Vietnamese stock market kicks off a vibrant week with strong momentum across the board. Leading stocks from various sectors, including banking and industry heavyweights, pushed the benchmark VN-Index higher.

The VN-Index opened with a positive gap and maintained its upward trajectory throughout the session, despite some intraday fluctuations. Notable performers included banking stocks such as VCB, TCB, and BID, alongside blue-chip giants VNM, GAS, SAB, and especially PNJ, which collectively propelled the index higher.

VN-Index Technical Analysis for August 19, 2024

At the closing bell, the VN-Index advanced by 9.39 points (+0.75%) to close at 1,261.62, with trading volume reaching VND 16,781 billion. However, foreign investors remained net sellers, offloading nearly VND 309 billion worth of shares across the market.

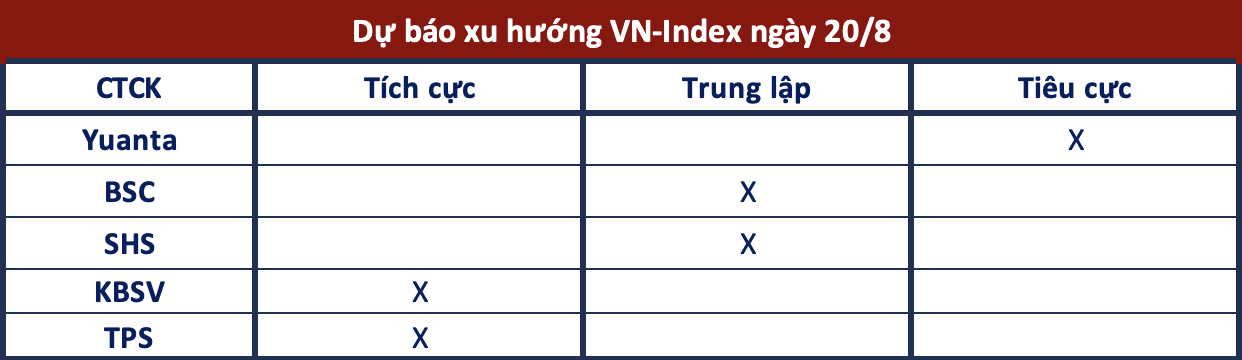

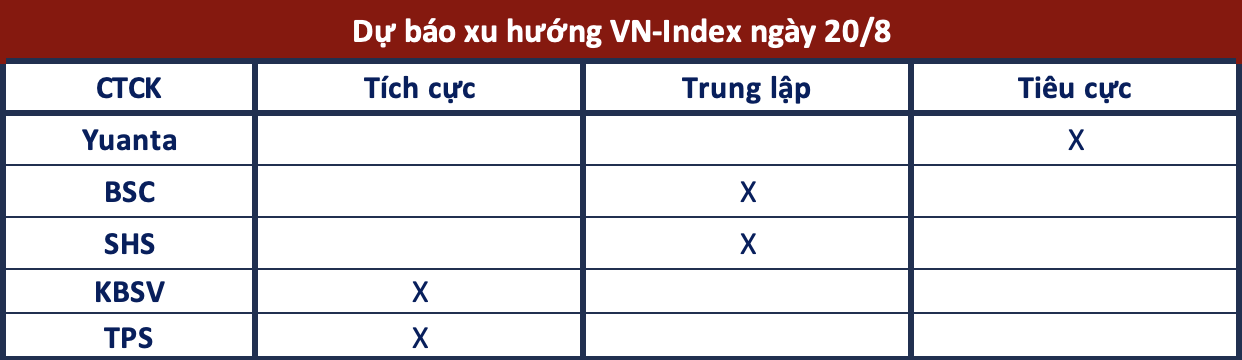

Looking ahead, brokerage houses offered mixed forecasts for the market’s near-term trajectory:

Potential for a Pullback

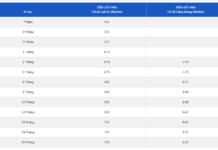

Yuanta Securities Vietnam: The market may experience a pullback, with the VN-Index likely to test the support zone of 1,253 – 1,256 points (the gap-up zone formed on August 19, 2024) in the next session. Additionally, the market appears to be entering a phase of heightened volatility, suggesting that the short-term trend could become clearer in the upcoming sessions.

Sideways Trading Expected

BSC Securities Corporation: The market breadth was positive, with 14 out of 18 sectors ending in the green, led by Personal & Household Goods, followed by Automobiles & Components. However, foreign investors were net sellers on both the HSX and HNX exchanges. With the market returning to the previous resistance level, sideways trading is expected in the near term. Investors are advised to remain cautious in the upcoming sessions.

Profit-Taking Pressure

SHS Securities Joint Stock Company: The short-term trend of the VN-Index remains under pressure for a corrective phase, testing the lower boundary of 1,250 points, corresponding to the low price regions of the sharp declines in early April, late May, June, and July 2024. Additionally, profit-taking pressure is anticipated following the high-volume trading session last Friday. In a positive scenario, the short-term trend of the VN-Index is expected to continue its sideways accumulation within the broad range of 1,250-1,300 points.

Extending the Rebound

KBSV Securities Joint Stock Company: The VN-Index opened with a gap-up and maintained its gains until the end of the session, indicating that buying pressure remains the dominant force driving the index. The index is likely to extend its rebound before encountering profit-taking and corrective pressure around the next resistance zone of 1,270 points. Investors are advised to gradually accumulate trading positions as the VN-Index or target stocks pull back towards nearby support levels.

Watch Out for Resistance at 1,270 – 1,280 Points