On August 30, Hai Duong Pump Manufacturing JSC (CTB) will finalize its 2023 dividend payout at a 20% rate, amounting to VND 2,000 per share. The payment is scheduled for October 4, totaling an expected VND 27 billion for its over 13.7 million circulating shares.

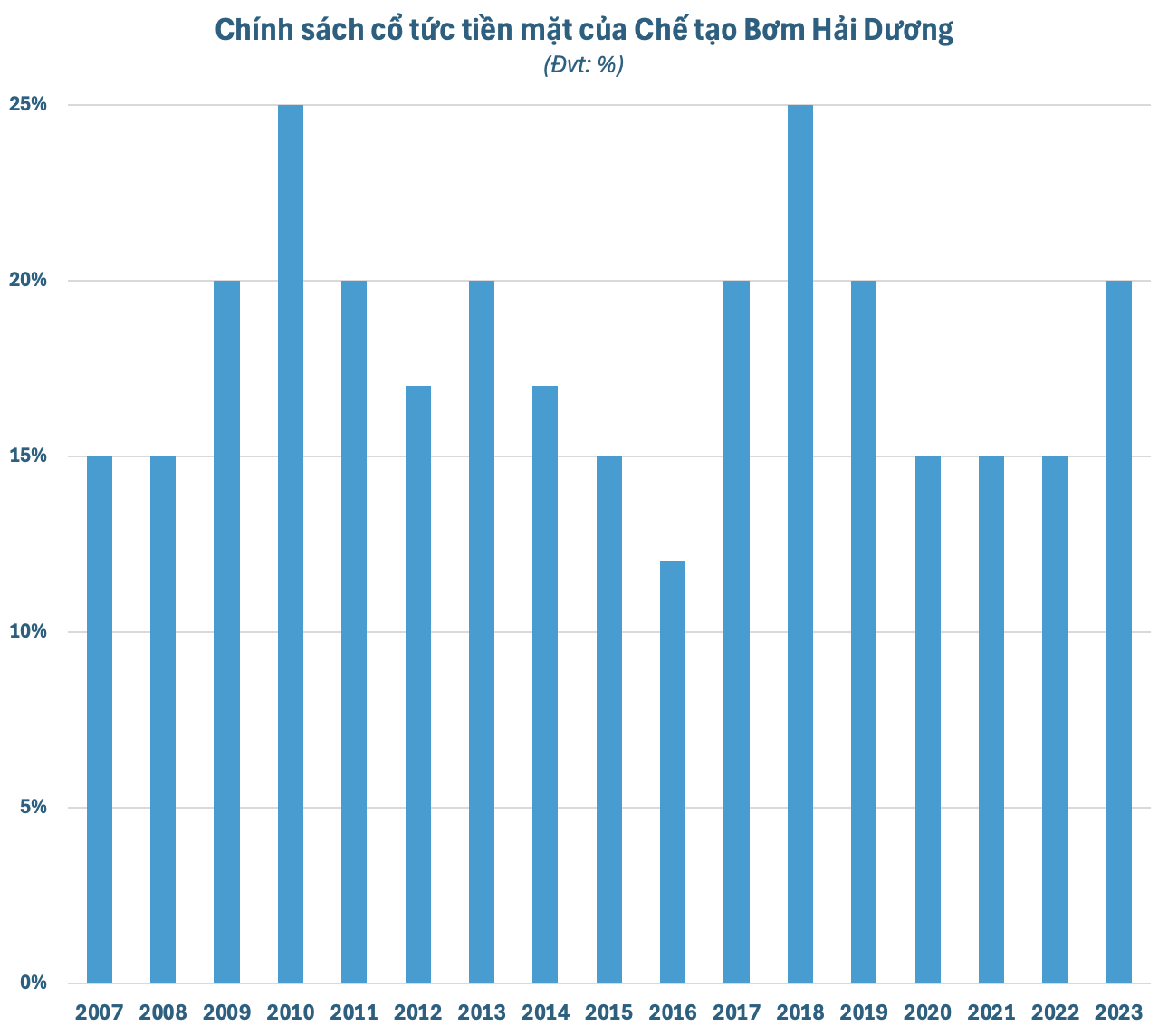

Since its listing on the stock exchange in October 2006, CTB has consistently distributed cash dividends to its shareholders. The dividend rate typically ranges between 15% and 25%. While the rate may not be the highest, the absolute amount of the 2023 dividend payout sets a new record for the company.

Established on August 1, 1960, in Hanoi, CTB, formerly known as Dong Da Mechanical Factory, resulted from the merger of Tien Giang and Hau Giang mechanical corporations. It began operating as a joint-stock company in April 2004, specializing in manufacturing, trading, importing, and exporting various pumps, water valves, industrial fans, and water turbines.

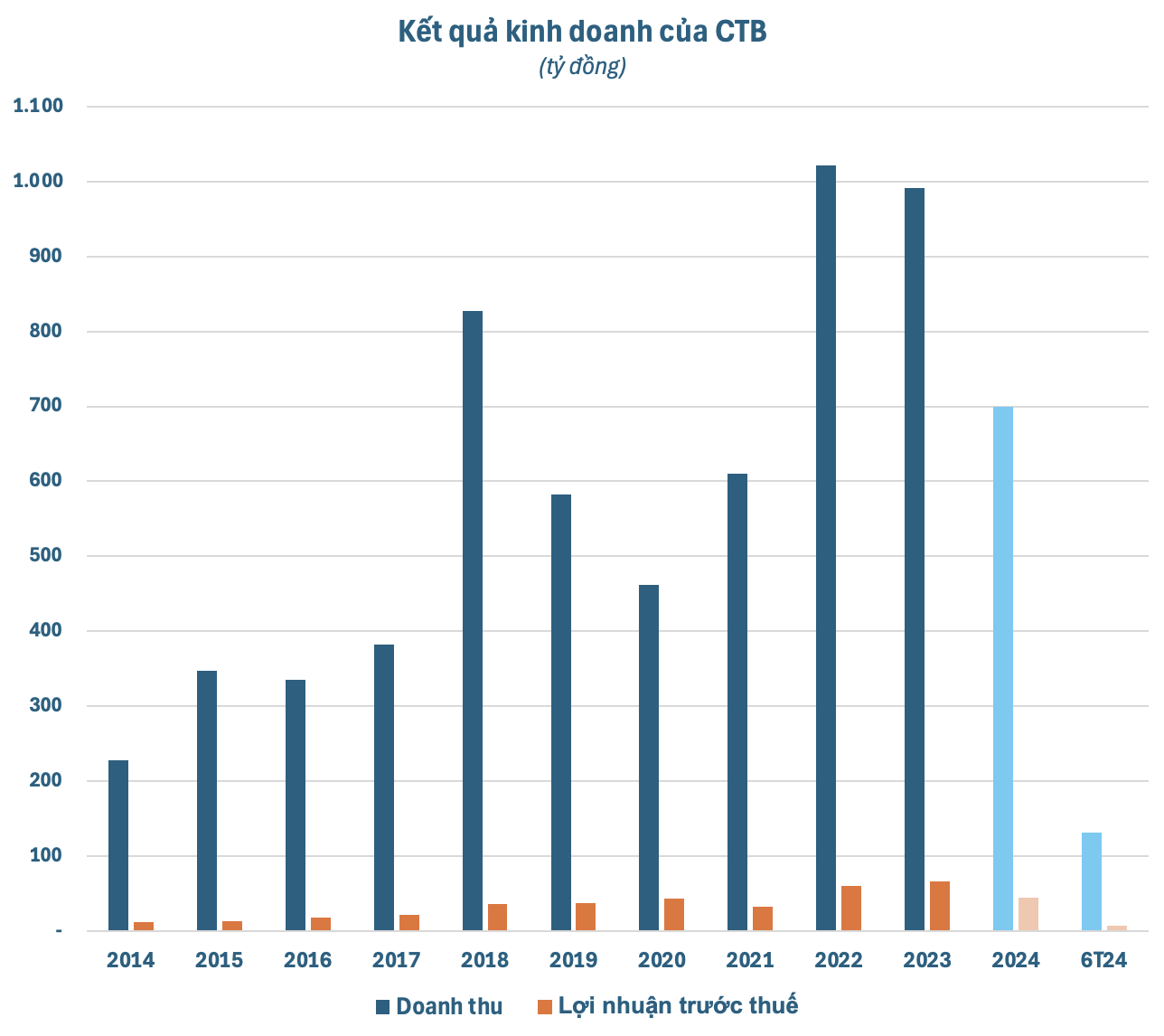

As introduced on their website, CTB is Vietnam’s largest and the region’s leading company in researching, designing, manufacturing, and supplying pumps, valves, water turbines, and synchronous electro-mechanical equipment for pump stations. Consequently, it’s no surprise that the company boasts impressive annual revenue in the hundreds of billions of VND. However, this figure has been inconsistent over the years.

In the last two years, CTB’s revenue reached the thousand-billion-VND mark. Interestingly, their profits have also been unpredictable. In 2023, despite a slight dip in revenue compared to the previous year, CTB recorded a remarkable pre-tax profit of nearly VND 66 billion, a 7% increase year-on-year.

For 2024, CTB has set a cautious business plan, targeting VND 700 billion in revenue and VND 45 billion in profits, a 29% and 32% decrease, respectively, from the previous year’s performance. In the first half of 2024, the company reported a 57% decline in revenue to VND 132 billion and a 55% drop in pre-tax profits to over VND 7 billion. With these results, CTB has accomplished nearly 19% of its revenue plan and 16% of its profit goal for the year.

In the market, CTB shares are currently trading at VND 22,200 per share, reflecting a 20% increase since the beginning of 2024. Its market capitalization stands at over VND 300 billion.