The Power of Pricing: Unraveling Vietnam’s Electricity Sector

On August 20th, the Government’s Electronic Information Portal organized a seminar titled “What Breakthroughs are Needed to Attract Investment in the Power Sector?”

Expert Nguyen Tien Hoa, Chairman of the Vietnam Valuation Association, shared his insights: The electricity pricing policy remains confusing and falls short of adhering to fundamental pricing principles. These principles are crucial to encouraging the development of the electricity sector and attracting investment from diverse economic entities, ultimately contributing to ensuring the country’s energy security.

Mr. Hoa identified four significant drawbacks. The first and most encompassing issue is that electricity prices have not been determined through a market-based mechanism, causing considerable challenges for electricity production and trading. The latest data from 2022-2023 indicates that this approach has resulted in losses for the electricity sector, amounting to approximately 47,500 billion VND. This poses a significant obstacle to improving the electricity sector’s cash flow, which is vital for investing in and developing new sources and grids.

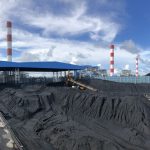

Wind power comes at a high price. Photo: Thach Thao |

Secondly, today’s electricity prices carry the burden of multiple objectives. We aim to calculate accurately, cover costs, encourage investment, ensure social welfare, guarantee energy security, and curb inflation. Balancing these goals is a delicate task, and it’s challenging to fulfill all our aspirations. Therefore, we must carefully consider the role of electricity prices and identify the most critical areas.

The third drawback lies in the cross-subsidy mechanism for electricity prices, which has been prolonged without a clear roadmap for resolution. This involves cross-subsidies among residential electricity consumers, with higher tiers subsidizing lower tiers, and to some extent, cross-subsidies in electricity production.

“Another aspect is the cross-subsidy between regions. Electricity prices in remote coastal districts and islands often range from 7,000 to 9,000 VND/kWh, but we still sell it at 2,000 VND/kWh, meaning that lower prices in one region are subsidized by higher prices in another,” shared Mr. Hoa.

The fourth shortcoming is the lack of distinction between electricity prices and social welfare policies.

Associate Professor Dr. Bui Xuan Hoi, an energy expert, emphasized: The key lies in price management. If we gradually separate public welfare activities from market activities, we can establish a suitable price adjustment mechanism. Even if we cannot immediately implement a market-based electricity pricing mechanism, all regulatory aspects must gradually move towards market orientation.

“We developed the tariff structure in 2014, aiming to promote manufacturing with low electricity prices. To balance EVN’s finances, we had to increase commercial electricity prices. During this process, we must gradually adjust and prioritize manufacturing, reducing the burden on this sector,” advised Mr. Hoi.

However, immediately eliminating cross-subsidies is not feasible as it would shock the economy. Thus, it is imperative to take action towards gradually adjusting electricity prices in line with market mechanisms. This is a necessary step.

Regarding electricity price forecasts, Mr. Hoi stated: “In the current situation, despite our best efforts, we cannot overlook the importance of baseload power sources, including coal and gas-fired power. No matter how much renewable energy we incorporate, these baseload sources remain crucial. With the ongoing trend of increasing fuel input prices, I believe the cost of electricity supply will inevitably rise,” he said.

“Given the geopolitical situation, we cannot expect input prices to drop immediately, and they may even settle at a new, higher range. We must accept this reality,” the expert cautioned.

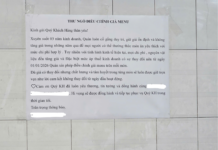

Renewable energy aligns with the Net Zero trend. Photo: Thach Thao |

The Myth of Cheap Clean Energy

Additionally, amid the Net Zero aspirations for 2050, Mr. Hoi candidly stated: “Other countries also strive for clean energy, and I assert that there is no such thing as cheap clean energy. Solar power can operate at maximum capacity for about four hours a day, and wind power is inconsistent. We cannot expect these sources to be inexpensive.”

“In summary, due to geopolitical fluctuations and the energy transition trend, the overall cost of electricity supply is likely to increase,” concluded Associate Professor Dr. Bui Xuan Hoi.

From a business perspective, Mr. Nguyen Dinh Tuan, Director of Son Dong Thermal Power Company, shared his thoughts: “We believe that hydropower sources have been mostly exploited to their full potential. According to the government’s roadmap, coal-fired power will be reduced by 2030 and phased out by 2050 in alignment with the Net Zero program. Consequently, developing new sources will rely on options such as gas-fired power, offshore wind power, etc. Associate Professor Dr. Bui Xuan Hoi has analyzed that these sources will significantly impact operations, particularly concerning their high investment rates.”

“Naturally, the cost of renewable energy is substantial, and this will influence the market’s average price. This, in turn, will affect EVN’s pricing and the government’s price management,” Mr. Tuan pointed out.

Considering the proportions of solar and wind power in the energy mix, Mr. Tuan expressed concern: “The development of additional high-cost power sources may impact the entire system’s operating mode. This, in my opinion, requires careful calculation.”

For thermal power companies like Son Dong, Mr. Tuan mentioned that there will be a program to modify fuels and blend them, as directed by the Ministry of Industry and Trade, and researched by various units. However, the conversation circles back to pricing, as the input prices of biomass and pellet fuels can be two to three times higher than those of coal. This is an aspect that experts need to consider carefully.

According to Associate Professor Dr. Bui Xuan Hoi, EVN is currently the largest electricity retailer. If electricity prices are too low, EVN will incur losses, and as a state-owned enterprise, these losses translate to a depletion of state capital. On the other hand, if EVN generates profits, the state benefits and has opportunities for EVN to reinvest and expand. Failure to address this issue will undoubtedly impact investment in power sources and grids.

Moreover, if EVN suffers significant losses and loses its ability to make payments, other companies selling electricity to EVN will be affected, triggering a domino effect. This, in turn, will make attracting investment in the power sector a challenging endeavor.

“We have an ambitious and expansive Electricity Planning VIII, but if we continue with the current price management approach, I believe implementing Electricity Planning VIII will remain a distant dream, if not an extremely difficult task,” predicted Associate Professor Dr. Bui Xuan Hoi.

Luong Bang

Sharp Decline in Consumption, Warning of Very Low Water Levels in Hydropower Reservoirs

The Ministry of Industry and Trade’s Electricity Regulatory Authority has announced that electricity consumption during the Lunar New Year holiday is significantly low nationwide. In light of the low water levels in the hydropower reservoirs in the northern region, coal-fired and renewable energy power plants have been maximally utilized.

Prime Minister demands completion of 500kV power line by June 2024

The Government’s leadership requires the Minister of the Ministry of Industry and Trade to coordinate with relevant units to guide, instruct, and support EVN in implementing and accelerating the progress of the 500kV Quang Trach – Pho Noi power line project for the northern region, aiming to complete and energize it by June 2024.