Lending Outpaces Deposits

The State Bank of Vietnam (SBV) reported that as of the end of June 2024, total credit in the economy reached nearly VND 14.4 million billion, up 6% from the previous year. After two months of negative growth at the beginning of the year, credit growth turned positive in the first quarter, reaching 1.34%. Thus, it can be seen that credit grew strongly in June.

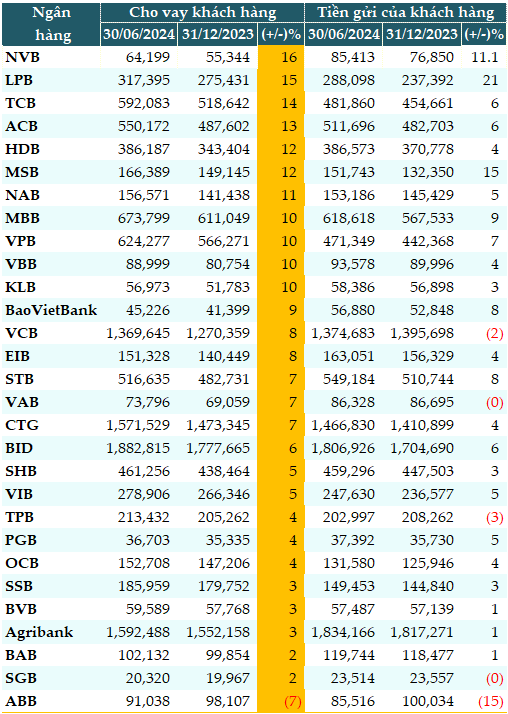

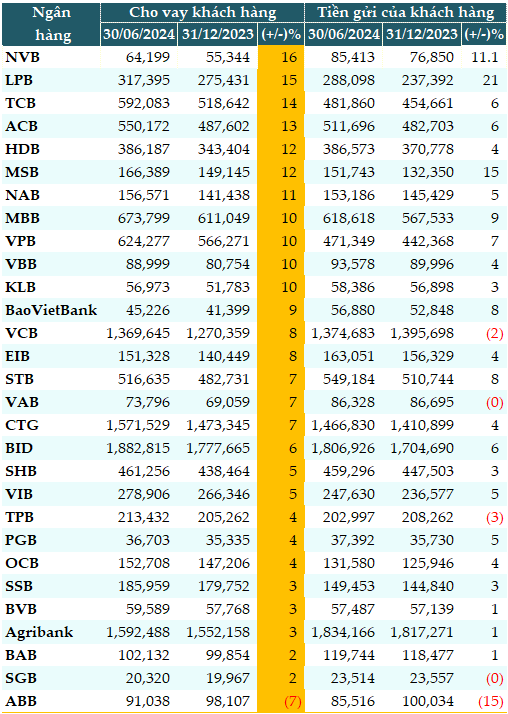

Data from VietstockFinance also showed that as of June 30, 2024, the total outstanding loans of 29 banks in the system exceeded VND 12.45 million billion, up nearly 7.2% from the beginning of the year.

ABBank (ABB) was the only bank with negative credit growth compared to the beginning of the year (-7%). The remaining banks achieved positive growth, with an average rate of 7.8%. Notably, NCB (NVB) led the pack with a 16% increase, followed by LPBank (LPB, +15%), Techcombank (TCB, +13%), HDBank (HDB, +12.5%), and ACB (+12.3%)…

|

Customer lending and deposits as of June 30, 2024 (in VND trillion)

Source: VietstockFinance

|

As the economy gradually recovers, funds are being withdrawn from banks and channeled into production, business activities, and investment opportunities. Total deposits in the 29 banks as of the end of the second quarter exceeded VND 12.15 million billion, up 4% from the beginning of the year.

Out of the 29 banks, 5 experienced negative deposit growth, while the rest achieved positive growth with an average rate of nearly 6%. LPB took the lead in deposit growth, mobilizing VND 288,392 billion, a 21% increase from the beginning of the year. This was followed by MSB with a 15% increase (VND 151,743 billion) and NVB with an 11% rise (VND 85,413 billion).

Loan-to-Deposit Ratio Increased in the Second Quarter

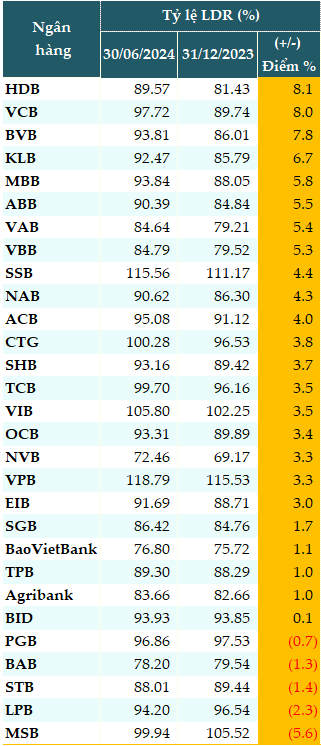

The loan-to-deposit ratio (LDR) is a crucial indicator for assessing banks’ utilization of mobilized capital for lending. As of the end of the second quarter, 24 out of 29 banks witnessed an increase in their LDR compared to the beginning of the year, indicating that these banks are utilizing more of their mobilized funds for lending purposes.

As of June 30, 2024, 6 out of 28 banks maintained an LDR below 85%, whereas there were 8 banks in the first quarter with an LDR below this threshold. This suggests that these banks are still lending out a smaller proportion of their deposits, reflecting lower credit quality relative to their mobilized capital.

Four banks reported LDRs exceeding 100%: VPB (118.79%), SSB (115.56%), VIB (105.8%), and CTG (100.28%).

|

LDR of banks as of June 30, 2024

Source: VietstockFinance

|

In theory, a higher LDR can be viewed as a positive sign, indicating that banks are efficiently utilizing their mobilized funds to provide credit to the economy. The economy is showing improved absorption of capital compared to the beginning of the year. However, it is essential to delve deeper into the allocation of credit by banks across sectors, such as production, commerce, services, and non-production fields (real estate or speculative investments). True economic growth is fostered when credit is primarily directed towards production, services, green economy, and the digital economy.

Focus on the Real Economy

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, assessed that in the context of the first six months of 2024, the increase in the LDR reflects the efforts of banks to utilize mobilized capital for lending.

The trends in credit and deposit mobilization in the second half of 2024 will depend on monetary policies, domestic and international macroeconomic conditions, and market factors, both domestically and internationally.

Firstly, it depends on the monetary policy of the State Bank of Vietnam (SBV). If the SBV maintains or cuts interest rates to stimulate the economy, banks may increase lending to support businesses and individuals, potentially leading to a higher credit-to-deposit ratio. The SBV could also grant additional credit limits to banks, especially those capable of expanding lending in priority areas such as production, exports, and agriculture.

Secondly, it depends on the macroeconomic situation. If economic growth remains positive, the demand for credit from businesses and individuals will increase, driving lending activities. Additionally, stable inflation provides an opportunity for the SBV to implement supportive policies to boost economic growth.

Thirdly, international factors and foreign trade come into play. Global economic uncertainties or fluctuations in international financial markets can impact investment flows into Vietnam, consequently affecting banks’ credit and deposit mobilization activities.

An increase or decrease in exports can influence the credit demand from businesses, especially in key export sectors such as textiles, electronics, and agricultural products.

Lastly, the recovery of the real estate market is a factor. A robust recovery may lead to increased lending in this sector, impacting the LDR.

In conclusion, the interplay of these factors will shape the efficiency and sustainability of credit provision in the economy. On a positive note, banks in Europe and the European Central Bank have simultaneously lowered interest rates, and the US Federal Reserve has sufficient grounds to cut rates by 25-50 points in the remaining months of 2024. Additionally, Vietnam has consistently achieved a trade surplus, strong remittance inflows, and increased FDI disbursements, which will ease pressure on exchange rates, facilitating exchange rate stability, inflation control, and interest rate reductions. These factors support credit growth to boost the economy.

Associate Professor, Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, added that although the higher LDR indicates improved efficiency in utilizing mobilized funds, given the current economic situation, the pace of economic recovery, and the capital needs of the economy, the demand for credit is expected to be lower than 15%.

“Promoting economic growth is not solely about increasing credit growth. Monetary policy should remain neutral, and money supply should match money demand. If there is an excess of money supply over money demand, the surplus money will flow into speculative areas like real estate, potentially causing more significant adverse effects on the economy. Therefore, we should focus on the real economy,” Mr. Huan cautioned.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

Need to excel at writing ads that grab attention, engage readers, and drive results?

Even in a stable market with low and stable interest rates, offering an attractive credit package remains essential and meaningful for the Bank-Business Connection program.