With the global economy facing numerous challenges and uncertainties, remittances have become an important source of stimulus for the economic and social development of countries, especially developing nations such as Vietnam.

According to the State Committee for Overseas Vietnamese, there are currently around 6 million Vietnamese living and working in over 130 countries and territories, along with approximately 650,000 Vietnamese workers in 40 countries and territories worldwide.

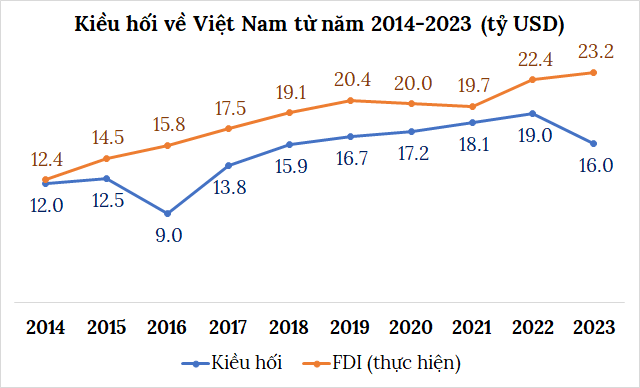

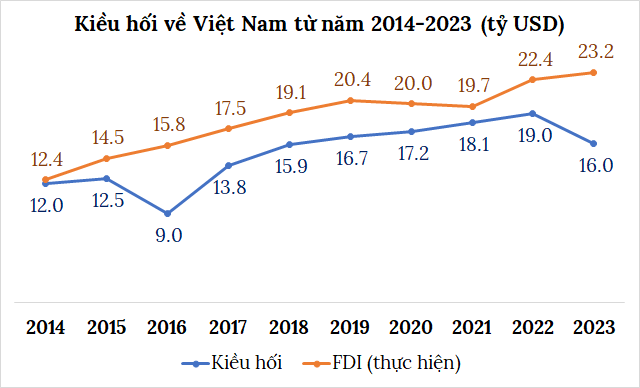

Statistics show that remittance inflows to Vietnam have been significant, even surpassing foreign direct investment (FDI) inflows in recent years. Remittances have consistently accounted for a large proportion of external capital sources and have been on an upward trend.

Source: Consolidated

|

Over the last decade, Vietnam has consistently ranked among the top 10 countries in the world and the top 3 in the Asia-Pacific region in terms of remittance receipts. The cumulative remittance inflows from 1993 to 2022 exceeded 190 billion USD, with an estimated 16 billion USD in 2023, nearly matching the FDI disbursements during the same period. Approximately 25% of annual remittances are estimated to flow into the real estate market.

Data from the State Bank of Vietnam’s Ho Chi Minh City branch reveals that remittances to the city reached nearly 5.2 billion USD in the first half of 2024, accounting for nearly 55% of the total remittances in 2023 and a nearly 20% increase compared to the same period last year.

These figures highlight the stability and significant growth of remittance inflows in recent years. With more favorable legal frameworks, the real estate market is expected to attract more remittance capital, revitalizing the market.

Reducing Risks for Overseas Vietnamese When Investing in Real Estate

Three new laws, namely the Real Estate Business Law, the Housing Law, and the Land Law, came into effect in early August, introducing significant changes. Notably, the laws expand land use rights for overseas Vietnamese.

Under the new Land Law provisions, overseas Vietnamese are now eligible for land use certificates from the state if they meet the requirements. Previously, overseas Vietnamese had to rely on relatives or acquaintances to invest in local real estate, leading to potential disputes and risks during the investment process.

This legal hurdle has been a significant factor in the hesitation of overseas Vietnamese to invest in Vietnam’s real estate market.

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, shared his insights on the matter, emphasizing the significance of remittance inflows for Vietnam’s long-term economic development. He applauded the new laws as a humanitarian gesture and expressed confidence that they would boost the real estate market’s vibrancy by encouraging more investments from overseas Vietnamese.

Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region

|

According to Mr. Tuan, while the demand for real estate among overseas Vietnamese has remained consistent, the amount of remittance inflows is influenced by the economic situation in their host countries. They may choose to invest in Vietnam to generate additional profits or send money back to their families, with a significant portion going into real estate purchases.

Analyzing search data from batdongsan.com.vn, he noted that the majority of overseas Vietnamese searching for properties on the website were from California, accounting for approximately 2% of the total searches nationwide, followed by Australia and Singapore.

“The new laws address the long-standing issue of overseas Vietnamese not having proper legal standing when investing in real estate through relatives or acquaintances, which carried inherent risks,” Mr. Tuan explained. “With the market becoming more transparent, we can expect to see more investments and remittances from overseas Vietnamese.”

Factors Motivating Overseas Vietnamese to Invest in Vietnam

The steady increase in remittance inflows for investments in Vietnam reflects the market’s stability and sustainability. Several factors drive overseas Vietnamese to invest in their home country.

In addition to Vietnam’s political stability and impressive economic growth rates, Mr. Tuan highlighted other compelling reasons. These include a sense of patriotism and a desire to contribute to the country’s development, the introduction of favorable regulations, and Vietnam’s competitive real estate market compared to other Southeast Asian countries.

Historically, overseas Vietnamese investments in Vietnam have been largely successful, providing further encouragement for continued investment. Moreover, if investment returns in Vietnam surpass those in their host countries, they are more inclined to choose their homeland for investment.

“Remittances play a crucial role in stimulating consumption and economic growth in Vietnam, contributing approximately 5-6% to the country’s GDP,” Mr. Tuan remarked. “The government has been proactive in creating an attractive investment environment to draw more remittance capital from overseas Vietnamese.”

Real Estate Preferences of Overseas Vietnamese Investors

While the new laws have just come into effect and may not have had a significant impact yet, Mr. Tuan anticipated a 30-40% increase in remittance inflows by the end of the year. However, he expected a more substantial surge in 2025-2026 as the laws become more established.

Regarding investment preferences, Mr. Tuan predicted that overseas Vietnamese investors would favor tangible real estate assets, particularly individual houses and apartments in central locations and major cities. These properties offer the potential for monthly rental income and long-term capital preservation, making them attractive options for this investor group.

“Overseas Vietnamese typically prefer investments that generate steady income rather than speculative ones, which often involve complex procedures,” he added.

Apartments are expected to be a favored investment choice for overseas Vietnamese in the coming time.

|

In terms of price points, Mr. Tuan noted that for individual houses, overseas Vietnamese tend to seek properties valued at over 15 billion VND in areas suitable for business operations. For apartments, they usually look for units priced at around 5 billion VND, which are easier to rent out.

Commenting on future apartment prices, Mr. Tuan predicted that they would continue to rise due to various factors, including increased input costs, more challenging permit processes, higher land prices, and elevated development project expenses. Additionally, apartment prices in comparable locations are often lower than those of land plots, as seen in Binh Duong, where the average apartment price is 35 million VND/m2 compared to 40 million VND/m2 for land.

Mr. Tuan anticipated that in the future, apartment and land prices in major cities would reach parity. As a result, apartment prices in Ho Chi Minh City and Hanoi will continue to climb but at a sustainable pace.

Furthermore, the more favorable legal environment is expected to stimulate additional real estate purchases by overseas Vietnamese, leading to price increases. However, these price adjustments will likely align with rental market trends.

“Currently, rental yields for individual houses are at 2%, while apartments offer slightly higher yields of 3.5-4%. If apartment prices rise to the point where rental yields drop to 2-3%, investors may shift their focus to land plots,” Mr. Tuan explained. “There will be a balance to ensure that apartment prices remain competitive with rental yields. While we can expect price increases, they will be gradual and sustainable.”

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.