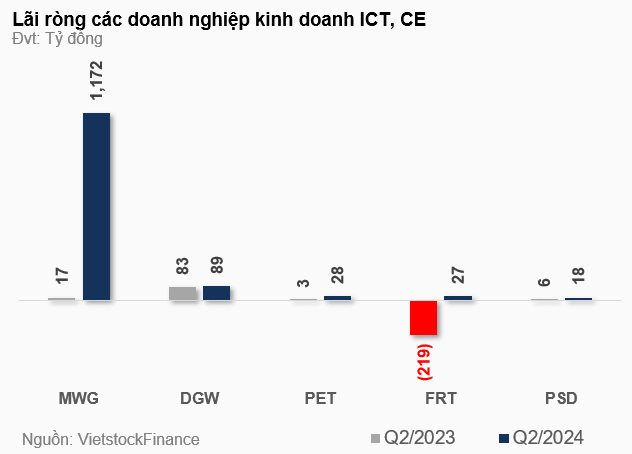

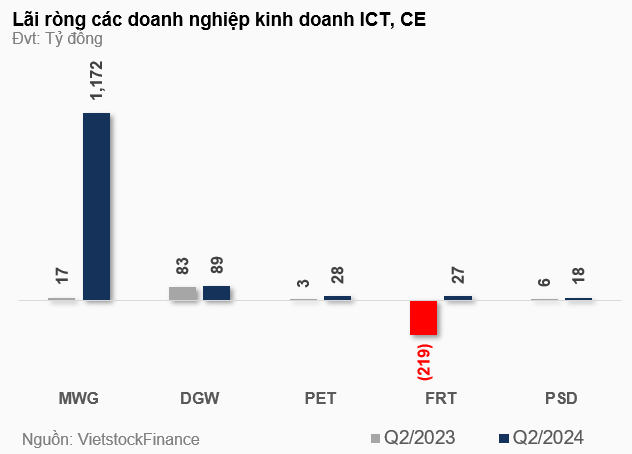

According to data from VietstockFinance, the five companies listed on the stock exchange that are engaged in the ICT and CE (mobile phones and electronics) business all reported profit growth in Q2 2024.

The retail group witnessed robust growth in the second quarter of 2024. Mobile World Investment Corporation (HOSE: MWG) generated over VND 34.1 trillion in revenue, up 16% year-on-year, bringing its six-month revenue to more than VND 65.6 trillion.

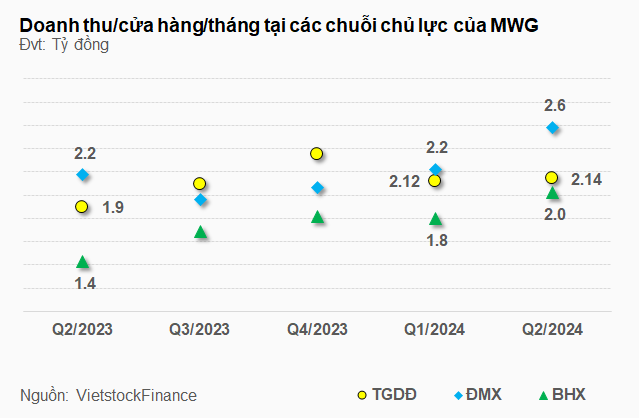

The monthly revenue per store of its main chains, including Dien May Xanh (DMX), The Gioi Di Dong (TGDD), which now includes Topzone, and Bach Hoa Xanh (BHX), all increased compared to the previous quarter and the same period last year.

For TGDD and DMX, April saw a boom in air conditioners and cooling equipment due to high demand during the hot season. In contrast, the following two months stood out for phones and TVs, thanks to promotions and football events.

As for BHX, its average revenue officially surpassed the VND 2 billion mark. The loss after tax incurred in 2024 decreased by approximately VND 7 billion compared to the figure at the end of the previous quarter, indicating that the chain turned a profit in Q2.

Finally, MWG’s net profit reached nearly VND 1.2 trillion, more than 67 times higher than the same period last year, bringing its six-month net profit to nearly VND 2.1 trillion.

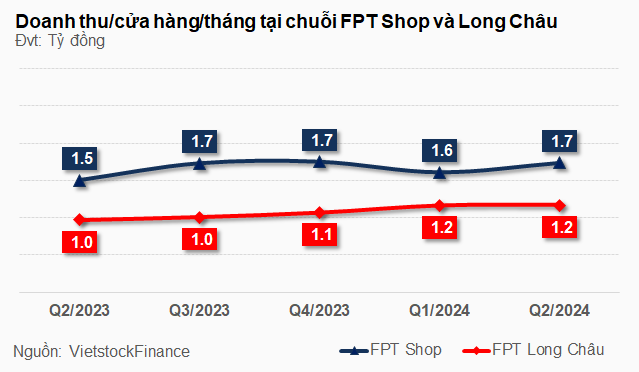

FPT Retail Joint Stock Company (HOSE: FRT) recorded revenue of over VND 9.2 trillion in Q2, a 29% increase year-on-year. Notably, FRT turned around from a net loss of nearly VND 219 billion in the same period last year to a profit of almost VND 27 billion. FRT attributed this improvement to cost optimization and a shift in product mix, which increased the gross profit margin for the FPT Shop chain.

Since the beginning of 2024, the company has also accessed better lending rates, reducing financial expenses by up to 55%. Moreover, by the end of Q2 2024, its subsidiary, Long Chau Pharmaceutical Joint Stock Company, had expanded its network by adding 463 more drugstores compared to the previous year. This chain grew its revenue by 67% year-on-year.

Consequently, FRT’s revenue for the first six months reached nearly VND 18.3 trillion, a 22% increase, with Long Chau remaining the primary growth driver. FRT also turned around from a net loss of nearly VND 224 billion to a net profit of almost VND 66 billion.

The wholesale group displayed diverse growth aspects.

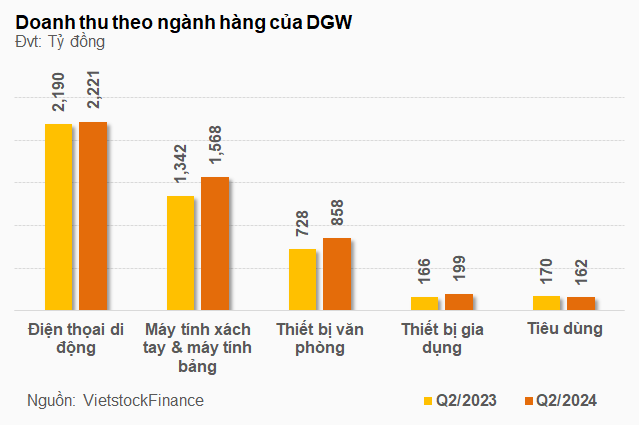

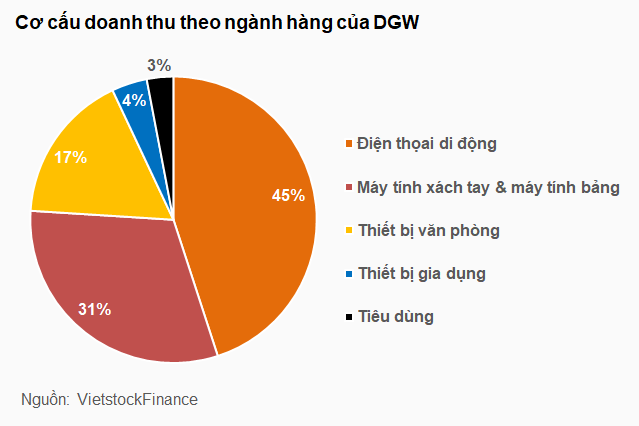

Digiworld Corporation (HOSE: DGW) achieved revenue and net income of VND 5,008 billion and over VND 89 billion, respectively, in Q2, representing increases of 9% and 8%. This growth was driven by the laptop and tablet segments, despite it being the low season.

In the first six months of the year, DGW generated VND 9,993 billion in revenue and nearly VND 182 billion in net income, reflecting increases of 17% and 12%, respectively.

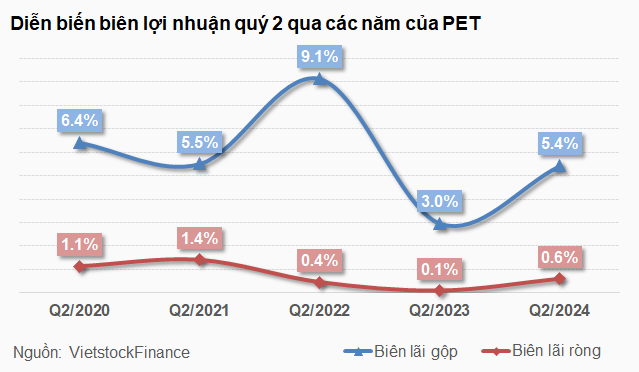

Although smaller in scale compared to DGW, the “parent-child” duo of Petrosetco, JSC (HOSE: PET) and Petrosetco – General Distribution Services JSC (HNX: PSD) stood out with their impressive growth rates.

PET recorded revenue of nearly VND 4,674 billion, a 5% increase. Meanwhile, its net income surged to VND 28 billion, a remarkable 643% increase. This performance was attributed to the growth in most business segments of its subsidiaries, as the market recovery improved gross profit margins.

PSD, a subsidiary in which PET directly holds a 76.93% stake, also witnessed a 205% year-on-year surge in net income, reaching nearly VND 18 billion. This improvement was mainly due to a significant reduction in financial expenses, resulting in a slight financial gain of VND 103 million compared to a loss of over VND 5 billion in the previous year.

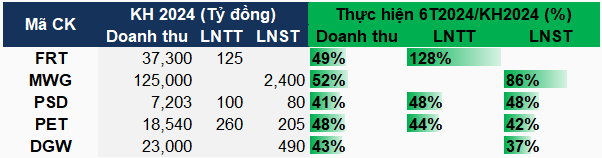

Evidently, the companies operating in the phone and electronics sectors experienced a promising Q2, putting them on track to achieve their 2024 targets, with FRT already surpassing its plan.

|

Performance against plans after Q2 2024

Source: VietstockFinance

|

Specifically, FRT set a target of VND 125 billion in pre-tax profit for 2024, aiming to turn around from a loss in 2023. As of the first six months, FRT has exceeded its profit plan by 28%.

The industry leader, MWG, has already achieved 86% of its net income target of VND 2.4 trillion. Chairman of the Board, Nguyen Duc Tai, stated that the VND 2.4 trillion target is well within reach, barring any uncontrollable variables.

The performance of the wholesale group differed, as the three companies included in the statistics had not yet reached the halfway point in their plans. PSD and PET had accomplished 48% and 42% of their goals, respectively, while DGW had only achieved 37% of its profit plan.

During an investor meeting on August 6th, DGW’s Chairman, Doan Hong Viet, acknowledged that the progress in the first half of the year was slightly lower than the usual 40%. However, he remained confident that DGW would meet its target, driven by new products from MSI and Xiaomi, along with expectations for new FMCG products to boost sales in the second half.

DGW also announced its Q3 revenue and profit plans of VND 6 trillion and VND 120 billion, respectively, representing increases of 11% and 18% year-on-year. If all goes as planned, DGW is expected to achieve 62% of its annual profit plan after nine months.