After a brief pause, Vinamilk’s VNM stock quickly resumed its upward trajectory with a nearly 3% gain on August 19th. This strong breakout extends the recovery that began in mid-July, with the stock surging over 16% in nearly a month. With this upward momentum, VNM has reached its highest level in almost a year, since mid-September 2023.

The sharp rise in the stock price pushed Vinamilk’s market capitalization to nearly VND 160,000 billion ($6.4 billion). This figure propelled the dairy giant past Vingroup, reclaiming its spot in the top 10 most valuable companies on the Vietnamese stock market. However, the current market cap still pales in comparison to its golden era in late 2017 when Vinamilk reigned as the most valuable name in the market.

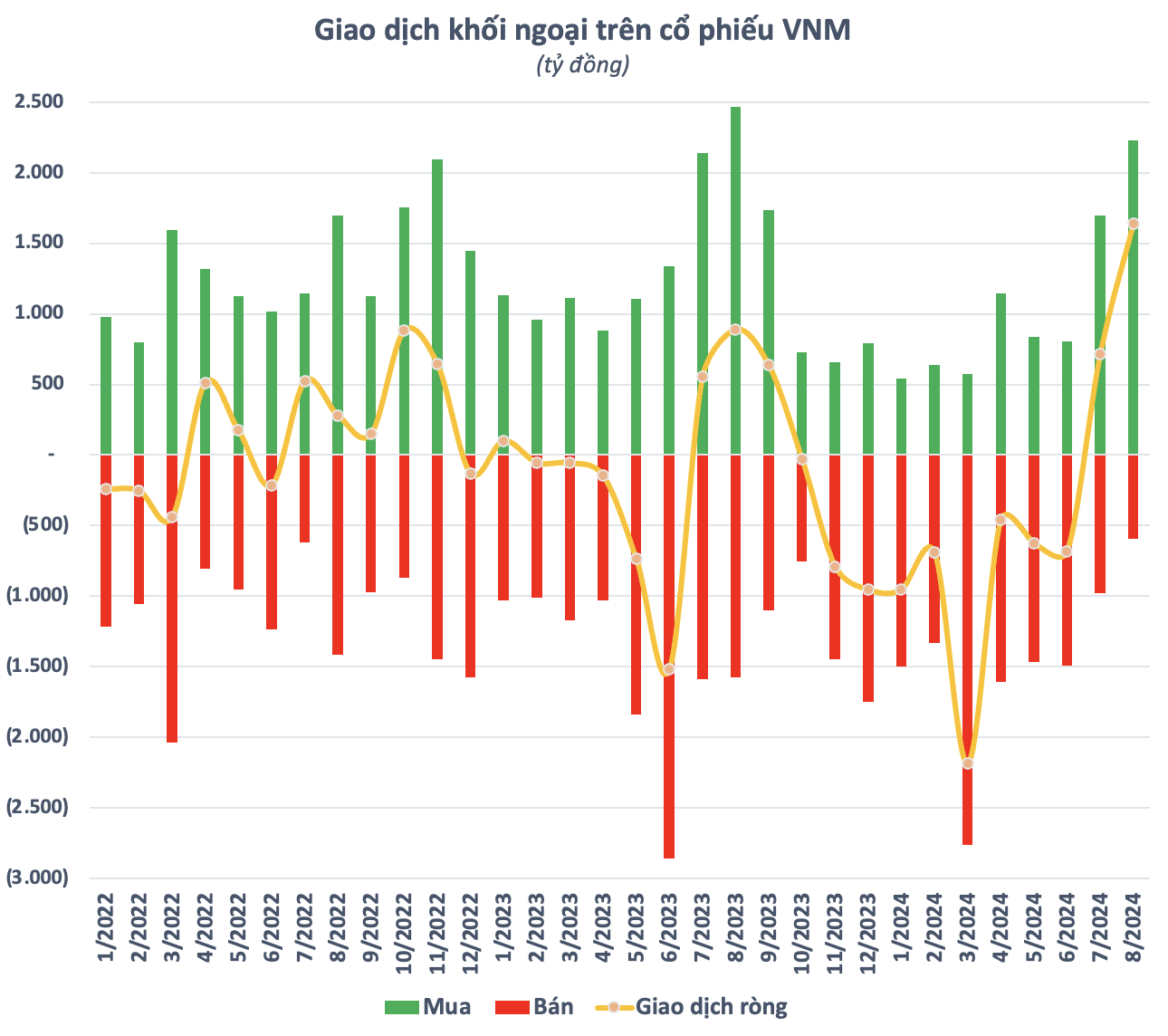

The upward trajectory of Vinamilk’s stock has been significantly bolstered by foreign investors. After a prolonged period of net selling, foreign capital has shown signs of a turnaround in the last two months. Since the beginning of July, foreign investors have net purchased approximately 33 million VNM shares, equivalent to a value of nearly VND 2,400 billion.

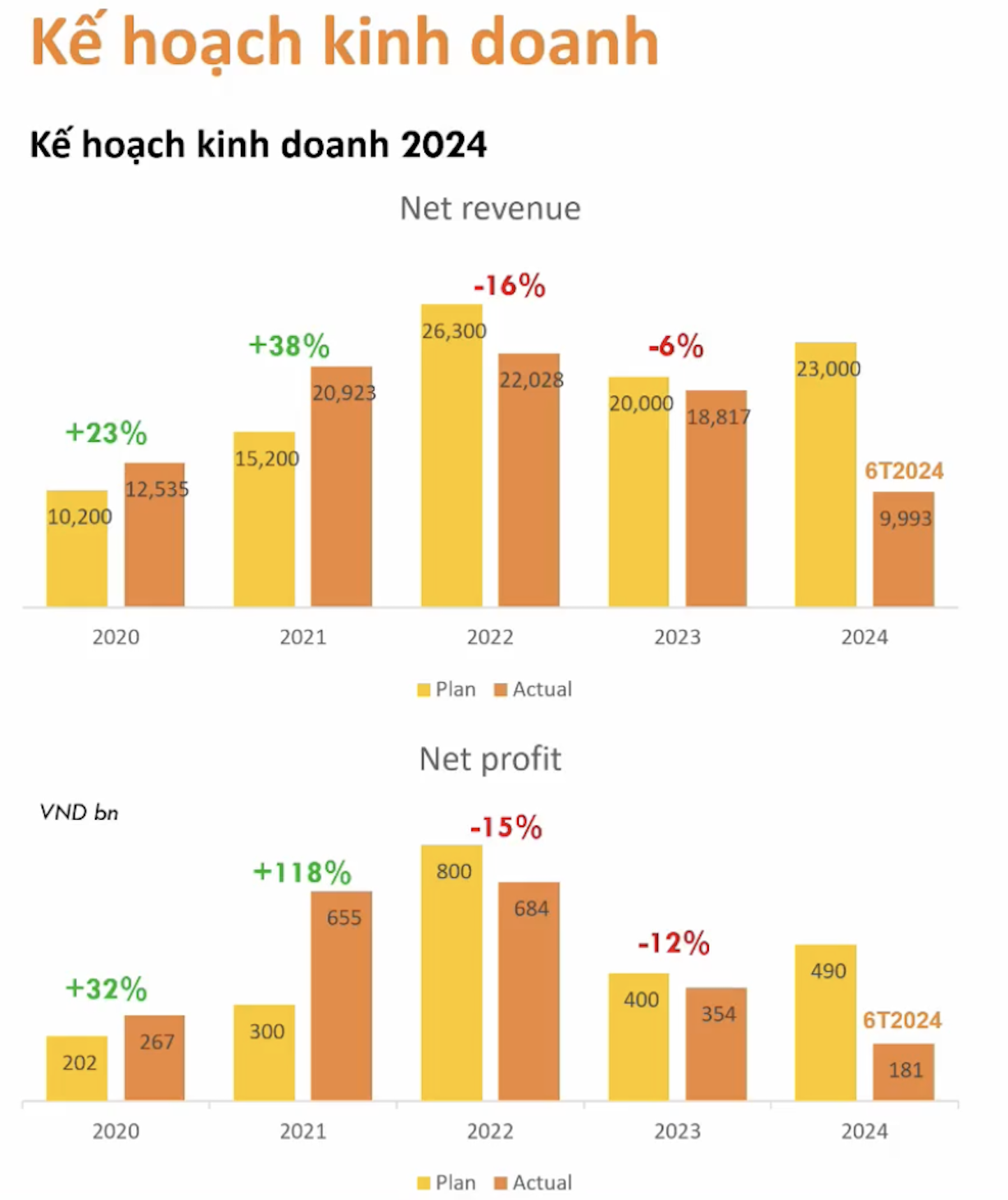

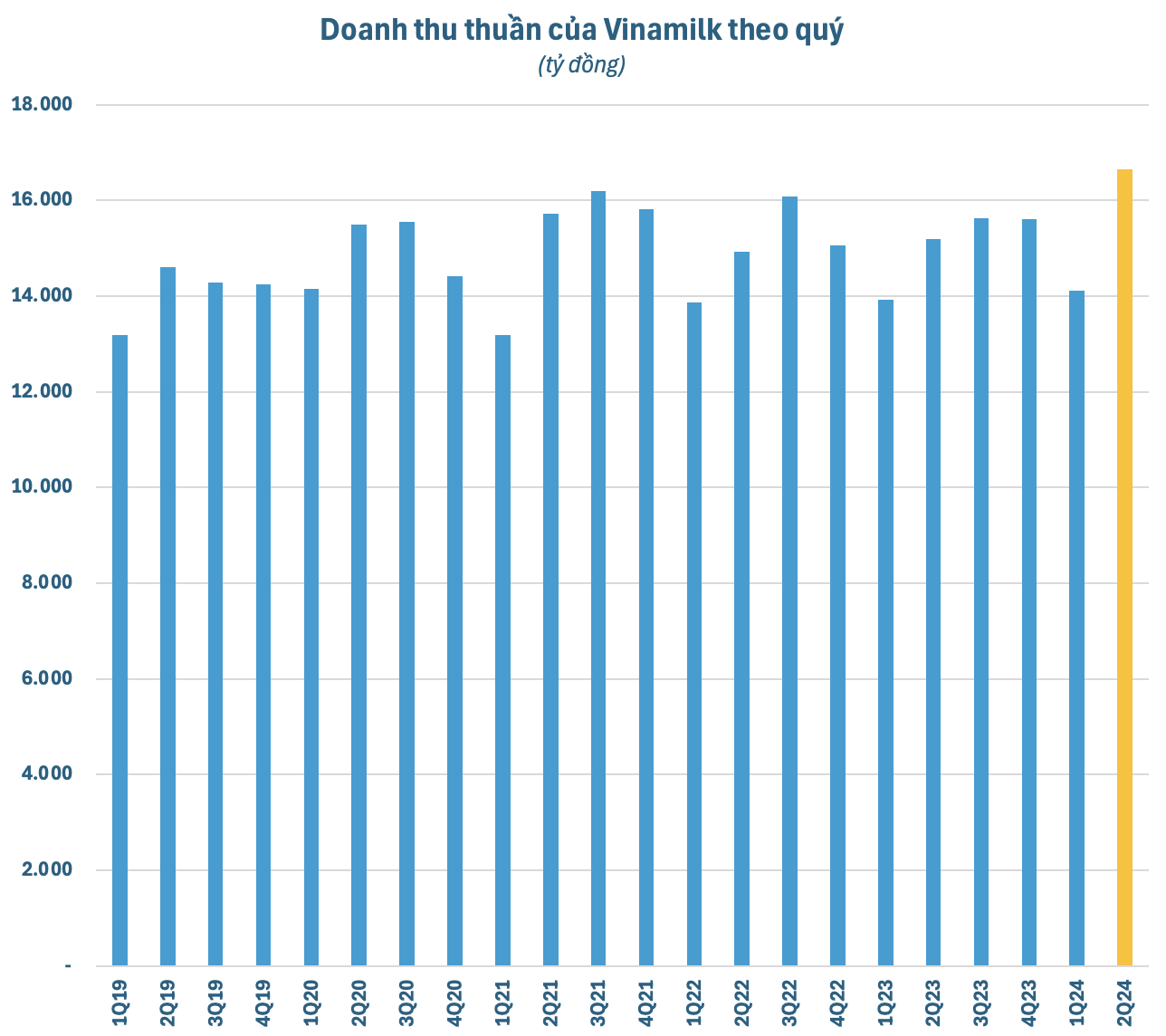

The return of foreign investors can be attributed to positive shifts in Vinamilk’s business performance. In Q2, Vinamilk recorded a remarkable 10% year-on-year increase in net revenue, reaching VND 16,656 billion. This set a new quarterly revenue record since the company’s inception, marking the highest growth rate for the enterprise since the start of 2022.

In terms of revenue structure, domestic revenue (accounting for 81%) witnessed a nearly 6% year-on-year increase, signifying the best growth rate since Q1/2022. Additionally, revenue from overseas markets also surged impressively by nearly 30% compared to the same period in 2023, driven by robust recovery in both foreign subsidiaries and direct export markets.

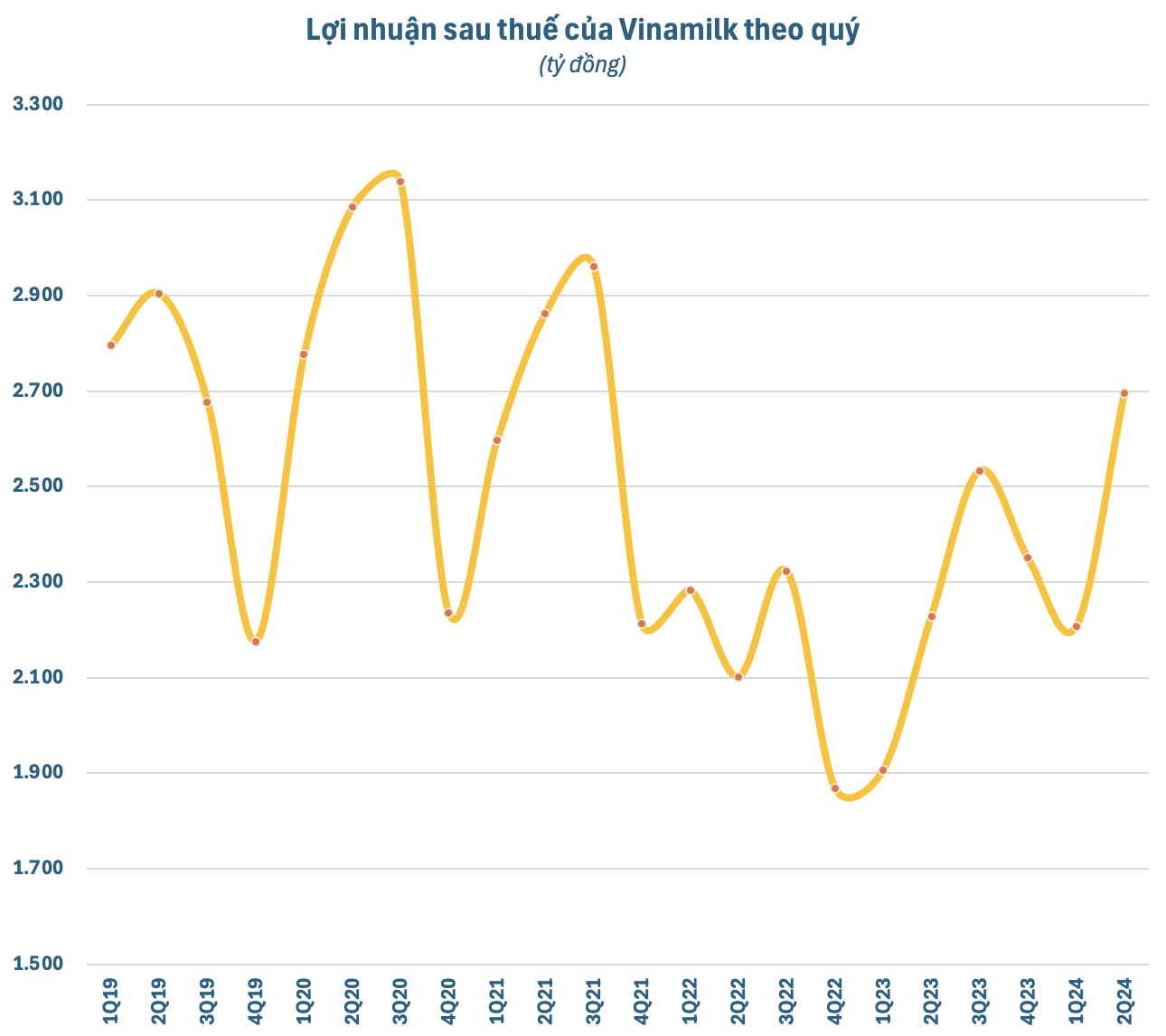

Gross profit margin improved by 2 percentage points year-on-year to 42.4% as Vinamilk secured better prices for imported milk powder raw materials. After deducting expenses, the leading dairy company posted a net profit of nearly VND 2,700 billion, reflecting a 21% increase compared to the same period in 2023. This profit represents the highest in 11 quarters and the fifth consecutive quarter of year-on-year growth for Vinamilk.

In a recent analysis report, MBS highlighted Vinamilk’s explosive performance in terms of media and brand positioning in 2023. With a new brand strategy targeting the new generation of consumers in Vietnam, Vinamilk is expected to gain domestic market share in the 2024-25 period, despite the weak domestic dairy consumption demand.

Moreover, the low-cost milk powder raw material is anticipated to enhance Vinamilk’s gross profit margin by approximately 2 percentage points in 2024, remaining stable in 2025. MBS forecasts a gross profit margin of 42.7% in 2024, with a slight decrease in global milk powder supply in 2025.

In the second half of the year, Vinamilk will finalize the new brand identity for the remaining products in its portfolio. Additionally, the company launched three improved product lines in Q2/2024, including the 1-liter Ong Tho condensed milk with a plastic lid and a plant-based protein drink to cater to consumer demands. Vinamilk plans to explore protein-rich beverages further to expand its customer base among teenagers and middle-aged individuals.

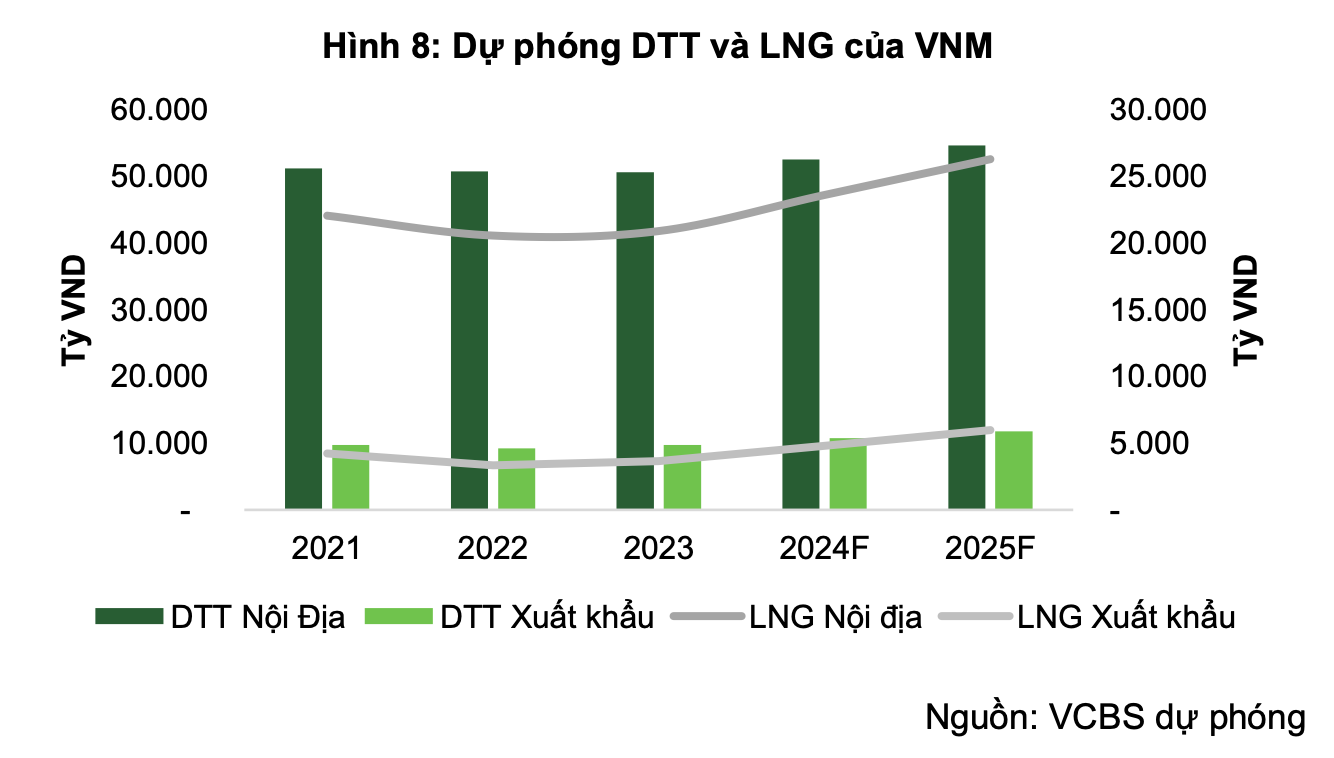

According to a recent VCBS report, Vinamilk’s domestic and export revenue growth in 2024 is projected to reach VND 52,541 billion (up 3.8% yoy) and VND 10,727 billion, respectively, translating to increases of 3.8% and 10% compared to the previous year. The gross profit margin for these two markets is expected to improve by 3.6% and 7.2%, respectively, year-over-year.

Looking ahead, Vinamilk remains committed to its long-term project, the “Vinabeef Cattle Farming and Meat Processing Complex,” which includes a 10,000-cow farm and a processing plant with an annual capacity of 10,000 tons. VCBS anticipates that Vinamilk will officially launch its beef products in Q4/2024, generating approximately VND 1,000 billion in revenue in 2025 and around VND 3,000 billion in 2029. The gross profit margin for the beef segment is projected to reach about 15% by 2029.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.