In their report titled “Retail Sector – Sustaining the Recovery,” KB Securities (KBSV) provides insights into the pharmaceutical retail segment, highlighting the dominance of FRT’s Long Chau chain. While its competitors, An Khang (MWG) and Pharmacity, are still striving to find their footing.

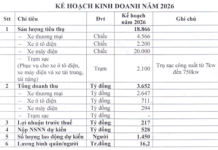

According to the report, for the first half of 2024, FPT Long Chau’s revenue reached VND 11,521 billion, contributing to 63% of the company’s total revenue. As of June 30, FPT Retail boasted a network of 2,435 stores nationwide, with Long Chau operating 1,706 pharmacies. Notably, in the second quarter of 2024, the company expanded its Long Chau vaccination centers, adding 36 new facilities and reaching a total of 87 centers across 40 provinces.

At the recent annual shareholder meeting, FPT Retail’s management affirmed their commitment to transforming Long Chau into a comprehensive healthcare ecosystem, with an initial focus on developing vaccination centers. The report quotes the management as saying, “In the coming time, Long Chau will be the main growth driver, contributing significantly to FRT’s revenue and profit.”

In contrast to Long Chau’s success, the An Khang pharmacy chain has posted lackluster financial results. For the first six months of 2024, the chain incurred a loss of VND 172 billion. The cumulative loss for the period from 2017 to the present amounts to VND 834 billion.

Mr. Doan Van Hieu Em, a member of the Board of Directors of The Gioi Di Dong Investment Joint Stock Company, recently shared with investors, “Similar to its older counterparts, An Khang is undergoing a restructuring process to reassess each pharmacy, considering closing down outlets that fail to meet revenue and profit expectations.”

Following the closure of 46 stores in the first half of the year, the management announced plans to shut down an additional 181 unprofitable outlets in the latter half. Currently, the average revenue per retail store stands at VND 500 million per month.

As for Pharmacity, after being surpassed by Long Chau in terms of pharmacy count at the beginning of 2023, the company is striving to regain its former glory. The departure of its founder, Chris Blank, from the CEO position and his role as the legal representative in September 2022 marked a period of leadership transitions, with two CEO changes within 18 months.

Prior to 2023, despite having the largest number of pharmacies in the industry, Pharmacity faced challenges in achieving profitability.

In 2019, the company reported a net loss of VND 265 billion. For the first half of 2020, Pharmacity posted a net loss of over VND 194 billion, a 60% increase compared to the same period in the previous year. By the end of 2020, the cumulative loss had exceeded VND 1,000 billion. As of now, Pharmacity continues to grapple with this accumulated loss.

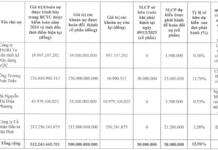

“Dragon Fund scores big with Long Chau stocks”

Dragon Capital’s aggressive buying of FRT stocks over the past year is likely targeting the Long Chau pharmacy chain, the main growth driver of FPT Retail.