With a payout ratio of 6% (1 cp receives VND 600) and nearly 133.5 million circulating shares, the company is estimated to pay out over VND 80 billion. The payment is expected to be made on September 27, 2024.

This dividend level is in line with the plan approved at the 2024 Annual General Meeting of Shareholders. At that time, the AGM authorized the Board of Directors to decide on the timing and implement the necessary procedures.

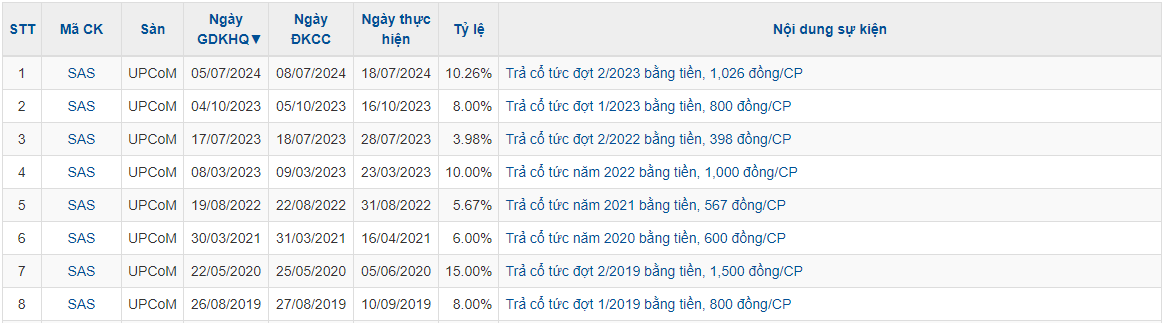

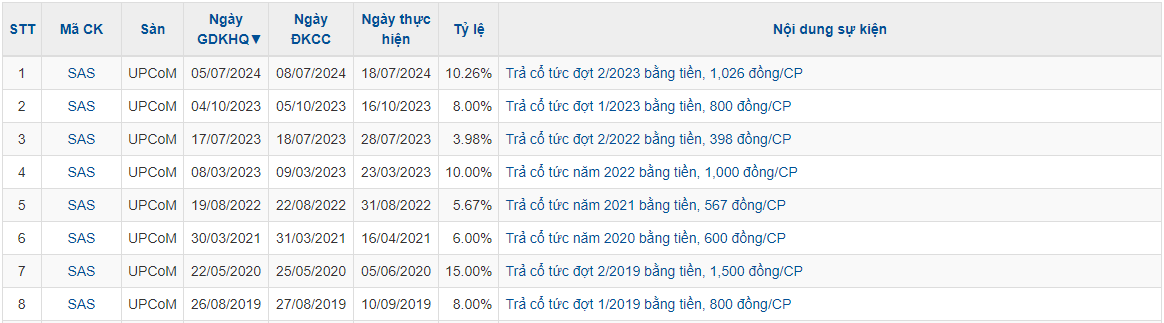

In the past, SAS has frequently split dividends into two phases. For the 2023 dividend, SAS also distributed a ratio of 8% in October 2023 and 10.26% in July 2024.

|

SAS’s dividend history in recent years

Source: VietstockFinance

|

In terms of business performance, in Q2 2024, the enterprise led by Mr. Johnathan Hanh Nguyen, announced a decline in net profit.

Specifically, SAS recorded VND 654 billion in revenue in Q2, up 8% over the same period last year. However, surprisingly, net profit decreased by nearly 9%, reaching VND 68 billion.

The main reason for this decline was the increase in expenses such as cost of goods sold, selling and administrative expenses, and financial expenses.

Nevertheless, overall, in the first half of 2024, SAS still experienced slight growth. Cumulative net profit for the six months reached nearly VND 114 billion, up nearly 3% over the same period. This result was largely due to the improvement in business performance in Q1 and the recovery of the aviation market.

| SAS’s business results during the recovery period |

Huy Khai

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.