The State Bank of Vietnam has announced today’s central exchange rate of the Vietnamese Dong against the USD at 24,251 VND, a decrease of 10 VND from yesterday.

With a 5% margin, commercial banks are allowed to trade at a ceiling of 25,464 VND/USD and a floor of 23,038 VND/USD.

Meanwhile, the USD buying and selling rates remain stable, maintained by the State Bank’s Trading Centre in the range of 23,400-25,450 VND/USD.

At commercial banks, the USD/VND exchange rate has been significantly adjusted, with some banks reducing rates by up to 130 VND.

As of 10 am on August 20, Vietcombank listed the USD cash buying rate at 24,710 VND/USD and the selling rate at 25,080 VND/USD, a decrease of 130 VND in both buying and selling compared to the previous day’s opening rates (August 19).

Bank USD rates witness a significant drop. Photo: Nam Khanh |

During the same period, USD rates at VietinBank witnessed a substantial drop of 106 VND in both buying and selling compared to the previous day’s opening rates, listed at 24,742-25,082 VND/USD.

In the private joint-stock commercial bank sector, USD rates also experienced a notable decline.

Techcombank’s USD cash buying and selling rates for the morning were 24,728 VND/USD and 25,119 VND/USD, respectively, a decrease of 95 VND and 97 VND compared to the opening rates on August 19.

Sacombank listed its USD rates at 24,760-25,100 VND/USD (buying-selling), a reduction of 110 VND in both buying and selling compared to the previous day.

Since the beginning of August, VND/USD exchange rates at banks have been on a downward trend, trading well below the ceiling rate set by the State Bank of Vietnam.

Compared to the beginning of August, USD rates at many banks have decreased by nearly 400 VND. The USD selling rate is approaching the 25,000 VND/USD mark.

In the meantime, the USD rates in the free market remain relatively stable.

Foreign currency exchange points in the free market are trading USD at around 25,250-25,400 VND/USD (buying-selling), unchanged from the previous session.

Compared to the bank channel, the USD buying rate in the free market is about 500 VND higher, while the selling rate is approximately 300 VND higher.

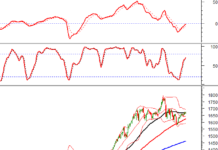

Globally, the USD is showing signs of recovery after plunging to a seven-month low.

The USD plummeted as the US Federal Reserve (Fed) is expected to initiate a rate cut in September, with the possibility of two reductions this year.

Investors are closely watching Fed Chair Jerome Powell’s speech on August 23 at the annual Jackson Hole symposium. They await clues regarding the potential rate cut in the upcoming meeting.

As of 10:47 am on August 20 (Vietnam time), the US Dollar Index stood at 101.95 points, up 0.07% from the previous session.

Hanh Nguyen

Hải Hà Petro and Xuyên Việt Oil accumulate bad debts of over 11,000 billion dong

Not only did these two petroleum companies commit violations regarding the Price Stabilization Fund and massive tax debts, but they also have bad debts at banks amounting to tens of thousands of billion Vietnamese dong.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.