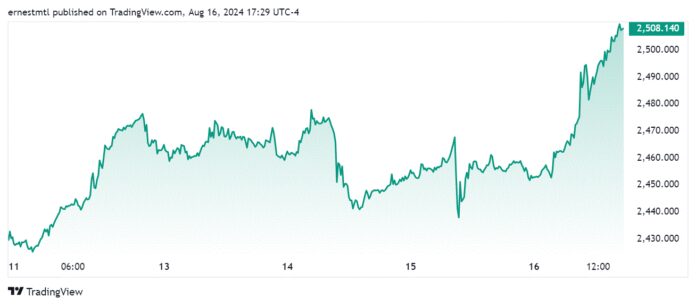

Gold prices soared to an all-time high as the US dollar weakened amid growing expectations of an interest rate cut by the Federal Reserve in September and escalating tensions in the Middle East, boosting demand for gold bullion.

In the last session of the previous week, spot gold prices briefly touched $2,500.99 per ounce (after the US announced lower-than-expected housing market data) and ended the session slightly lower but still at a robust $2,498.72 per ounce. Gold futures for December 2024 ended the week at $2,537.80 per ounce.

For the week, gold prices rose nearly 3%, the biggest gain this year, as the Dollar Index fell for the fourth consecutive week.

In the domestic market, SJC gold bar prices on the last two days of the week (buy-sell) were quoted at VND 78-80 million per tael, up about VND 2 million compared to the level of VND 76.5-78.5 million per tael a week earlier. SJC 9999 gold rings were priced at VND 77-78.4 million per tael (buy-sell), also higher than the VND 76.25-77.7 million per tael range a week earlier.

Gold prices have just set a new historical record.

The latest Kitco News survey showed that most experts and retail investors believe that gold prices could soon surpass the all-time high just reached.

Mark Leibovit, editor of VR Metals/Resource Letter, said there was no reason to doubt that gold would continue to rise this week (August 19-23). “We have to be bullish on both gold and silver,” he said.

Marc Chandler, chief executive of Bannockburn Global Forex, said gold prices would consolidate in the near term before setting a new record high. “Gold is oscillating in a range near its all-time high.” “I don’t think yen-carry trades based on interest rate differentials are back in vogue; instead, it’s a generally weaker US dollar move. That supports gold. Moreover, although US retail sales rose and weekly jobless claims hit a five-week low, the yield on the 10-year Treasury note was essentially unchanged.”

Meanwhile, Adrian Day, president of Adrian Day Asset Management, said prices would be “unchanged.” He commented, “At record-high levels, economic news or comments from Fed officials could slow the pace of rate cuts this year, which would cause gold to retreat. But that would only be short-lived. The odds still favor the Fed cutting rates in September, plus the cuts we’ve seen at many other central banks around the world, and the long-term trend for gold is definitely up.”

“Prices will decline,” said Darin Newsom, a senior analyst at Barchart.com. “I may be a bit overthinking, but technically, gold is overbought and may be approaching the peak of one of the five short-term upward waves,” said Mr. Newsom.

Based on the fact that gold buyers on Friday tried to hold prices above $2,500, Bob Haberkorn, senior commodity broker at RJO Futures, said: “Currently, prices are rising too fast and may fall early next week to regain momentum to return to the $2,500 level.”

According to Mr. Haberkorn, once the price breaks above $2,500 per ounce, traders will want to wait for a price correction to immediately buy in. However, overall, he expected prices to consolidate this week.

However, Mr. Haberkorn believed that the current high prices would be difficult to attract new buyers. “The market will continue to rise and rise, but at the moment, it is difficult to find buyers at levels above $2,500 – the level that has just been broken. That could be why gold prices next week will consolidate or fall.” However, in the not-too-distant future, he believed that the current $2,500 per ounce level of the December futures contract could become a support level.

This week, nine analysts on Wall Street participated in the Kitco News survey, with most expecting gold prices to likely surpass last week’s record high. Specifically, five analysts, or 56%, predicted gold prices would rise this week, while three analysts, or 33%, believed gold would trade sideways, and only one person (11%) forecast a decline.

Meanwhile, 219 retail investors on Main Street participated in the survey, with 130 people (59%) predicting higher prices in the coming week; 44 others (20%) expected lower prices, and 45 people (21%) foresaw a sideways market.

Kitco News survey results on the outlook for gold prices for the week of August 19-23.

This week, analysts and gold traders await speeches from two Fed officials (Mr. Darren Waller on Monday, August 19; Mr. Bostic and Mr. Barr on Tuesday, August 20), the minutes of the Fed’s July meeting (released on Wednesday, August 21), US initial jobless claims, and the S&P global manufacturing and services PMI for August (Thursday, August 22), and new US home sales for July (Friday, August 23).

Reference: Kitco News