Closing the trading session on August 13, NAB shares surged to the daily limit, reaching VND 16,200 per share. With a trading value of VND 94 billion, liquidity exceeded 6 million units, nearly triple the average.

The upward momentum continued, and by the end of the trading session on August 14, NAB shares climbed 3.09% to VND 16,700 per share, setting a new all-time high since its listing on the HoSE. The following sessions of the past week saw the bank’s share price maintain its positive trajectory.

With an incredibly impressive rally, Nam A Bank’s market capitalization surpassed the VND 22,000 billion mark for the first time.

This development came immediately after MSCI announced the quarterly review results, with the MSCI Frontier Market Index adding seven stocks and removing four. Among the additions were two newcomers from Vietnam, including NAB, which was newly listed on the HoSE earlier this year.

NAB’s surge to the daily limit was supported by its inclusion in the MSCI Frontier Market Index, despite the stock’s recent debut on the HoSE at the end of the first quarter of 2024. This testament to the high level of confidence that NAB enjoys in the market.

Additionally, Nam A Bank has improved its ranking, surpassing several peers as ROE increased by 1.9 percentage points to 20.7% at the end of the second quarter, placing it among the top 10 banks with the highest ROE in the first half of 2024. This indicates a significant enhancement in the bank’s capital efficiency.

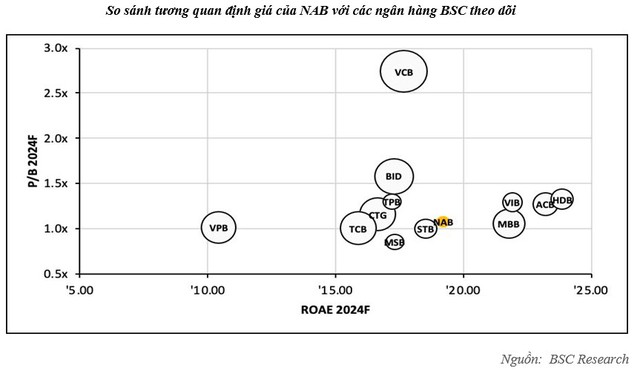

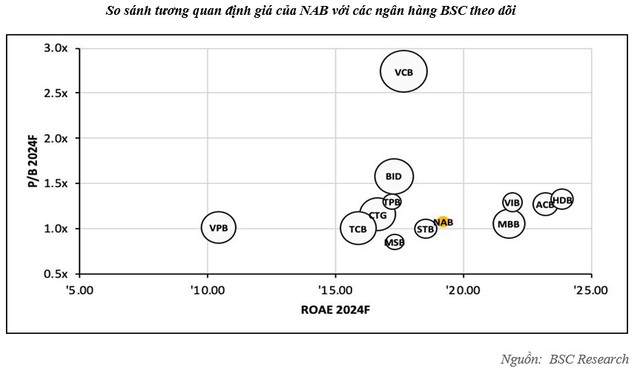

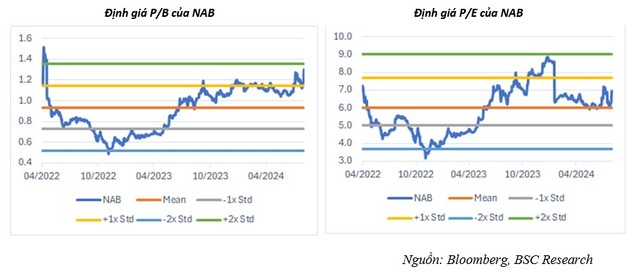

Currently, NAB is trading at around 1x P/B. This valuation is approximately 20% lower than the average of similarly-sized listed banks and is on par with the valuations of banks like OCB and MSB. BSC considers NAB to be relatively undervalued, given the bank’s significant growth potential in the coming periods. This potential stems from the bank’s ongoing restructuring of its customer portfolio and expansion into the individual customer segment. Moreover, Nam A Bank is one of the few banks that still has considerable room for foreign ownership and has yet to attract any strategic investors. These factors could enhance NAB’s appeal to institutional investors, particularly foreign funds.

Image 1: NAB’s impressive performance on the stock market

Image 2: Nam A Bank’s impressive business results in the first half of 2024

According to the bank’s business results for the first six months of 2024, Nam A Bank’s pre-tax profit reached VND 2,217 billion, a 45.4% increase compared to the same period in 2023. As of June 30, 2024, the bank’s total assets exceeded VND 228,000 billion, marking a 14.3% year-on-year growth.

Funds mobilized from individuals and economic organizations grew impressively to nearly VND 173,000 billion, representing a 9.4% increase compared to the same period last year. Loan balances to customers expanded in line with the credit growth limit granted by the State Bank of Vietnam, reaching nearly VND 157,000 billion, a 21.2% year-on-year increase.

Notably, this was the second consecutive quarter in which Nam A Bank recorded a quarterly profit of over VND 1,000 billion. Net interest income increased by VND 834 billion, equivalent to a 27% year-on-year growth.

With impressive business performance and its inclusion in the MSCI Frontier Market Index, NAB shares are showcasing strong growth potential. This positive signal is attracting the attention of investment funds, enhancing liquidity and share value, while also boosting the bank’s reputation and access to international investors.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

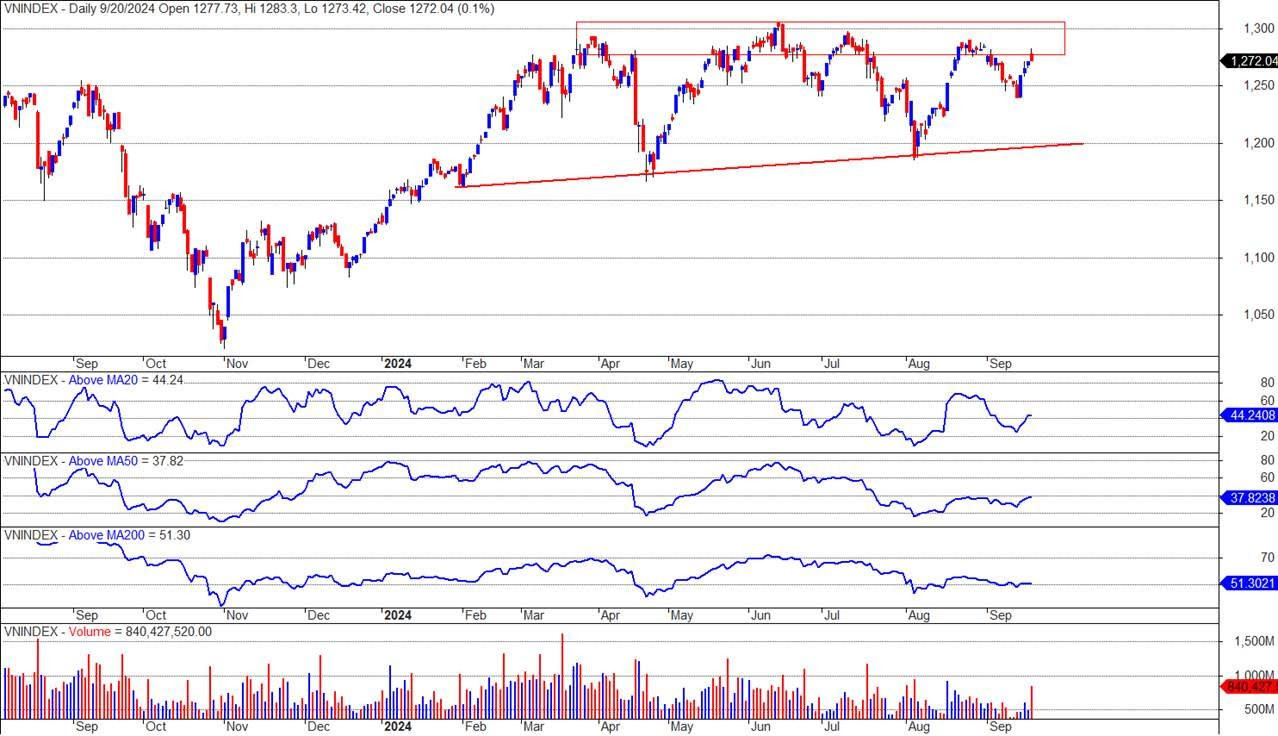

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.