The Vietnamese stock market witnessed a positive trading session on Monday, riding on the momentum from the previous week’s gains. Bottom-fishing activities dominated the market, painting the VN-Index green throughout the day. The index closed August 19th with a gain of 9.39 points, ending at 1,261.62. HoSE recorded a liquidity of VND16,781 billion.

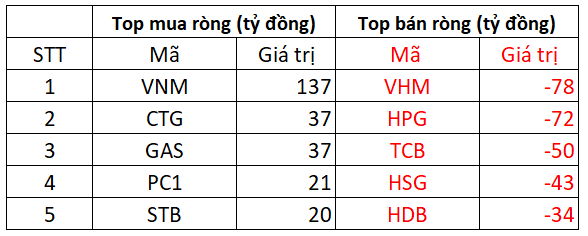

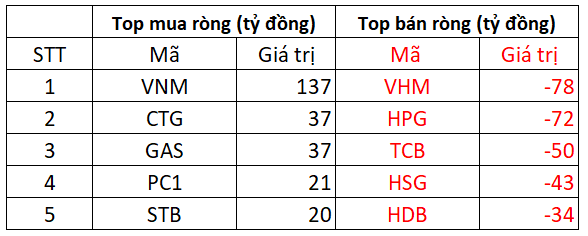

In terms of foreign investors’ activities, they net sold nearly VND 309 billion in the entire market, as follows:

On HOSE, foreign investors net sold nearly VND 312 billion

On the buying side, VNM witnessed the strongest net buying from foreign investors, with a value of VND 137 billion. GAS and CTG followed closely, with net purchases of VND 37 billion each. PC1 and STB were also bought for around VND 20 billion each.

On the other hand, VHM faced the strongest selling pressure from foreign investors, with nearly VND 78 billion sold. HPG and TCB also witnessed net selling of VND 72 billion and VND 50 billion, respectively.

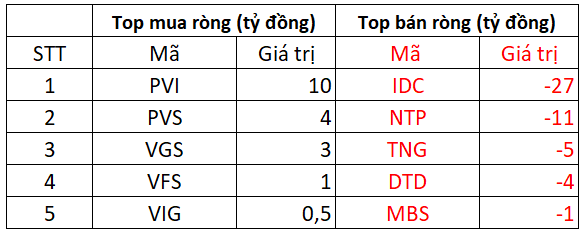

On HNX, foreign investors net sold over VND 28 billion

PVI was the most net-bought stock on HNX, with a value of VND 10 billion. PVS followed closely, with net purchases of VND 4 billion. Foreign investors also bought a few billion dong worth of VGS and VFS each.

On the opposite side, IDC faced net selling pressure of VND 27 billion from foreign investors, followed by NTP with VND 11 billion. TNG, DTD, and MBS also witnessed net selling of a few billion dong each.

On UPCOM, foreign investors net bought over VND 31 billion

Conversely, QNS faced net selling of nearly VND 2 billion from foreign investors. They also net sold VAB, TED, PAT, UDC, and a few other stocks.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”