Hoa Dao Mua Xuan Trading and Service Co., Ltd. (referred to as Hoa Dao Mua Xuan Company) has acquired 3 million FHS shares, equivalent to 23.53% of the capital, and became a major shareholder on August 9. Prior to this, the company did not own any FHS shares.

Data from the exchange did not record the transaction of 3 million FHS shares, suggesting that Mr. Pham Minh Thuan likely transferred his shares to Hoa Dao Mua Xuan Company through an off-exchange transaction.

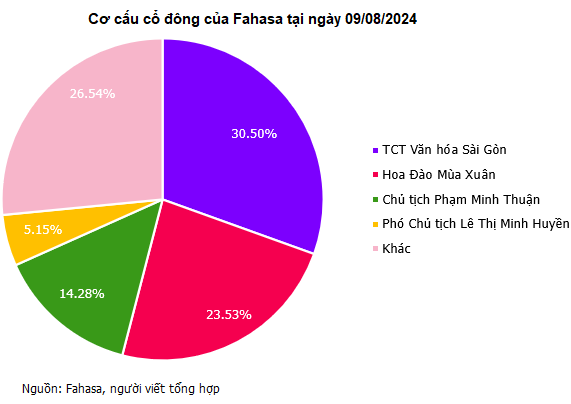

Following the transaction, Mr. Thuan’s ownership in FHS decreased from 37.8% to 14.28%, while he remains a major shareholder. Hoa Dao Mua Xuan Company increased its ownership from 0% to 23.53% and became the second largest shareholder, following Saigon Culture Corporation which holds 30.5% of FHS’s capital.

Hoa Dao Mua Xuan Company is a newly established enterprise, founded just over two months ago on June 7, 2024. Its main business activities include agency, brokerage, and auction of commodities. The company’s legal representative is Mr. Pham Minh Thuan, who also serves as the Chairman of the Members’ Council.

|

Hoa Dao Mua Xuan Company has a chartered capital of over VND 40.2 billion, with 5 founding shareholders. Mr. Pham Minh Thuan holds the majority stake with a contribution of VND 40 billion, equivalent to 99.441% of the capital. Ms. Pho Nam Phuong holds a 0.249% stake with a contribution of VND 100 million, while Mr. Pham Nam Thang and Mr. Pham Minh Nhat Hung each hold a 0.124% stake with contributions of VND 50 million each. Ms. Le Vi Anh holds the remaining 0.062% stake with a contribution of VND 25 million.

Notably, the registered addresses of all 5 individuals are the same as the head office address of Hoa Dao Mua Xuan Company, located at 37 Hoa Dao Street, Ward 2, Phu Nhuan District, Ho Chi Minh City.

Among the shareholders, Ms. Pho Nam Phuong currently serves as the Chairman of the Board of Directors of Binh Duong Culture and Trade Joint Stock Company (Fabico), the only subsidiary of Fahasa, in which Fahasa holds a 74.04% stake.

Fahasa, established in the 1970s, has grown to become the largest bookstore chain in Vietnam, with a network of 120 stores across most provinces and cities nationwide. In terms of financial performance, in the second quarter of 2024, the company recorded revenue of over VND 1,113 billion and a net profit of over VND 7 billion, representing a 1% decrease and a 5% decrease, respectively, compared to the same period last year. For the first half of 2024, the net profit remained stable at over VND 22 billion, achieving more than 40% of the annual profit target.

Most recently, Fahasa announced a dividend payout of VND 600 per share for the first dividend payment of 2024, equivalent to a dividend rate of 6%. The record date for this dividend payment is September 5, and the payment date is scheduled for September 18, 2024.

According to the resolutions of the General Meeting of Shareholders, FHS shareholders approved a dividend rate of 16% in cash for 2024, slightly lower than the 18% rate in 2023. The company is expected to make an additional dividend payment of 10% to fulfill its annual dividend plan.

This marks the seventh consecutive year that Fahasa has maintained dividend payments to its shareholders since its listing on the UPCoM in 2018, with a relatively stable dividend rate ranging from 10% to 18%.

In the stock market, the FHS share price has been trading sideways for the past month, hovering around the VND 32,000 per share mark. Compared to the beginning of the year, the FHS share price has increased by over 33%. However, the liquidity remains low, with an average trading volume of 335 shares per day.

|

FHS Share Price Movement since the beginning of 2024 |

By The Manh