On August 17, 2024, HNX and Vietcombank held a conference to summarize the one-year operation of the Private Corporate Bond Trading System (from July 19, 2023, to July 19, 2024).

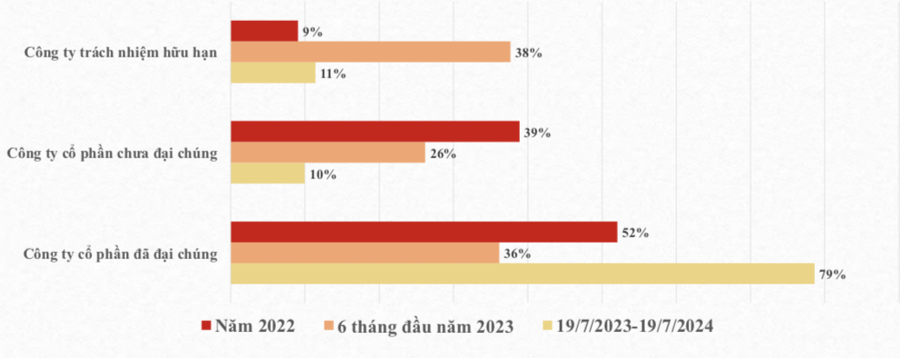

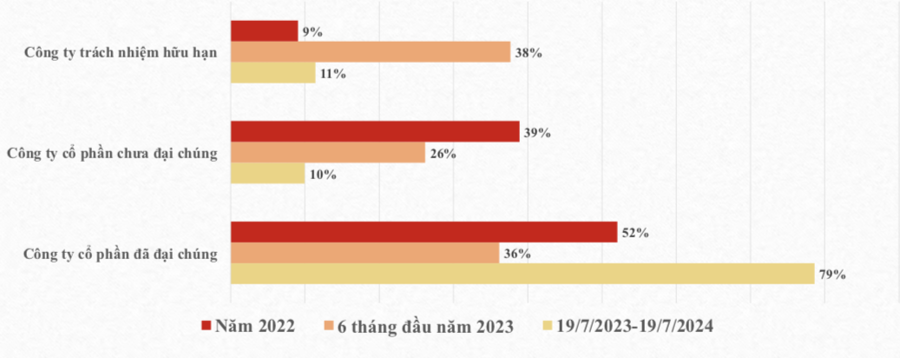

According to HNX’s report, at the time of its inauguration (July 19, 2023), the market had 19 private corporate bond codes from 3 issuing organizations registered for trading, with a total registered trading value of VND 9,060 billion. However, after one year, there were 1,146 bond codes from 301 enterprises with a registered trading value of nearly VND 832,189.4 billion posted on the trading system. However, there were 103 codes of corporate bonds registered for trading decrease; 120 codes of corporate bonds canceled registration. Therefore, by July 19, 2024, the number of private corporate bond codes registered for trading was 1,026, and the registered trading value was VND 747,485 billion.

38.1% OF BONDS TRADED OUT OF TOTAL REGISTERED CODES

Currently, there are 151 issuing organizations (enterprises) trading out of a total of 301 registered issuing organizations, equivalent to a rate of 50.1%. Only 391 corporate bond codes traded out of a total of 1,026 registered bond codes, a rate of 38.1%. Notably, 278 of these were non-standard or insufficient information bonds (bonds with unusual interest payment periods, floating-rate bonds, etc.). According to HNX, the ratio of bonds without a basis for bond price calculation/total number of codes with trading is 71%.

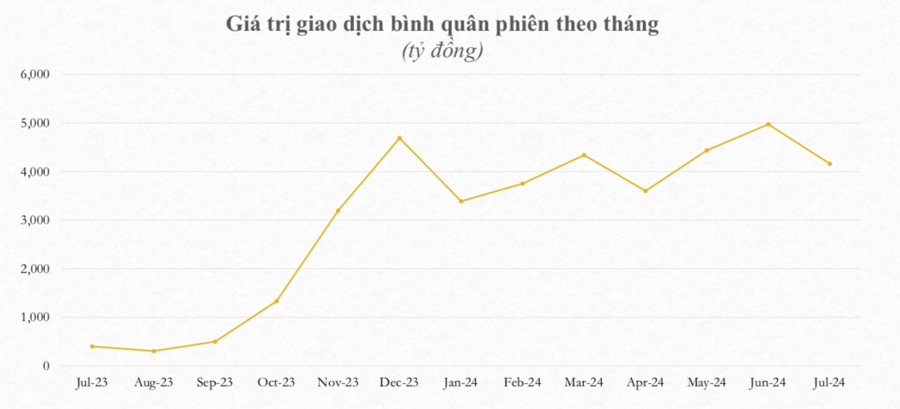

The liquidity of private corporate bonds has improved significantly, with the average trading value in the first month of the market’s opening reaching VND 250.6 billion/session. After one year, the average trading value of private corporate bonds reached VND 3,704.5 billion/session. The liquidity of private corporate bonds in the secondary market recorded a strong increase in December 2023 and peaked in June 2024 (VND 5,000 billion/session) before falling back in July 2024.

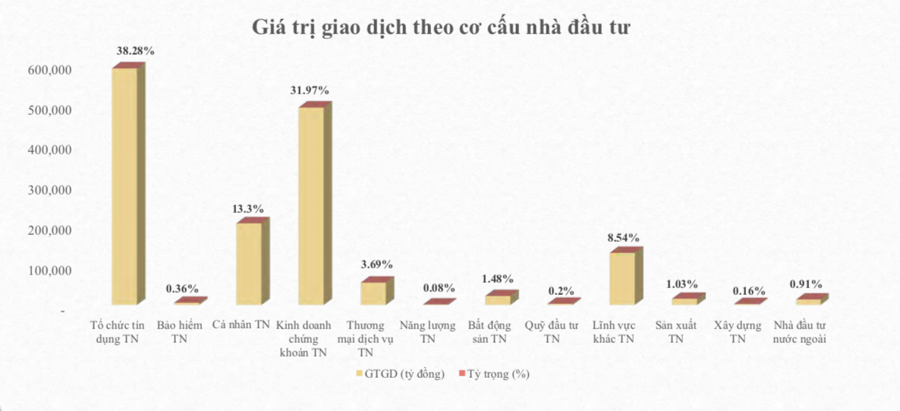

In terms of the investor structure in the private corporate bond secondary market, credit institutions were the largest buyers (accounting for 38.28% of the market’s trading value), followed by securities companies (38.3%). Other institutional investors such as investment funds (0.2%), insurance companies (0.36%), and foreign investors (0.91%). Individual investors accounted for 13.3% of the trading volume in the private corporate bond secondary market.

As the payment bank, Vietcombank has executed 243,146 deposit/withdrawal transactions since the private corporate bond trading floor came into operation (from July 19, 2023, to July 19, 2024) with a total trading value of VND 1.6 quadrillion. Vietcombank monitored transaction information for 193,161 investors with a total trading value of VND 793,000 billion.

According to Mr. Vu Quang Dong, Deputy Director in charge of the Capital Market Division at Vietcombank, the bank’s system has made instant payments for each transaction and managed the money purchase/sale balance for each investor.

As a result, private corporate bonds are instantly settled on T0, a significant advantage over other securities payment systems (T+1.5 for the underlying market and T+1 for the derivatives market), improving market liquidity and accelerating capital turnover.

The operating efficiency of the private corporate bond payment system reached 2 million transactions/minute. Vietcombank’s representative said that the system is designed to ensure processing performance and market expansion speed over the years. All transactions connected to the depository members are encrypted and digitally signed to ensure security and confidentiality. The operating procedures and system interventions ensure information security and comply with the State Bank’s standards and regulations for level 3 information systems.

In addition, the paying bank also manages detailed investor balance information, making investors’ transaction information transparent and clear, limiting risks, and aiming to separate securities trading accounts from deposit accounts as directed by the State Securities Commission of Vietnam.

SOLUTIONS FOR DEVELOPING THE CORPORATE BOND MARKET

At the conference, Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission of Vietnam, proposed that units study and implement five specific solutions to build and develop a sustainable private corporate bond market.

First, continue to improve the quality of goods on the market by enhancing the quality of issuing organizations. There should be fundamental solutions to control the quality of private corporate bonds by promoting the application of credit ratings for private corporate bond-issuing organizations. Consider tightening the conditions for issuing private corporate bonds to minimize the number of newly established enterprises without operations or established enterprises without operations that can issue private corporate bonds on a scale many times larger than their equity.

Second, continue to improve the quality of investors by attracting professional investors in finance, financial investors, and foreign institutional investors.

Third, close coordination between policy-making agencies, supervisory organizations, and market members in proposing solutions and initiatives to promote the sustainable and healthy development of the market and address difficulties, problems, and obstacles in the market’s operation.

Fourth, consider promoting standardization and studying and applying a set of standard conditions and terms for corporate bonds, referring to international experience and practices, to address the current situation of bonds with many different conditions and terms.

Fifth, study and encourage the development of an ecosystem for the market by developing and improving the quality of service providers and market intermediaries such as consulting organizations, underwriting organizations, and credit enhancement organizations (CGIF-Credit Guarantee and Investment Facility)…

Sixth, strengthen communication about the activities, operations, and regulations of the private corporate bond market to help enterprises and investors improve their knowledge of their rights, obligations, and responsibilities in complying with the law and fulfilling their obligations as prescribed.

An HR member of the Big4 team with higher salary and bonus than the Chairman and CEO

Vietcombank, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, has recently released its financial report for the fourth quarter of 2023. In this report, the bank has disclosed the figures for the salaries, wages, and bonuses of the executives within the Board of Directors and the Executive Board.