Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 609 million shares, equivalent to a value of more than 14.4 trillion VND; HNX-Index reached over 53 million shares, equivalent to a value of more than 1,104 billion VND.

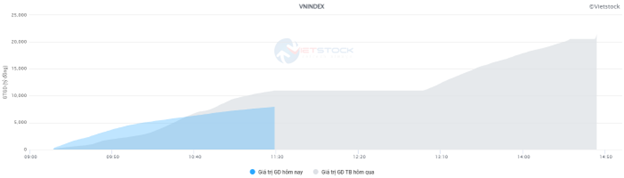

| Top 10 stocks with the strongest impact on the VN-Index on August 19, 2024 (in points) |

The afternoon session started with a prolonged tug-of-war due to short-term profit-taking pressure, but buying power remained slightly stronger, helping the VN-Index maintain its green color until the end of the session. In terms of impact, VNM, GAS, VCB, and TCB were the most positive influences on the VN-Index, contributing over 3.9 points. On the other hand, HVN, SSI, GEE, and PLX had negative impacts, but their effects were negligible.

The HNX-Index also performed quite positively, with positive contributions from PVS (+1.77%), KSV (+3.16%), IDC (+1.31%), CEO (+2.65%), and others.

|

Source: VietstockFinance

|

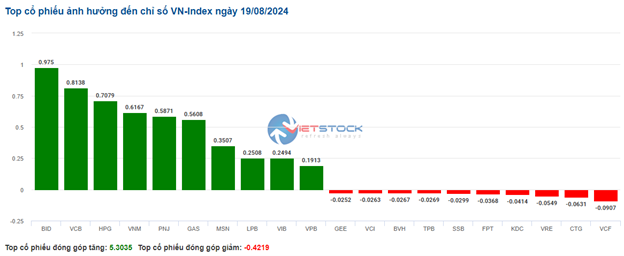

The telecommunications services sector was the group with the strongest growth, up 2%, mainly driven by VGI (+2.4%), ELC (+1.92%), and FOX (+1.93%). This was followed by the industry and energy sectors, with increases of 1.74% and 1.29%, respectively. On the contrary, the information technology sector saw the most significant decline in the market, falling by -0.01%, mainly due to FPT (-0.08%), VTB (-0.97%), and PIA (-2.59%).

In terms of foreign trading, they continued to net sell over 308 billion VND on the HOSE exchange, focusing on VHM (77.97 billion), HPG (68.08 billion), TCB (49.88 billion), and HSG (42.69 billion). On the HNX exchange, foreigners net sold more than 28 million VND, focusing on IDC (26.77 billion), NTP (10.85 billion), TNG (4.59 billion), and DTD (4.41 billion).

| Foreign Trading Buy – Net Sell Dynamics |

Morning Session: Maintaining the Uptrend

The market continues to attract positive buying interest in the morning session of the new week. At the midday break, the VN-Index stood at 1,261.64 points, up 9.41 points, or 0.75%; while the HNX-Index rose 0.47% to 236.26 points. Buyers temporarily held the upper hand, with 455 stocks rising and 224 falling.

Morning session liquidity decreased compared to the strong surge of the previous week. The trading volume of the VN-Index reached nearly 328 million units, equivalent to a value of almost 8 trillion VND. The HNX-Index recorded a trading volume of nearly 27 million units, with a value of nearly 575 billion VND.

Source: VietstockFinance

|

In terms of impact, GAS, VCB, and VNM were the main contributors to the VN-Index, helping the index gain about 3 points. Conversely, FPT, SSB, and KDC performed less favorably in the morning session, negatively impacting the index, but the extent was not significant.

Green dominated most industry groups, with telecommunications services temporarily taking the lead with a 2.28% gain, driven mainly by VGI (+2.7%), FOX (+2.15%), and CTR (+0.63%). The energy sector also traded quite actively in the morning session, rising nearly 2%. Most stocks were in an uptrend, notably BSR (+2.1%), PVS (+1.77%), PVD (+1.1%), and PVC (+1.5%).

On the other hand, information technology was the only sector in the red during the morning session, but the decline was not significant, mainly due to the “big brother” FPT falling slightly by 0.23%.

Foreign investors were a negative factor, net selling over 202 billion VND on the three exchanges. The largest net sell volume was spread across TCB, VHM, HSG, CSV, and FPT (ranging from about 20 to over 30 billion VND). Conversely, VNM continued to be favored by foreign investors, net buying over 60 billion VND.

10:45 a.m.: Buyers Remain in Control

The main indices maintained their positive momentum as market-wide liquidity continued to recover in the morning session. As of 10:40 a.m., the VN-Index rose more than 7 points, trading around 1,260 points. The HNX-Index gained over 1 point, trading around 236 points.

Stocks in the VN30 group had a relatively balanced breadth, but the gainers had a slightly stronger impact. Specifically, BID, VCB, HPG, and VNM contributed 0.97, 0.81, 0.71, and 0.62 points to the VN30-Index, respectively. Meanwhile, VCF, CTG, VRE, and KDC were under selling pressure but with minor losses.

Source: VietstockFinance

|

Financial and real estate stocks remained the two main groups supporting the market’s recovery. However, the financial sector showed strong internal divergence, with gainers slightly outperforming. The increases were modest, such as VIX up 0.42%, VPB up 0.27%, EIB up 0.27%, and STB up 0.51%… Conversely, SSI fell 0.31%, TPB fell 0.29%, MBB fell 0.42%, and SSB fell 0.23%… covered in red, but the declines were not significant.

Similarly, the real estate sector exhibited similar dynamics, with slight internal divergence. The gainers included PDR up 2.93%, DIG up 1.05%, DXG up 4.26%, and NVL up 1.26%… On the other hand, VRE fell 0.27%, HDG fell 0.18%, KDH fell 0.4%, and SIP fell 0.14%… indicating that buying pressure slightly outweighed selling pressure in this sector.

Additionally, the non-essential consumer goods sector rose by a solid 0.82%. The focus of this group was on PNJ and HAX stocks, which turned purple early in the session. From a technical perspective, on August 19, 2024, PNJ stock witnessed a strong surge and formed a Rising Window candlestick pattern accompanied by a breakout in trading volume, surpassing the 20-session average. This indicated a significant influx of capital into the stock. Moreover, PNJ‘s price reached a new 52-week high, while the MACD continued its upward trajectory and remained above zero after generating a buy signal, suggesting a positive outlook for the medium term.

Source: VietstockFinance

|

Compared to the opening, the tug-of-war dynamics resulted in a high proportion of reference stocks, with 980 stocks, but the gainers outnumbered the decliners, with 394 rising and 216 falling.

Source: VietstockFinance

|

Opening: Real Estate Group Continues Uptrend

At the start of the August 19 session, as of 9:40 a.m., the VN-Index rose more than 5 points to 1,259.78 points. The HNX-Index also edged higher to 236.19 points.

At 9:27 a.m. (local time) on August 18, the General Secretary of the Central Committee of the Communist Party of Vietnam, President of the Socialist Republic of Vietnam, To Lam, and his spouse, along with a high-ranking Vietnamese delegation, arrived in Guangzhou, Guangdong Province, China, beginning a state visit to the People’s Republic of China at the invitation of the General Secretary of the Central Committee of the Communist Party of China, President of the People’s Republic of China, Xi Jinping, and his spouse.

As of 9:40 a.m., the telecommunications services sector led the market with a 2.17% gain in the morning session. Notable performers included VGI up 2.55%, CTR up 0.86%, FOX up 1.07%, and ELC up 0.64%,…

Additionally, energy stocks also spread greenery early in the session, with a series of gainers such as BSR up 2.1%, PVD up 0.55%, PVC up 0.75%, AAH up 5%, and PSB up 8%…

Following closely was the real estate sector, which continued its growth trajectory with a 1.33% gain. Standouts in this group included NHA up 5.75%, PDR up 3.46%, DXG up 4.61%, NVL up 2.51%, NLG up 1.52%, and VRE up 0.27%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.