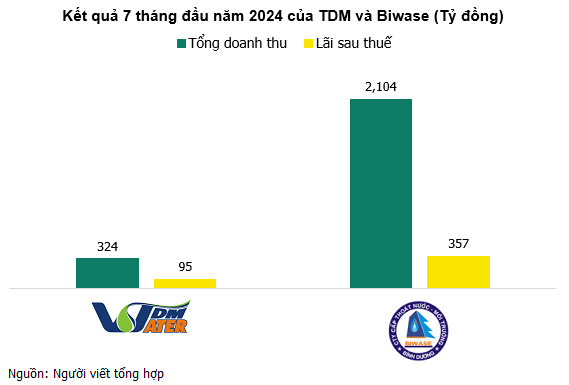

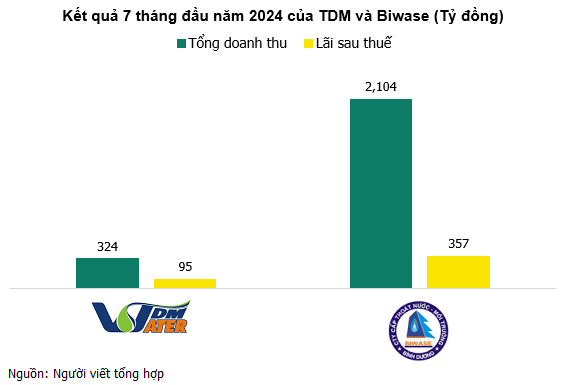

For the first seven months of 2024, Biwase, HOSE: BWE), a leading water and environment company, reported estimated earnings of 2,104 billion VND in total revenue and 357 billion VND in post-tax profits, marking a 6% increase and a 7% decrease, respectively, compared to the same period last year.

The company disclosed that, as of July, nearly 222 billion VND in revenue from waste and wastewater treatment had not yet been recognized. Taking this into account, the total revenue is estimated to be nearly 2,326 billion VND, achieving 57% of the annual plan.

Specifically, for July, Biwase’s total revenue was estimated at 230 billion VND, with post-tax profits of 55 billion VND.

TDM Water (HOSE: TDM) preliminarily estimated their results for the same seven-month period, reporting total revenue of over 324 billion VND and post-tax profits of more than 95 billion VND. These figures represent a 9% and 49% decrease, respectively, compared to the same period in 2023. The company has achieved 62% of their revenue target and 50% of their profit goal for the year.

A breakdown of their performance shows that the water production segment contributed over 272 billion VND to the total revenue (accounting for nearly 84%), a 5% increase from the previous year. They also generated nearly 48 billion VND in revenue from the sale of materials. In contrast, financial activities yielded only 4 billion VND, a steep 96% drop due to the lack of cash dividends from Biwase.

For the month of July, TDM is estimated to have achieved nearly 27 billion VND in total revenue and over 13.5 billion VND in post-tax profits.

TDM is a strategic shareholder of BWE, holding a 37.42% stake. However, there is a significant gap in their business scale and performance. In fact, both leading water companies experienced a decline in profits in the second quarter of 2024.

Specifically, TDM posted a net profit of nearly 44.4 billion VND, a decrease of almost 20% year-over-year, while Biwase reported a 36% drop in profit to 133.5 billion VND, which is still three times higher than TDM‘s profit.

Both companies attributed the profit decline to foreign exchange losses amid volatile currency markets. Additionally, TDM recorded an increase in allowance for investment loss.

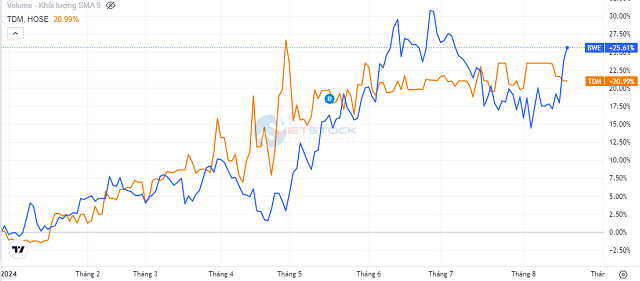

Despite recent adjustments, both water industry stocks have performed well since the beginning of 2023. BWE shares have risen over 25%, approaching their highest peak of 47,000 VND per share reached in late June 2024. TDM shares have also climbed over 20% to the 49,000 VND level.

Stock price performance of TDM and BWE since the beginning of 2024

Source: VietstockFinance

|

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.