The Q2 business results of listed enterprises, both financial and non-financial sectors, were very positive. However, stock price movements did not reflect this as the VN-index witnessed sharp declines and fell below 1,200 points, only recovering in recent sessions. The low profitability of bank stocks, which account for a large market capitalization, has impacted the market’s growth trend.

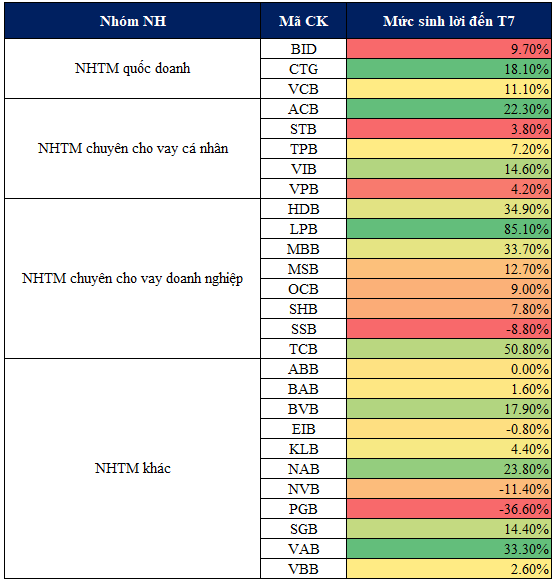

In addition, the disparity in profitability among bank stocks is significant since the beginning of the year. Some banks have almost doubled their profits, while many others have posted strong gains. However, several banks are experiencing significant declines. In the context of challenging credit growth, the profitability of bank stocks heavily relies on the ability to direct credit flow to efficient customer segments based on the implementation of different banking groups’ business strategies.

Overall trend in profitability among banking groups

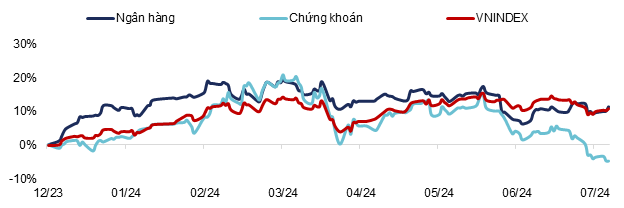

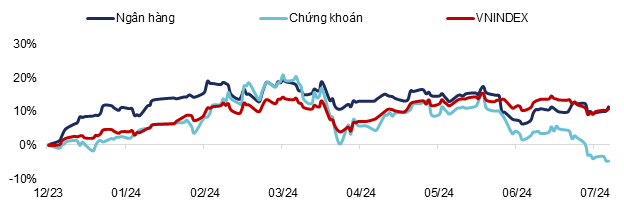

After outperforming the general market in the first four months of the year, bank stocks began to underperform in the following months, thus contributing to the market’s stagnation. The profitability of bank stocks up to this point is only comparable to the market average of around 9-10% year-to-date. Moreover, the profitability of bank stocks varies considerably among banks implementing different business strategies.

|

Chart 1: Profitability of the Banking Sector from the Beginning of the Year to the End of July

Source: Consolidated

|

State-owned bank stocks have shown much more stable growth than the industry average. These banks maintain stable profitability, usually ranging from 9% to 18%, a relatively safe and attractive figure for long-term investors. This reflects the stability of large banks’ operations, with a strategy focused on corporate clients and tight risk management. However, this stable profitability also indicates a lack of breakthrough to some extent, as the market becomes increasingly competitive, and smaller banks emerge with more flexible business strategies in the current challenging context. Among this group, Vietinbank stands out with its stable growth potential by effectively leveraging its existing customer base, contributing to better profitability in the first half of the year.

Banks like Techcombank, HDB, and LPBank have achieved far more impressive profitability by focusing on corporate lending, thus creating a stronger profit growth momentum for their stocks. However, these corporate lending-focused banks also exhibit a wide range of profitability, from 7.9% to 34.85%. They have effectively leveraged the economic recovery trend, especially as businesses expand their production and investment. Nevertheless, high profits always come with risks. By boosting lending, banks face the challenge of rising non-performing loans, which can impact asset quality and long-term profitability.

Banks specializing in personal lending have underperformed compared to the above two groups due to credit growth challenges amid weak demand from households. These banks have had to shift their growth momentum towards corporate lending to support overall growth. Some banks, such as ACB and VIB, have achieved good profitability by creating new credit growth drivers in the corporate sector instead of traditional personal credit.

|

Chart 2: Profitability of Bank Stocks as of the End of July

Source: Consolidated

|

Impact of credit growth and business strategy on profitability

The profitability of banks is clearly differentiated based on their credit growth capabilities. In Q2-2024, credit growth among banks varied significantly. Banks like Techcombank, LP Bank, and HDBank achieved impressive credit growth, contributing to improved profits with enhanced NIM due to reduced funding costs as CASA ratios increased. However, focusing on credit also comes with risks, especially when the economy is still facing uncertainties. Banks must address the challenge of maintaining asset quality and controlling bad debts. Credit growth not only impacts short-term profits but also shapes the long-term strategies of banks in an increasingly competitive environment.

The business strategy of each bank plays a crucial role in determining profitability. Banks with clear and focused strategies on specific market segments tend to achieve higher and more stable profitability, aligning with the trend of economic recovery and increased credit to private enterprises. In contrast, small banks with unclear or overly dependent strategies on certain income sources will struggle to maintain profits in the highly competitive landscape.

The combination of factors related to hot credit growth, along with rising non-performing loans and declining provisions, has kept bank stocks in a low valuation zone based on both P/E and P/B ratios. The P/B ratio of the banking sector remains in a mid-range valuation compared to historical levels, from 1.3 to 1.4. The decline in profit quality has led to a P/E ratio of only 9x for the sector, significantly lower than the average of other sectors, which typically ranges from 16-18x.

Q2-2024 marked notable changes in the profitability and stock performance of banks. The clear differentiation among banking groups reflects both the macroeconomic landscape and individual bank strategies. Selecting suitable bank stocks requires in-depth knowledge of each bank’s business strategy, credit growth, and risk management capabilities. Investors should closely monitor market developments and adjust their investment strategies to optimize performance during this challenging period.

Le Hoai An, CFA – Nguyen Thi Ngoc An – HUB

When leaders write about company culture, core values resonate, employees say ‘great’, but when it’s time to execute…whoops

Many retail organizations talk about transforming their culture from selling to “customer centric,” but the key to delivering on this strategy is enabling every employee to want to do it and know what they need to do differently every day.