Today’s market witnessed a strong afternoon rally, with new orders flowing in and buyers willing to take on risk to chase prices. As a result, the market closed with a significant gain and high trading volume.

The combined trading volume of the two exchanges reached approximately 19,300 billion VND, a substantial increase compared to the initial stages of the current uptrend (around 14,000 billion VND per day). Today’s liquidity confirms the presence of new money entering the market or money that corrected their previous premature profit-taking decisions. Regardless of the source, the buying power is synergizing, and as long as prices continue to expand towards the upside, it indicates that buyers are taking control.

There are generally two approaches to buying: either waiting for the price or actively matching existing sell orders. The first approach is passive, assuming that the price may retreat, and one can buy if the opportunity arises. The second approach is more decisive and proactive, aiming to complete the purchase promptly and avoid gradually increasing the buying price as trading progresses. This second approach always boosts the momentum for prices to rise and is a sign of market enthusiasm.

The VN Index has recorded three consecutive sessions of substantial gains, approaching the 1273 mark, and the distance to the 1300 peak of 2024 is no longer significant. This proximity to the previous peak may create a certain level of concern as the index enters this zone. However, it’s important to remember that the index is merely representative and may not necessarily reflect the peak potential of individual stocks. Similar to the previous correction phase, the index could continue to decline, but many stocks have found their bottoms through establishing a balance between supply and demand. At this point, it’s crucial to observe the supply and demand dynamics of individual stocks to gauge the short-term saturation phase rather than solely focusing on the index. Even if the VN Index consolidates, the momentum for specific stocks to continue their upward trajectory remains intact as long as the inflow of money persists.

Risk assessment varies across market stages, and it differs for each individual and their investment strategies. A recurring pattern is that during correction phases, buying is relatively easy, but many investors are gripped by fear and choose to wait. When the market starts to turn around, doubts loom large, and hesitation causes them to miss the initial wave. Only when the last doubters are convinced and the fear of “missing the boat” sets in, do they take decisive action. Once this wave of money enters the market, the momentum accelerates.

If one can overcome the initial jittery phase of quick profit-taking, many stocks would have already generated decent profits. While the majority scramble to buy and use all sorts of information to reinforce their purchasing decisions, the most relaxed approach is to sit tight and observe the supply and demand dynamics of the stocks in your portfolio. There will always be profit-taking episodes during the session, but if this pressure is mild and short-lived, and there are buyers absorbing the selling, the chances of prices continuing their upward trajectory remain intact. There’s no need to obsessively try to pinpoint the exact top, but it’s prudent to sense the pressure and gradually reduce your stock holdings, especially if you’re utilizing margin or holding a 100% stock portfolio.

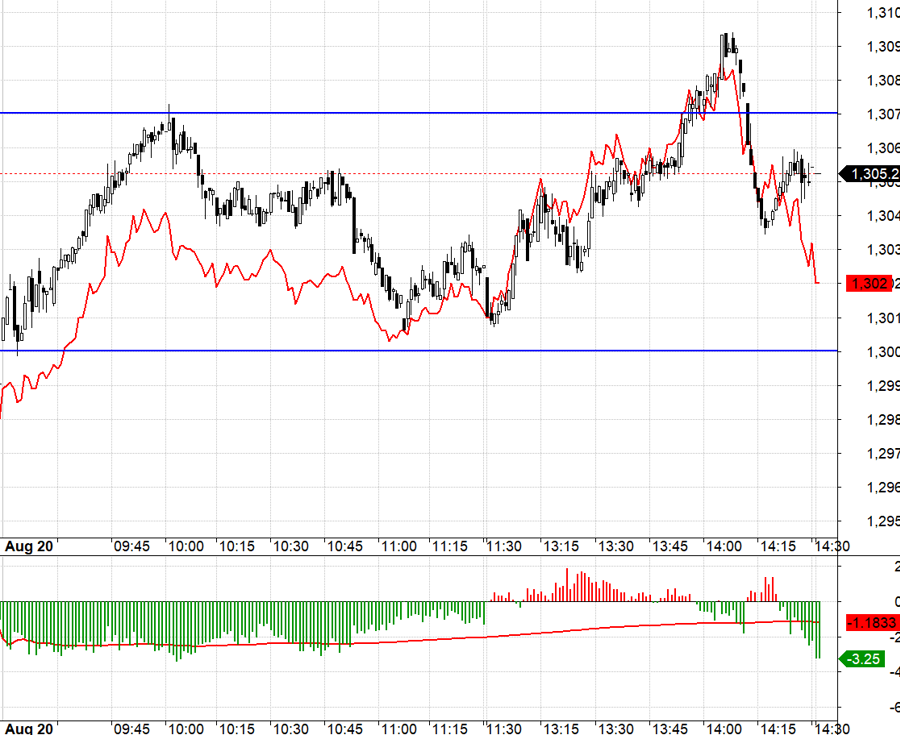

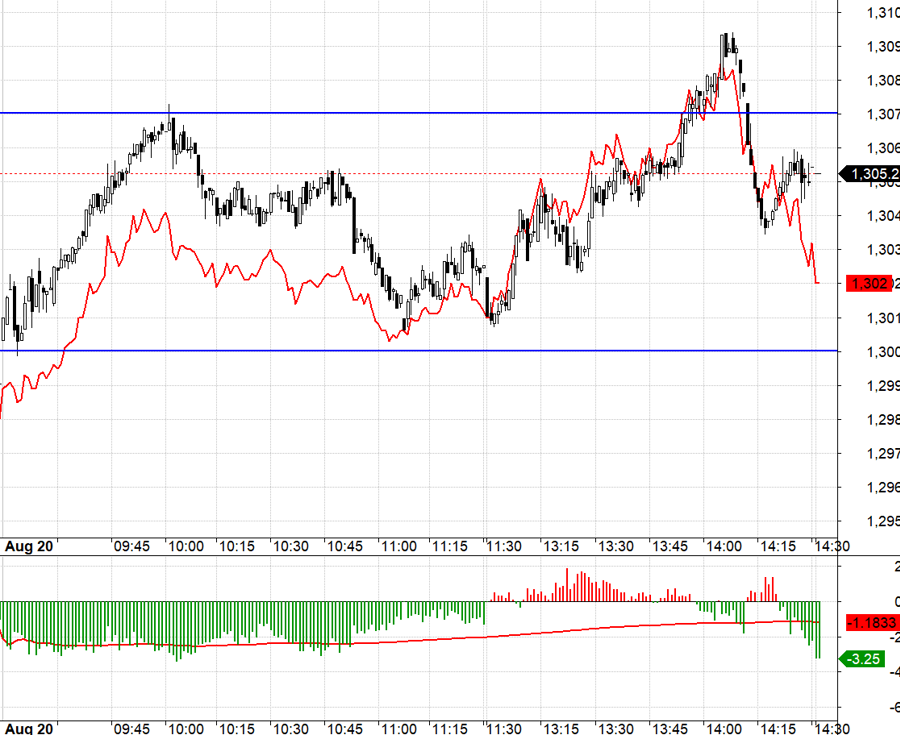

Today’s derivatives market also reflected a noticeable shift in sentiment. During the morning session, the F1 basis remained at a discount of nearly 3 points, despite a negligible difference the previous day. The intraday decline further widened this discount. However, in the afternoon, immediately after the market reopened, F1 rallied faster and the basis nearly disappeared as the buyers overpowered the sellers in the derivatives market.

VN30 fluctuated within a range of 1300.xx to 1307.xx today, with the upper band extending to 1315.xx and the lower band dipping to 1290.xx. Given the early basis discount, being long had its advantages, but contrary sentiment hindered the full exploitation of this advantage. Nonetheless, the afternoon session fared better due to a tighter basis. Towards the end of the morning session, the basis had already contracted significantly, and F1 broke through quickly at the start of the afternoon session, even before VN30 exhibited any clear signs of an upward push. This suggests that there was a buildup of long positions beforehand.

As the weight of the large-cap stocks starts to constrain the VN30’s volatility, trading derivatives may become more challenging in the upcoming sessions. Nevertheless, small and mid-cap stocks are likely to continue their upward trajectory. The strategy going forward is to adopt a flexible long/short approach with derivatives and gradually unwind stock positions depending on individual stock performance.

VN30 closed today at 1305.25, with tomorrow’s immediate resistance levels at 1307, 1315, 1319, 1325, 1333, and 1337. Support levels are 1300, 1290, and 1280.

Disclaimer: “Blog chứng khoán” reflects the personal views and opinions of the author and does not represent the position of VnEconomy. The opinions and views expressed are those of the individual author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the opinions and views expressed in this article.