On a sweltering autumn afternoon in Hanoi, 32-year-old Le Minh Anh, owner of a chain of fashion stores, is busy preparing for her online business expansion. “I need a flexible and secure payment solution for my online store,” she shares. That’s when she discovers Military Commercial Joint Stock Bank’s (MB) Banking-as-a-Service (BaaS) offering.

BaaS – MB’s Strategic Focus in the Digital Banking Era

BaaS, a relatively new concept in Vietnam, is quickly becoming a highlight in MB’s digital transformation strategy. Mr. Vu Thanh Trung, Vice Chairman of MB’s Board of Directors, explains, “BaaS is a model that allows third-party partners to connect to the bank’s system via APIs to offer financial and banking services directly to customers on the partner’s application/platform.”

Illustrative image

MB’s BaaS service enables financial institutions to connect flexibly with third-party partners via APIs, thereby offering digital financial services directly to end customers on the partner’s platform. Currently, MB boasts the richest API portfolio in the market with approximately 1,200 APIs, allowing customers to optimize cash flow management with absolute security.

“No matter the size of the partner, when integrating banking services into their platform, we commit to a swift integration process of no more than three weeks,” asserts Mr. Trung.

Le Minh Anh, owner of a fashion store chain

“This helps me save significant time and cost,” remarks Minh Anh. “I can focus on product development and customer care without worrying about complex payment issues.”

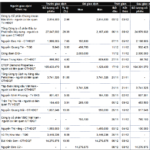

To date, MB has deployed BaaS services with over 1,000 enterprises across various sectors: retail, logistics, payment intermediaries, hospitals, schools, manufacturing, and more. By the end of 2024, transaction volume through MB’s BaaS services is expected to surpass VND 500,000 billion, solidifying MB’s leadership in deploying this service in Vietnam.

Challenges and Opportunities in the Digital Journey

However, the path of a pioneer is not without challenges. Observers note that ensuring cybersecurity and information security in an open ecosystem like BaaS is a significant challenge, with banks facing increasingly sophisticated and complex cyber threats.

In response to these concerns, MB has heavily invested in security technology and strictly adheres to the State Bank’s regulations. The bank implements multilayered security measures, including end-to-end encryption, two-factor authentication, and continuous monitoring to ensure customer safety.

Additionally, educating and raising awareness among customers about information safety is a priority for MB. The bank regularly conducts workshops and online training sessions on information security for enterprise customers using BaaS services.

Building an Ecosystem through Expanded Collaboration

Grasping market trends and demands, MB has also endeavored to launch innovative services on applications/platforms that customers use. Banking services are provided at any touchpoint where a transaction need arises with the bank, in the simplest and most convenient manner.

MB’s digital banking services

MB has seamlessly integrated its services with over 1,000 businesses, including leading names such as WinCommerce, THMilk, Vietnam Airlines, Momo, Zalopay, Vetc, Epass, and Thegioididong, minimizing manual reconciliation, optimizing business operations, and providing a convenient payment experience for customers. With MB’s BaaS, the enterprise’s system will be directly integrated with the bank’s system in the shortest time (no more than three weeks) and at the most competitive cost.

From Traditional Banking to the Center of a Digital Ecosystem

MB’s digitalization strategy doesn’t end with BaaS. The bank has also achieved impressive results in card and electronic payment services. Sharing MB’s digitalization progress, Mr. Luu Trung Thai, Chairman of MB’s Board of Directors, revealed that as of August 4, 2024, MB officially reached 28 million customers.

MB is actively expanding collaborations with partners in diverse fields, from e-commerce to transportation technology services. According to Mr. Thai, BaaS is an ideal service for chain enterprises, helping them automate their sales processes quickly. “This is a new and very promising direction,” affirms MB’s leader.

For Minh Anh and thousands of other small and medium-sized enterprises in Vietnam, the development of digital banking services like BaaS presents a significant opportunity to join the booming digital economy. “I feel like I’m part of a technological revolution in the financial industry,” enthuses Minh Anh. “This not only helps my business grow but also contributes to the overall development of Vietnam’s digital economy.”

Lucky Shipper Wins Big During Lunar New Year

In the days leading up to Tet holiday, the amount of online shopping has significantly increased, with delivery personnel being busy on every route in Hanoi. According to an e-commerce expert, online shopping during this Tet holiday has seen a remarkable surge and is expected to continue rising in the coming period.