CafeF has released a list of the top 10 private banks in Vietnam that made the largest tax contributions to the state budget. This initiative aims to recognize the significant contributions of these private banks and offer an objective perspective on their role and responsibilities towards society and the community.

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) is among the top private banks in Vietnam, contributing nearly VND 3,000 billion to the state budget in 2023.

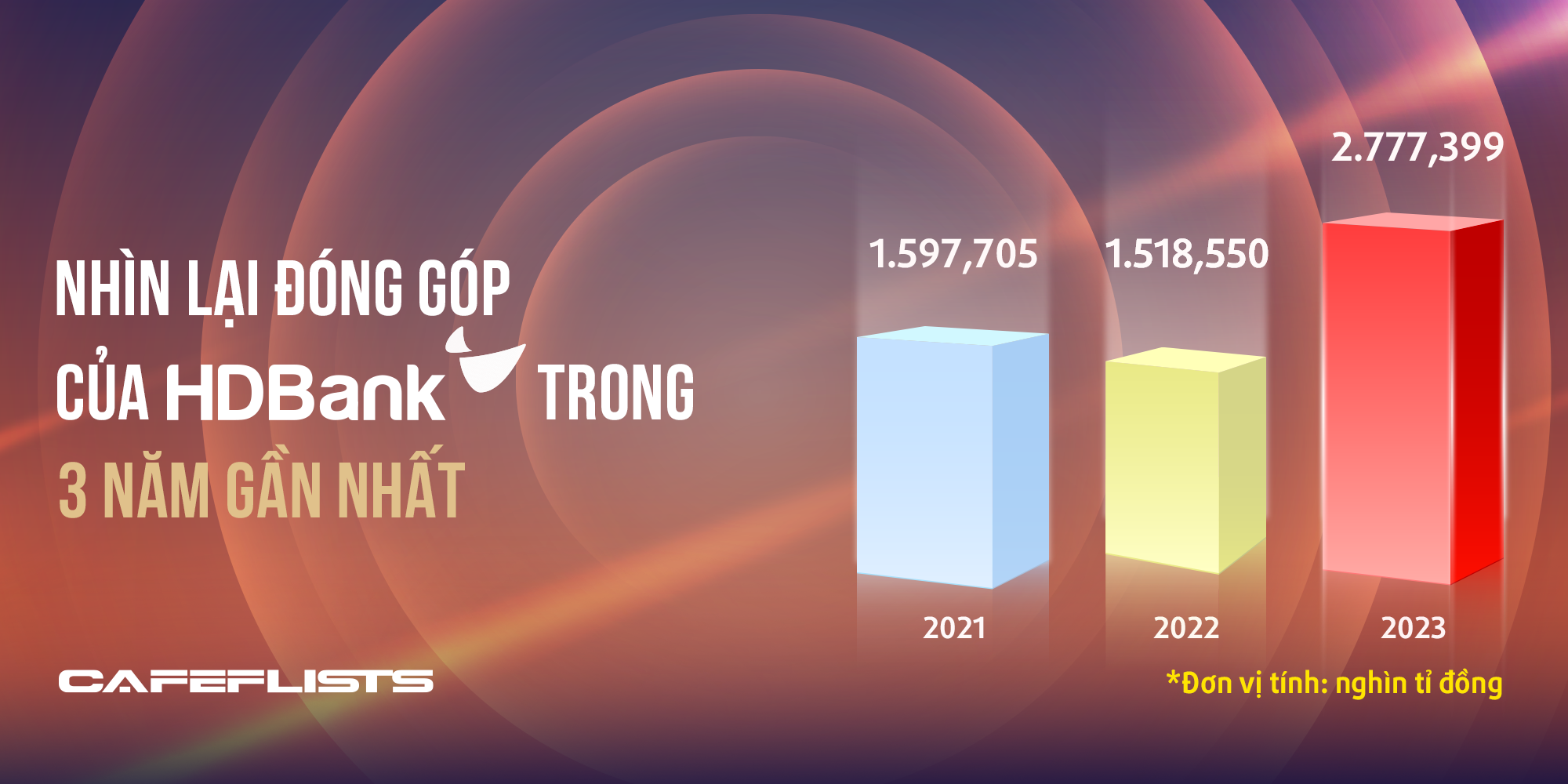

According to the list, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) is among the top private banks in Vietnam, contributing nearly VND 3,000 billion to the state budget in 2023. This amount reflects a 60% increase compared to 2022 and accounts for 23% of the bank’s pre-tax profit. Over the last three years, HDBank has contributed more than VND 6,700 billion to the state budget.

Prior to this, HDBank had consistently been among the top tax-paying enterprises for three consecutive years, as recognized by the General Department of Taxation. Their contribution has tripled over the last five years.

HDBank’s comprehensive digital transformation and expansion strategy have contributed to its impressive tax contributions.

This impressive performance can be attributed to HDBank’s strategic investments in expanding its branch network, human resources, and technological capabilities. The bank has also focused its lending activities on sectors that drive economic development, including agriculture, rural areas, supply chains, small and medium-sized enterprises, women-owned businesses, and household businesses.

Beyond revenue growth, HDBank’s comprehensive and synchronized digital transformation across products, services, and internal processes has led to significant cost reductions, resulting in improved profit margins. This consistent growth trajectory, maintained for over a decade, has translated into increasingly larger contributions to the country’s budget.

Paying taxes is not just a legal responsibility for HDBank but also a demonstration of its social responsibility and commitment to the community. Moreover, the substantial tax contributions reflect the bank’s stability and growth, instilling confidence in investors and customers and fostering the sustainable development of the banking sector and the national economy.

HDBank has successfully navigated challenges and maintained impressive performance despite economic difficulties in Vietnam.

2023 presented significant challenges for the Vietnamese economy, particularly for the banking system. Banks faced difficulties due to fluctuations in the corporate bond market that extended from late 2022 to early 2023. Additionally, slower economic growth, reduced credit demand, and weakened financial health of customers required banks to be more cautious in their operations, customer selection, and debt collection.

However, HDBank successfully overcame these challenges thanks to its unique strengths, including its diverse customer base, strong governance capabilities, market insight, and agile response to changing market conditions. As a result, the bank excelled in achieving its set goals.

By the end of 2023, HDBank had surpassed its targets, with total assets reaching over VND 602,000 billion, a remarkable 44.7% increase compared to 2022. Total mobilized capital exceeded VND 536,000 billion, an increase of 46.5%. Credit balance surpassed VND 353,000 billion, reflecting a 31.8% year-on-year growth. Pre-tax profit reached VND 13,017 billion, a 26.8% increase compared to the previous year. These results led to a return on assets (ROA) of over 2% and a return on equity (ROE) of 24.2%, maintaining HDBank’s leading position in the market in terms of efficiency.

HDBank continues its stable and sustainable growth trajectory in the first half of 2024, building on its impressive performance in 2023.

HDBank maintained its stable and sustainable growth trajectory in the first half of 2024, building on its impressive performance in 2023. During this period, the bank recorded a total income of VND 16,045 billion, a 32.9% increase compared to the same period last year. Pre-tax profit reached VND 8,165 billion, a significant 48.9% year-on-year increase, driven by enhanced operational efficiency and the successful implementation of digital transformation initiatives.

Additionally, HDBank took a significant step forward in its comprehensive environmental, social, and governance (ESG) strategy by becoming the first bank in Vietnam to publish a sustainability report, prepared in accordance with international standards. Through this report, HDBank demonstrated its commitment to sustainability principles and its goal of becoming a net-zero emissions bank by 2050.

Driving Digital Transformation in the HR Industry

Thanks to technology, the labor management tasks, procedures, and administrative processes that used to be done manually will be significantly reduced.