High property prices remain stagnant despite high demand

The Ministry of Construction has released its Q2 2024 real estate market report, highlighting that while property prices remain high, actual transactions are relatively low. The report attributes this phenomenon to the significant gap between property prices and people’s income, a trend that persists amid economic challenges and stagnant income levels among prospective buyers.

Despite the market cooling down from its peak in April-May 2024, apartment prices in Hanoi remain high with no signs of decreasing. Apartments priced at VND 2 billion and below are almost non-existent on brokerage floors or online listings. The few listings in this price range are typically studio apartments with one bedroom and one bathroom or two-bedroom apartments with only one bathroom, mostly from projects that have not yet started construction or are still awaiting pink book issuance.

Interestingly, some brokers on Batdongsan.com.vn have been observed deliberately posting outdated apartment listings at attractive prices to lure potential buyers. However, upon contact, these brokers redirect interested parties to other, more expensive options, mostly consisting of collective housing or studio apartments.

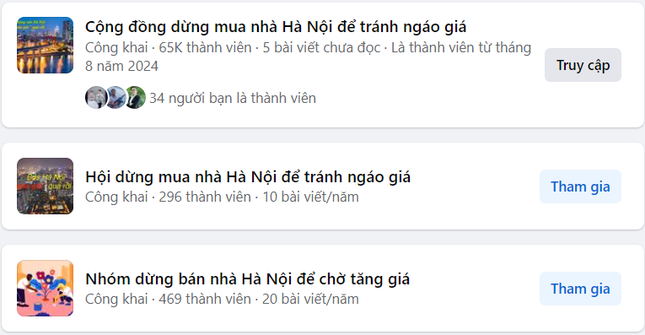

Frustrated by the relentless price hikes and unethical brokerage practices, various online communities such as the “Hanoi Homebuying Pause Community to Avoid Price Shock,” with 65.3 thousand members, have emerged on social media, gaining traction among like-minded individuals.

Online communities are forming to combat the challenges of rising apartment prices and unethical brokerage practices.

Slowdown in loan demand from both individuals and businesses

The Q2 2024 real estate market report from the Ministry of Construction also reveals a significant slowdown in loan demand from both businesses and individuals in the real estate sector, which has traditionally been a major driver of credit growth.

Mr. Nguyen Quang Ngoc, Deputy Head of Credit Policy at Agribank, shared that the bank has allocated VND 30 trillion at a supportive interest rate of 2% for legal entities and individuals investing in projects or purchasing houses in social housing, worker housing, and renovated old apartment building projects as approved by the Ministry of Construction.

Loan demand related to housing projects has slowed down from both businesses and individuals.

As of July 31, 2024, Agribank has approved 13 social housing projects and 113 individual home buyers, with a total approved amount of VND 3,065 billion and outstanding loans of VND 731.523 million, an increase of VND 490 billion and 112 customers compared to the beginning of the year (with VND 663.749 million in outstanding loans to investors and VND 67.774 million to home buyers).

In Hai Phong city, as of the same date, outstanding loans for social housing purchases stood at only VND 4,264 million, with 19 customers across two branches: Bac Hai Phong and Dong Hai Phong.

“Agribank recognizes that the demand for social housing loans in Hai Phong city and across the country remains relatively low. As such, Agribank aspires to connect with developers and individuals seeking capital for social housing development and purchase,” said Mr. Nguyen Quang Ngoc.

Regarding credit issuance, the Ministry of Construction cited data from the State Bank of Vietnam, indicating that as of May 31, outstanding loans for real estate business activities reached VND 1,205,437 billion.

Of this, outstanding loans for urban area, housing project development, and office leasing stood at VND 318,799 billion, VND 44,080 billion, VND 86,330 billion, and VND 49,127 billion, respectively.

Additionally, outstanding loans for restaurant and hotel projects were VND 61,483 billion, while loans for house construction, repair, sale, and leasing amounted to VND 126,794 billion. Loans for land-use right purchases reached VND 94,402 billion, and loans for other real estate business activities totaled VND 424,422 billion.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.