Total Investment Development Construction Joint Stock Company (DIG-HOSE) announces the trading results of its insider’s shares.

Accordingly, DIG’s Vice Chairman, Mr. Nguyen Hung Cuong, submitted a report to the Ho Chi Minh Stock Exchange (HoSE), stating that a securities company forced the sale of over 5.3 million shares owned by the Chairman of the Board of Directors.

As a result, his ownership decreased from over 46.8 million shares, or 7.68%, to over 41.5 million shares, representing 6.8% of the charter capital in DIG. The transaction was executed on August 12th.

Previously, Mirae Asset also announced the forced sale of 4.7 million DIG shares owned by Mr. Nguyen Thien Tuan, the Chairman of the Board of Directors.

At the close of the trading session on August 12th, Mirae Asset Securities disclosed that it had forced the sale of 2,954,500 DIG shares.

This forced sale of shares occurred following the announcement by DIC Corp that Mr. Nguyen Thien Tuan, Chairman of the Board of Directors and legal representative, had passed away on August 10th.

According to the 2023 Annual Report, as of December 29, 2023, the company had 68,475 shareholders, with individual shareholders holding 93.93% and foreign shareholders owning 5.04%, of which institutions held 4.77%.

At the same time, DIG’s major shareholders included Mr. Nguyen Thien Tuan, with a 7.68% stake, and Mr. Nguyen Hung Cuong, with a 10.16% stake.

During the trading session on August 12th, there was significant selling pressure on DIG shares, with the stock falling to a low of VND 21,550 per share at one point. However, it closed the day down 3.67% at VND 22,300 per share, and by the close of August 16th, it had risen to VND 23,750 per share.

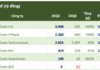

In the second quarter of 2024, DIC Corp recorded revenue of VND 821.25 billion, a surge of 407.8% year-on-year (VND 161.7 billion); and after-tax profit of VND 125.19 billion, a remarkable increase of 1,281.43% compared to the same period last year (VND 9 billion).

According to the company’s explanation, the profit increase was due to a 26.2% decrease in finished product sales revenue (manufacturing materials), but a 145.78% surge in construction revenue at subsidiaries, and a 28.95% drop in service revenue, resulting in a over 407% increase in net revenue and a 1,281.43% jump in after-tax profit.

In the first half of 2024, DIC Corp recorded revenue of VND 821.74 billion, up 129.2% year-on-year, and after-tax profit of only VND 3.96 billion (due to a loss of VND 121.24 billion in the first quarter, the profit in the first half of 2024 was lower than in the second quarter), a decrease of 95.4% over the same period.

In 2024, DIC Corp set a target of VND 2,300 billion in revenue, up 72% year-on-year; VND 1,010 billion in expected pre-tax profit, up 508.9% from 2023; and planned investment capital of VND 7,211.8 billion, up 541% year-on-year.

Thus, with a pre-tax profit of VND 47.95 billion in the first half of 2024, DIC Corp has achieved only 4.7% of its full-year plan.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.