Gold prices weakened during Monday’s trading session (August 19) as investors realized profits after a strong rally the previous week, but managed to hold above the key $2,500 per ounce level. New developments from the US Federal Reserve and geopolitical tensions in the Middle East are expected to influence gold price movements this week.

At the close of trading, spot gold prices in New York fell by $3.7 per ounce compared to Friday’s close, equivalent to a decline of nearly 0.15%, to $2,505 per ounce, according to data from the Kitco exchange.

Just before 8 a.m. Vietnam time today, spot gold prices in the Asian market fell by $0.6 per ounce compared to the US session close, trading at $2,504.4 per ounce. Converted at Vietcombank’s selling exchange rate, this is equivalent to about VND 75.9 million per tael.

“We are not surprised to see gold prices dip slightly, as gold traders may be disappointed if the Fed signals only a 0.25 percentage point cut in its first cut, instead of a 0.5 percentage point reduction,” said David Meger, director of trading at High Ridge Futures, in an interview with Reuters.

Investors are expecting a clearer picture of the interest rate path this week, and they are currently betting that the Fed will cut interest rates three times by the end of the year, with the first cut expected in September. Fed Chairman Jerome Powell will deliver a speech on Friday at the Fed’s annual conference in Jackson Hole, Wyoming. Prior to that, the Fed will release the minutes of its July meeting on Wednesday.

The interest rate futures market is betting on a 25% chance that the Fed will cut interest rates by 0.5 percentage points at the September 18 meeting, according to data from the FedWatch Tool on the CME exchange. The actual reduction will depend heavily on the August employment report.

A smaller-than-expected Fed rate cut could put downward pressure on gold prices after the precious metal hit a new record high last Friday.

According to Reuters technical analyst Wang Tao, gold prices could fall to the $2,479-2,487 per ounce range after failing to break through the $2,507 per ounce resistance level.

Meanwhile, Giovanni Staunovo, an analyst at UBS, said gold prices could climb higher in the coming months, possibly reaching $2,600 per ounce by the end of the year. Staunovo also noted that the gold market’s focus this week will be on Powell, as investors eagerly await an early signal of a rate cut from the world’s most powerful central bank leader.

In the physical gold market, several Chinese commercial banks have recently been granted new gold import quotas by the People’s Bank of China (PBOC). This development could boost Chinese gold demand despite high prices.

Additionally, geopolitical tensions in the Middle East continue to provide support for gold prices. However, the US is pushing for a ceasefire in Gaza. On Monday, US Secretary of State Antony Blinken said that the latest US diplomatic effort to reach a ceasefire agreement for Gaza was “probably the best opportunity and the last chance.” Blinken also called on the parties involved to actively work to bring the agreement to a successful conclusion.

With gold prices reaching new highs, the value of a gold bar has, for the first time in history, surpassed $1 million, according to Bloomberg. This milestone was achieved last Friday when gold prices breached the $2,500 per ounce level. As international standard gold bars typically weigh around 400 ounces, the value of each gold bar now exceeds $1 million at these price levels.

According to the London Bullion Market Association (LBMA), gold bars on the London gold market – the center of global precious metals trading – usually weigh around 400 ounces but can contain anywhere from 350 to 430 ounces of pure gold. In addition to these large gold bars, investors around the world can also purchase much smaller gold wafers, such as those sold by the American retailer Costco.

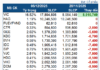

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.