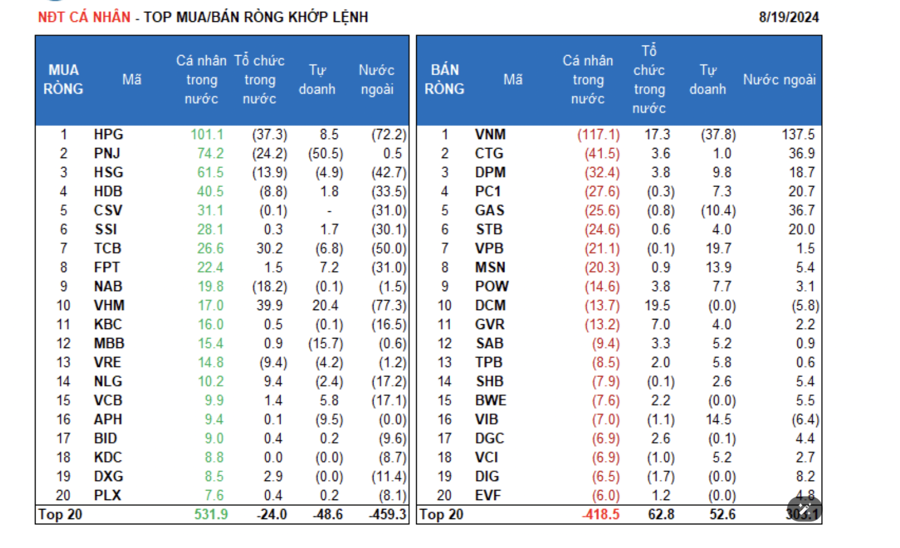

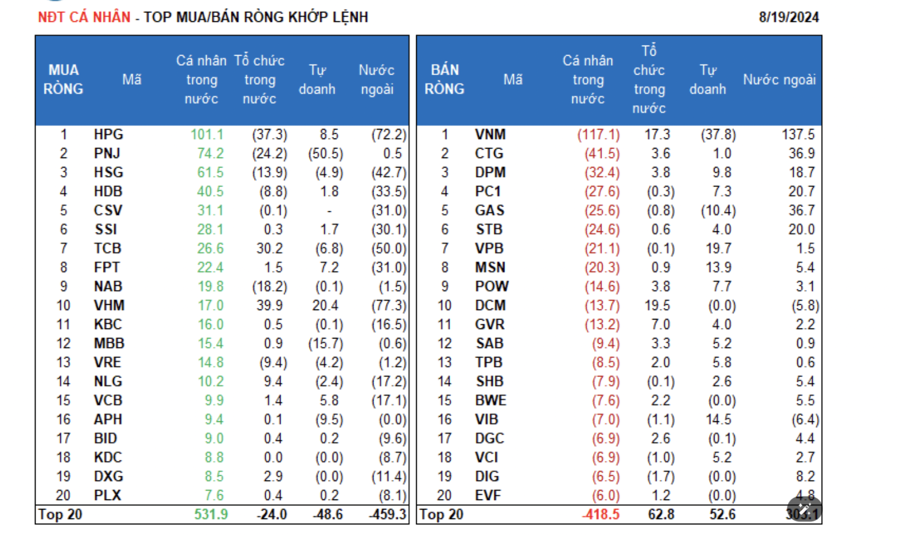

Foreign investors’ net-bought matched orders focused on the food and beverage sector, as well as electricity, water, and oil and gas. Their top net-bought stocks by matched volume were VNM, CTG, GAS, PC1, STB, DPM, EIB, DIG, GMD, and BWE.

On the selling side, foreign investors offloaded real estate stocks, with their net-sold matched orders concentrated in VHM, HPG, TCB, HSG, HDB, CSV, SSI, FUESSVFL, and MWG.

Individual investors net bought VND218.9 billion, including VND221 billion worth of net bought matched orders. In terms of matched transactions, they net bought 13 out of 18 sectors, primarily basic materials. Their top net bought stocks were HPG, PNJ, HSG, HDB, CSV, SSI, TCB, FPT, NAB, and VHM.

Meanwhile, they net sold five sectors via matched orders, mainly food and beverage, along with electricity, water, and oil and gas. Their top net sold stocks by matched volume included VNM, CTG, DPM, PC1, GAS, STB, MSN, POW, and DCM.

Proprietary traders net bought VND16.7 billion, including VND29.6 billion worth of net bought matched orders. By matched volume, they net bought 10 out of 18 sectors, with a focus on banks and real estate. Their top net bought stocks by matched volume were VHM, VPB, VIB, MSN, DPM, VIC, HPG, POW, PC1, and FPT.

On the selling side, they offloaded consumer durables and appliances. Their top net sold stocks included PNJ, VNM, MBB, GAS, APH, TCB, HSG, VRE, ACB, and PTB.

Local institutions net bought VND75.8 billion, including VND52.8 billion worth of net bought matched orders. In terms of matched transactions, they net sold seven out of 18 sectors, primarily basic materials. Their largest net sold sector by value was real estate. Their top net sold stocks included HPG, PNJ, NAB, HSG, VND, VRE, NKG, HDB, EIB, and GMD.

On the buying side, they focused on real estate. Their top net bought stocks were VHM, TCB, FUESSVFL, DCM, VNM, FUEVFVND, NLG, ACB, GVR, and MWG.

Block deals today totaled VND2,413.0 billion, surging 40.8% from last Friday and contributing 12.9% to the overall value.

Notable block deals occurred in banks (HDB, SHB, SSB, EIB, VIB) and VIC, KOS, as well as SSI, VHM, KDC, MWG, and SJS. There were also block deals between foreign investors in ACB and MBB.

A sectoral breakdown of cash flow allocation showed an increase in banks, food and beverage, steel, warehousing and logistics, consumer durables, and oil and gas. Meanwhile, there was a decrease in real estate, securities, retail, construction, and information technology.

Specifically, for matched orders, cash flow allocation increased for mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing for large-cap (VN30) stocks.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.