Insider Trading: A Glimpse into Vietnam’s Stock Market

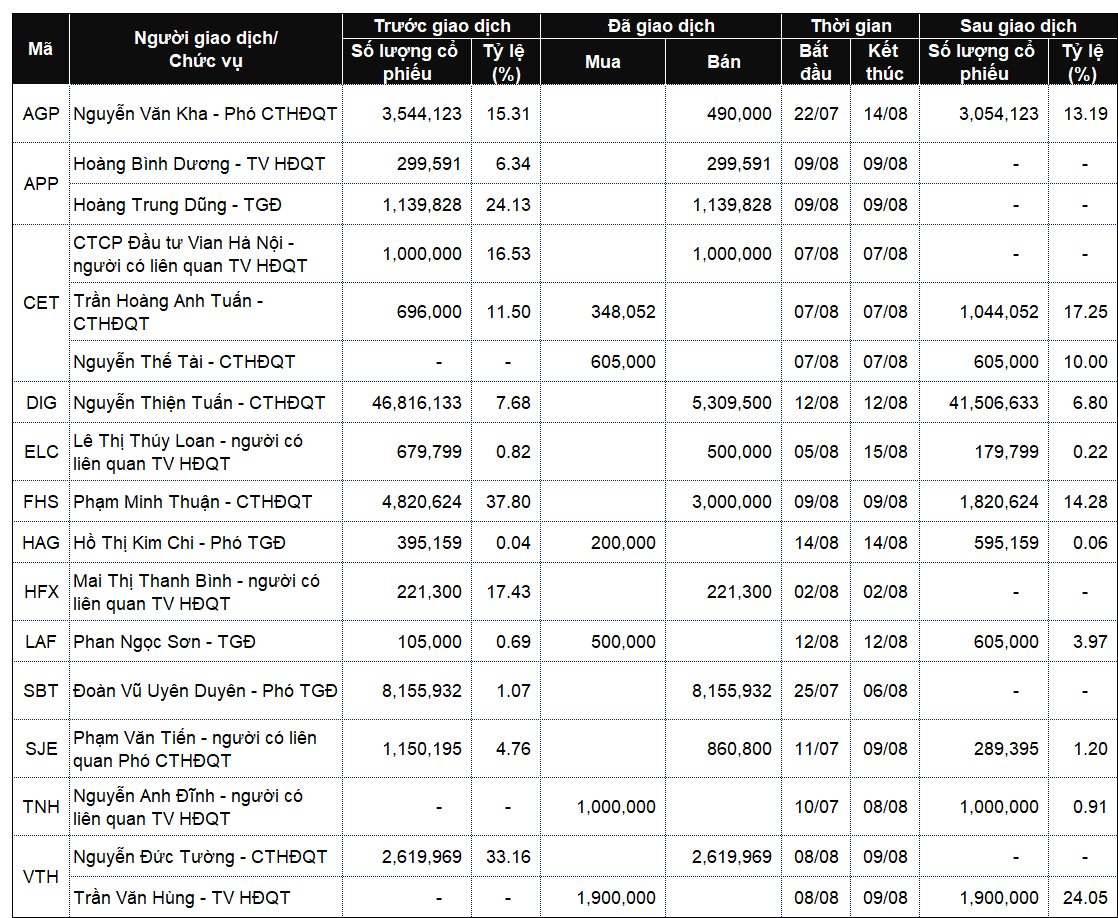

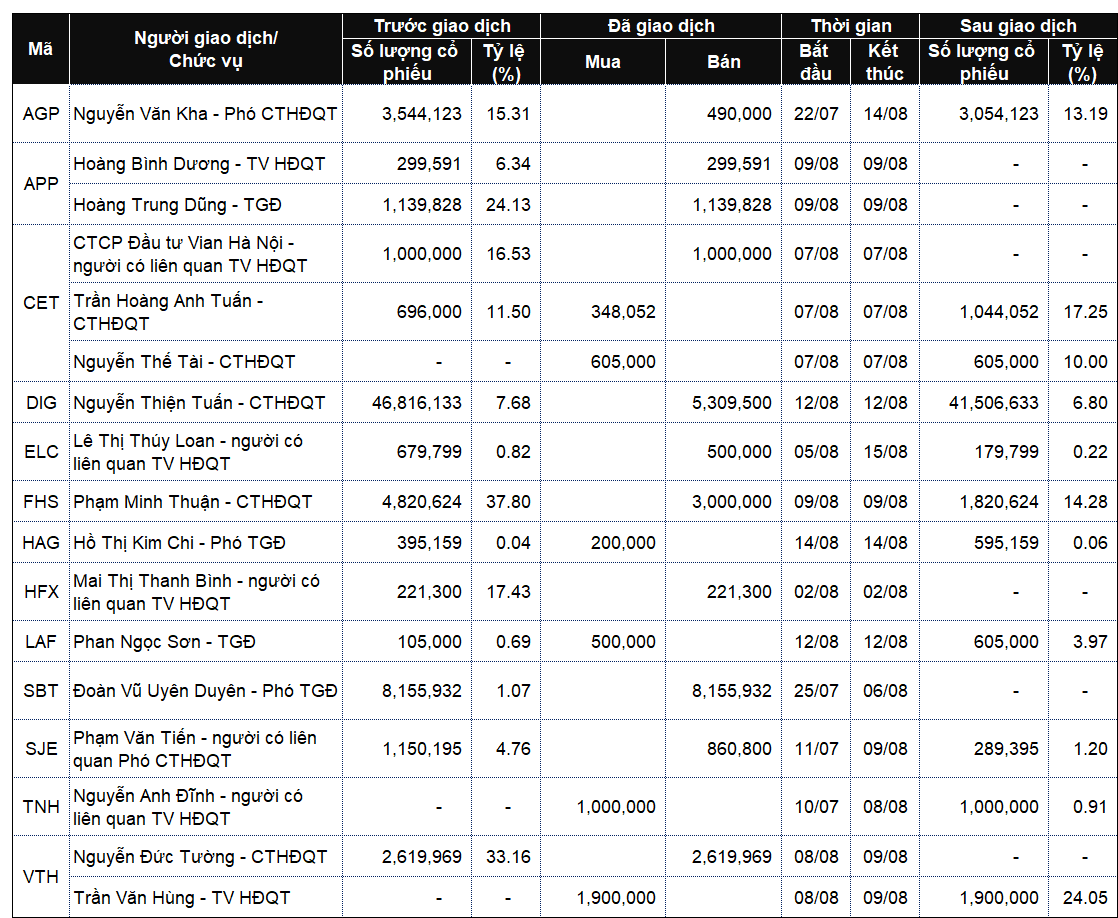

Leadership stock transactions: Sparse buy orders

1 million CET shares change hands

Mr. Nguyen The Tai, Chairman of the Board of Directors of HTC Holding JSC (HNX: CET), has purchased 605,000 shares, thus officially becoming a major shareholder of the Company with a 10% holding. Prior to this transaction, Mr. Tai did not own any CET shares. Mr. Tran Hoang Anh Tuan, Vice Chairman of the Board of Directors, successfully acquired more than 348,000 shares, increasing his stake to 17.26%, equivalent to more than 1 million shares.

Meanwhile, major shareholder Ms. Bui Thi Hai Yen also purchased nearly 47,000 shares, expanding her ownership to 22.26%. All these transactions were executed on August 7.

On the opposite side, Hanoi Vian Investment JSC has divested its entire holding of 1 million CET shares, representing a 16.53% stake, and is no longer a shareholder of the Company as of August 7.

In terms of connections, Mr. Nguyen Quoc Phuong, Member of the Board of Directors and General Director of CET, is also currently the CEO of Hanoi Vian Investment JSC. Mr. Phuong does not own any CET shares.

Notably, the number of shares bought by Mr. Tai, Mr. Tuan, and Ms. Yen matches the number of shares sold by Hanoi Vian Investment JSC. Additionally, on August 7, there was a matched trade of 1 million shares valued at VND 6 billion (equivalent to VND 6,000 per share). This was likely the transaction between Hanoi Vian Investment JSC and Mr. Tai, Mr. Tuan, and Ms. Yen.

Fahasa Chairman completes sale of 3 million shares

Mr. Pham Minh Thuan, Chairman of the Board of Directors and legal representative of Ho Chi Minh City Book Distribution Corporation (Fahasa, UPCoM: FHS), successfully sold 3 million shares on August 9, 2024.

Following this transaction, Mr. Thuan’s stake decreased from 37.8%, or more than 4.8 million shares, to 14.28%, equivalent to over 1.8 million shares.

Based on the closing price of FHS shares on August 9, the share price stood at VND 31,000 per share. With this price, Mr. Thuan is estimated to have pocketed VND 93 billion.

Camimex’s young leader aims to accumulate 14 million CMM shares

After purchasing 3.4 million shares in May, Mr. Bui Duc Dung, Member of the Board of Directors of Camimex JSC (UPCoM: CMM), has just registered to buy an additional 14 million shares to increase his ownership from 3.5% to 18.4%.

The expected transaction period is from August 15 to September 13, 2024, and the shares can be acquired through matched trades or order matching. The purpose of this transaction is for investment.

As of the opening of the morning session on August 14, the market price of CMM shares was VND 5,700 per share, a decrease of nearly 15% in the last three sessions. If Mr. Dung purchases at this price, he will need to spend approximately VND 80 billion.

The CMM share price has plummeted from its all-time high since its listing in 2022, dropping from VND 11,000 per share to VND 5,700 per share (post-adjustment), losing half its value in less than two weeks. The trading volume during the morning session of August 14 was also exceptionally high, exceeding 627,000 shares compared to the average of a few tens of thousands of shares since the beginning of the year, excluding sessions with zero liquidity.

DRG persists in selling its entire holding of nearly 22.4 million DRI shares

Dak Lak Rubber JSC (UPCoM: DRG) announced that it had sold more than 4.2 million shares of Dak Lak Rubber Investment JSC (UPCoM: DRI) out of the nearly 22.4 million shares registered for sale from June 3 to July 2, 2024.

DRG attributed the reason for not selling all the registered shares to unfavorable market conditions. Following this transaction, DRG’s ownership in DRI decreased from 66.6% to 60.84%, equivalent to more than 44.5 million shares.

During the period of DRG’s trading, there were no matched trades of DRI shares. Consequently, all of DRG’s transactions were executed through order matching. Based on the average closing prices during the trading period, the transaction value is estimated to be nearly VND 57.8 billion.

Immediately after completing this transaction, DRG registered to sell an additional 18.2 million DRI shares from July 10 to August 8, 2024. If this transaction is successful, DRG’s ownership in DRI will decrease to 36%.

DRG’s determination to sell its entire holding of nearly 22.4 million DRI shares aligns with the company’s capital divestment strategy. Specifically, on May 27, 2024, the DRG Board of Directors approved the goal of divesting nearly 22.4 million DRI shares at a starting price of VND 14,100 per share. Accordingly, if the divestment is successful, DRG could potentially reap nearly VND 316 billion from this transaction.

|

List of company leaders and relatives trading from August 12 to 16, 2024

Source: VietstockFinance

|

|

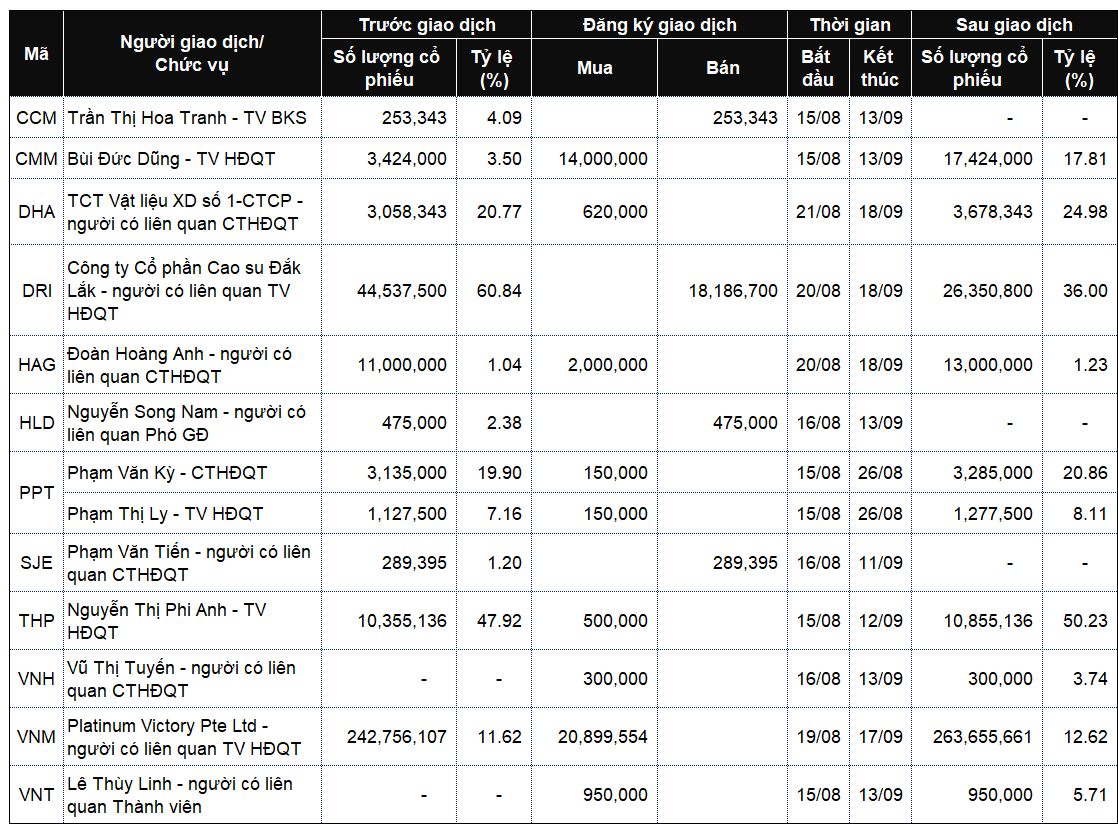

List of company leaders and relatives registering to trade from August 12 to 16, 2024

Source: VietstockFinance

|