Coffee prices are expected to remain volatile until the end of 2024, according to experts, due to adverse weather conditions, transport disruptions, and tightening legal environments in several countries.

While some experts predict that tensions will ease in 2025, long-term price trends are still expected to be upward due to climate change and other factors.

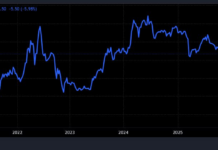

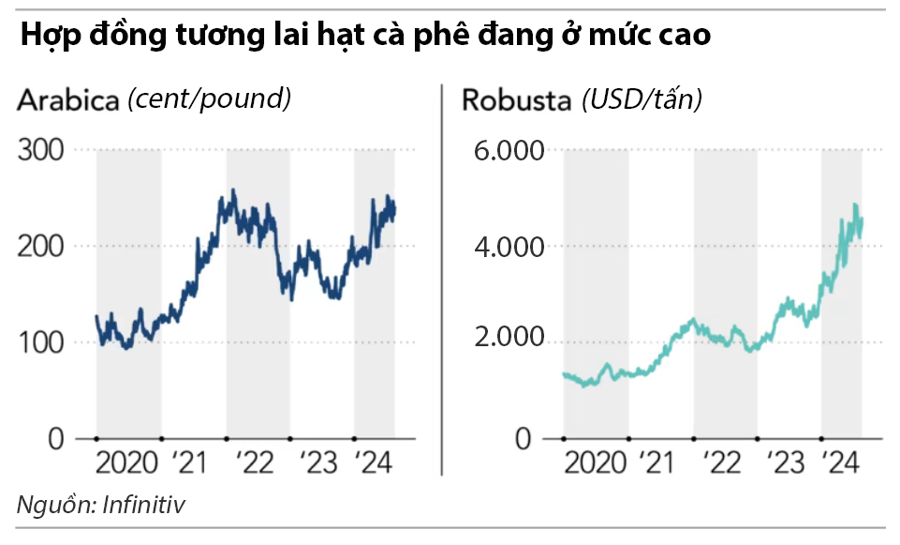

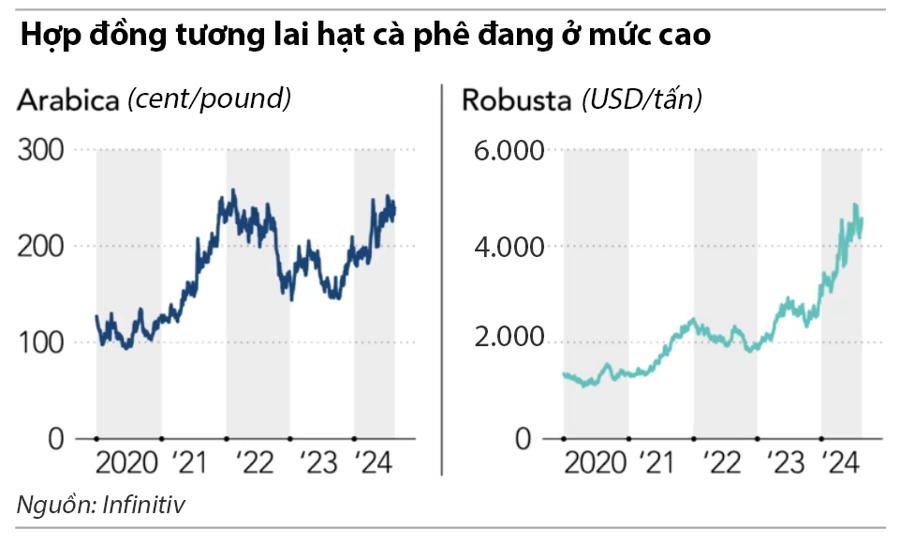

In recent months, global coffee prices have been strong. Robusta coffee bean futures contracts on the London Commodity Exchange hit a historical high last month and have since maintained levels above $4,000 per ton. Meanwhile, Arabica coffee bean futures contracts on the New York Commodity Exchange have been trading above $2 per pound (equivalent to $4,444 per ton) since the beginning of this month.

“We used to think that $2,000 per ton for robusta coffee beans was already very high,” said Kosuke Nakamura, import manager at UCC Ueshima Coffee of Japan, in an interview with Nikkei Asia. “The price of this type of coffee bean is now at a level that was unthinkable about 1-2 years ago.”

According to experts, the upward price trend reflects several factors, including a drop in production in Vietnam last year – the world’s second-largest coffee producer – due to El Niño.

“Vietnam’s coffee production was not too disappointing, only about 5% lower than expected, but this followed a decline in Brazil’s coffee production in previous years, leading to low inventory levels,” said Carlos Mera, head of agricultural commodity market research at Rabobank.

Transport delays have also impacted prices. Shipping issues have become more common as carriers have had to change routes due to concerns about crises in the Red Sea region.

Meanwhile, coffee importers in Europe are facing challenges in complying with the European Union’s Anti-Deforestation Regulation (EUDR). The new regulation aims to ensure that products consumed in the EU do not contribute to deforestation or forest degradation. European coffee businesses are rushing to increase imports ahead of the EUDR coming into force later this year.

All these factors have contributed to the surge in coffee prices.

“We predict that coffee prices will continue to rise in 2024, before falling in 2025 if Brazilian coffee production reaches stable levels,” Mera said.

However, Charles Hart, a senior commodity analyst at BMI, argued that coffee prices are becoming more sensitive to news than before due to market tightness.

“After the dry period caused by El Niño, the La Niña weather phenomenon could bring more rain during the latter part of the coffee crop year in Vietnam. This is a positive signal for the market,” Hart said.

Taisuke Horie, a coffee trader at Marubeni in Japan, pointed out that some of the factors influencing the market may self-correct in the coming months.

“Demand is currently focused on cheaper coffees, not the expensive ones,” Horie said. “From 2021 until now, some large importers have switched to buying robusta coffee, which is usually cheaper than Arabica, when Brazilian supply was severely affected by fog and price surges during the pandemic. Even though this year’s crop in Brazil is better, importing companies have not completely returned to Arabica, especially the high-quality wet-processed type.”

Experts believe that while coffee prices may ease, structural changes will keep prices in the next decade higher than in the past. One of these factors is climate change.

“Extreme weather events are becoming more frequent and could cause significant fluctuations in global coffee production and, consequently, prices,” Hart of BMI commented.

Another factor is the challenge of complying with the EUDR.

“If this regulation is strictly enforced, I think many coffee-producing countries may not be able to comply immediately,” Horie of Marubeni said. “Proving that a farm is not contributing to deforestation will be difficult without data, even if the farm is not doing anything harmful to the forest.”

According to Horie, these legal barriers will make it challenging for many EU importers to find sources of supply.

“When the regulation is enforced, producing countries will have to bear the costs of compliance. So, this is not just an issue for the EU,” Nakamura of UCC concluded.

Prime Minister discusses investment, production, and business with 19 corporations and conglomerates

On the morning of February 5th, Prime Minister Pham Minh Chinh chaired a working conference with the State Capital Management Committee in Enterprises and 19 groups and corporations to discuss the implementation of production and business activities in 2024, as well as promoting investment for economic and social development.

Ensuring a Stable Fuel Supply for the Lunar New Year 2024

The Ministry of Industry and Trade has recently issued a letter to key petroleum producers, petroleum trading companies, and petroleum distribution businesses, requesting them to ensure a stable supply of petroleum for production, business, and consumption during the Lunar New Year holiday in 2024, which falls on the Year of the Wood Dragon.