The Vietnamese stock market witnessed a positive start to the week with a broad-based green rally. In line with this, shares of HAX of Ha Xanh Automobile Service JSC (Haxaco) surged significantly. HAX’s share price quickly rose to the maximum allowed limit, reaching VND 17,100 per share and even faced a “sell-side drought.” This rally pushed HAX to its highest level in a month, approaching its 2-year peak, with its market capitalization surpassing VND 1,800 billion.

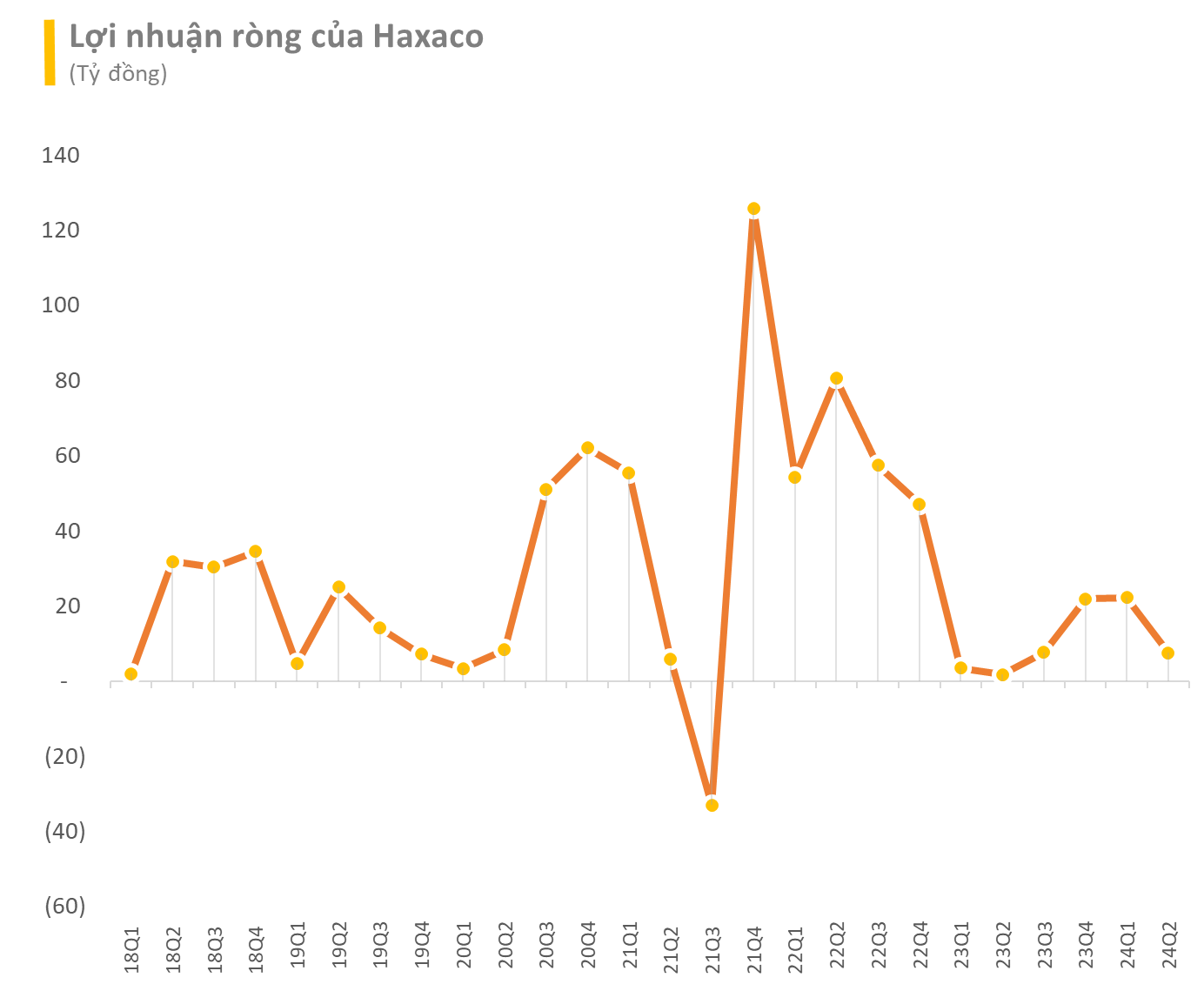

Haxaco is known for its distribution of luxury Mercedes-Benz vehicles in Vietnam. The strong performance of HAX shares was supported by impressive financial results in the second quarter of 2024. Specifically, the company recorded net revenue of VND 1,123 billion, a 41% increase compared to the same period last year. After deducting expenses, Ha Xanh Automobile reported a pre-tax profit of over VND 28 billion, a remarkable 530% jump from the previous year. For the first half of 2024, HAX’s pre-tax profit exceeded VND 69 billion, representing a substantial 585% year-on-year increase.

Entering 2024, Haxaco set an ambitious target, aiming for a consolidated pre-tax profit of VND 200 billion, more than four times the previous year’s achievement of VND 48 billion. With these impressive results, Haxaco has already accomplished 35% of its full-year plan within just six months.

In their explanatory note, Haxaco attributed the performance to the recovery of the automotive industry, especially the luxury segment, which is still unstable. Car manufacturers are engaged in intense competition, offering deep discounts and generous incentives to boost consumer demand. Nonetheless, the company’s subsidiaries are operating efficiently, expanding steadily, and witnessing robust growth compared to the previous year, driving a significant increase in consolidated net profit for the second quarter and the first half of 2024.

Amid an economic downturn and cautious consumer spending, Haxaco has demonstrated its adaptability by expanding its distribution of mid-range MG-branded automobiles. This brand is believed to have a growth advantage due to lower interest rates on car loans, providing an incentive for consumers to purchase vehicles. According to the Chairman of Haxaco’s Board of Directors, Do Tien Dung, the MG automotive distribution segment is estimated to have contributed 90% of Haxaco’s profit in the second quarter of 2024.

As of June 30, 2024, the company’s total assets stood at VND 1,995 billion, with inventory slightly down from the beginning of the year to VND 636 billion. Short-term receivables increased by 28% to VND 273 billion over the same period. Regarding capital, short-term debt decreased by 8% to VND 770 billion, of which VND 608 billion was short-term loans and financial leases.

Haxaco had nearly VND 34 billion in undistributed post-tax profit as of the end of the second quarter of 2024.

In a separate development, Mr. Do Tien Dung reported the sale of 100,000 HAX shares out of the previously registered 700,000 units, citing unfavorable price movements as the reason for not completing the transaction. As a result, his ownership in Haxaco decreased to 17.38%, equivalent to 18.7 million shares.

Stock market: An efficient capital-raising channel

Despite several fluctuations, the Vietnamese stock market has managed to maintain stable growth. On the occasion of the Lunar New Year 2024, Chairwoman of the State Securities Commission Vu Thi Chan Phuong has given an interview to Thoi Bao Ngan Hang regarding operational and management solutions.