HOSE has announced that PTC‘s undistributed post-tax profit as of June 30, 2024, was VND 14.14 billion, based on the reviewed semi-annual financial statements for 2024. As a result, PTC has been removed from the warning list as per regulations.

Previously, PTC had been placed on the warning list since April 14, 2023, due to its consolidated audited financial statements for 2022, which showed an undistributed post-tax loss of VND 23.59 billion.

It is noteworthy that in the reviewed semi-annual financial statements for 2024, PTC‘s revenue was nearly VND 9 million, a significant decrease from the same period last year, which stood at VND 32 million. However, their net profit reached nearly VND 11 billion. The company’s financial investments, amounting to nearly VND 15 billion, were a key factor in this profit, almost quadrupling the figure from the previous year. Of this, profit from securities investment accounted for nearly VND 10.6 billion, compared to just VND 1.4 billion in the previous year.

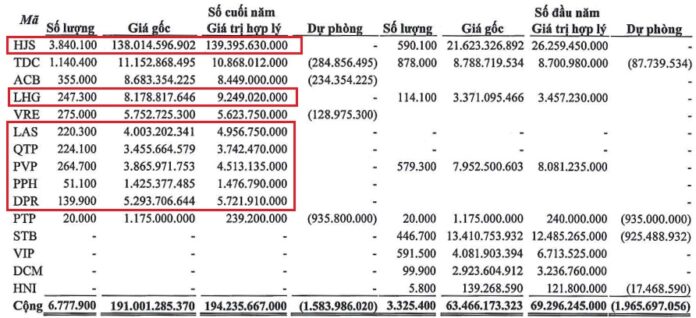

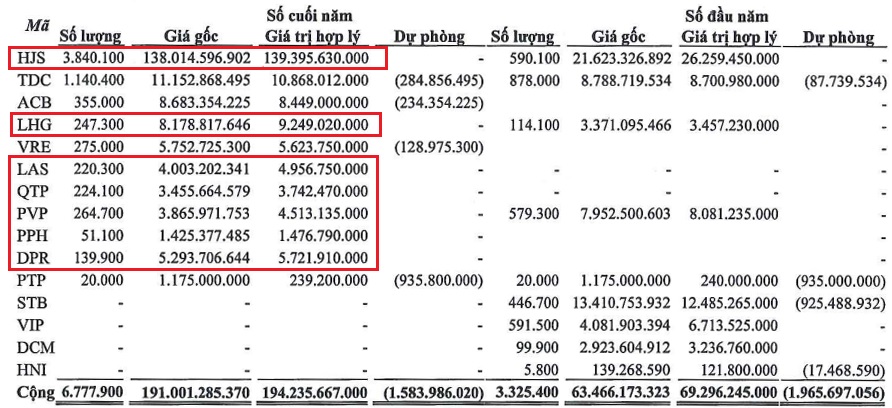

As of June 30, 2024, PTC was investing in 11 stock codes, with 6 codes showing profits compared to the beginning of the year.

|

PTC’s securities investment portfolio as of June 30, 2024

Source: PTC

|

| Business performance and undistributed post-tax profit of PTC |

ICapital Investment Joint Stock Company, formerly known as Postal House Construction Company, was established on October 30, 1976, under VNPT (Vietnam Post and Telecommunications Corporation). It was later equitized and renamed Postal and Telecommunications Construction Joint Stock Company.

In April 2022, the company changed its name to iCapital Investment Joint Stock Company, with a current charter capital of over VND 323 billion. The company operates in the fields of construction and financial investment, managing and operating subsidiary and affiliated companies in the wind power sector. PTC owns 50.1% of the charter capital of iCapital Wind Power Joint Stock Company and has one affiliated company, iCapital Wind Power Joint Stock Company, in which it holds 32.81% capital.

However, in the first quarter of 2024, PTC terminated the contract for the sale and purchase of shares to reduce its ownership in iCapital Wind Power Joint Stock Company. This was one of the solutions implemented by PTC to address accumulated losses, in addition to financial investments, with the aim of removing the PTC ticker from the warning list as per HOSE regulations.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.