Workers manufacturing garments at Joint Stock Company 29/3 Textile and Garment. (Photo: Tran Le Lam/VNA)

|

The spread of political unrest in Bangladesh could disrupt the global textile and apparel supply chain and impact Vietnam’s textile industry.

However, businesses believe that there will not be a sudden shift in orders. Vietnam’s textile industry needs to focus on improving competitiveness and long-term strategies.

Since the beginning of August, numerous protests and riots have taken place in Bangladesh, severely affecting its production activities. The textile and garment industry, which is the country’s main manufacturing sector and contributes nearly 90% of Bangladesh’s export turnover, has suffered the most damage, with many factories closing or temporarily suspending operations.

The Vietnam Textile and Apparel Association (VITAS) quoted Bangladesh’s Business Standard newspaper as saying that the Bangladesh Textile Mill Association had announced the closure of all member factories for three days, following the Bangladeshi government’s decision to implement a three-day public holiday. Meanwhile, many Bangladeshi textile and garment exporters are witnessing a 25-40% decrease in orders.

However, the reduction in orders in Bangladesh is not only due to internal conflicts but also because of decreased demand in its major markets, such as Western Europe and Russia, due to inflation. Bangladesh is currently the world’s second-largest textile and apparel exporter, ranking above Vietnam and only behind China.

About 80% of Bangladesh’s textile and apparel exports go to markets in North America and the EU. The country’s main export items are products manufactured for leading fashion brands from Europe, such as H&M and Zara.

Workers at a garment factory in Savar, on the outskirts of Dhaka, Bangladesh, on April 13, 2023. (Photo: AFP/VNA)

|

According to VITAS, the closure of many textile and garment factories in Bangladesh may cause customers to consider transferring orders to other countries. Vietnamese enterprises will have certain advantages and are fully capable of accepting new orders. In the short term, Bangladesh’s textile and garment production capacity will be reduced during the peak production season for winter clothing.

Buyers will have to calculate the shift of orders to other countries to make up for the shortage. Political instability also reduces customer confidence in the production activities in general and the textile and garment industry in Bangladesh in particular. Notably, while Bangladesh has the advantage of cheap labor, the ongoing protests are putting pressure on wages to increase.

However, according to experts, the degree of order transfer from Bangladesh to other countries, including Vietnam, will depend on various factors, such as the nature of the orders and partners. Overall, Bangladesh still has a significant advantage in production costs due to its low labor costs, low bank interest rates, and duty-free and quota-free access to all EU markets.

Bangladeshi businesses also receive energy cost subsidies from the government to boost exports. Moreover, despite the ongoing unrest, the new government in Bangladesh will undoubtedly soon implement measures to support the textile and garment industry, as it is the country’s economic backbone.

SSI Securities Joint Stock Company believes that the closure of many factories in Bangladesh due to violence concerns may cause the textile and garment supply chain to shift to other countries such as China, India, and Vietnam. India will have a more significant advantage as a neighboring country, and the textile industries of the two countries are closely related. India is both a supplier of cotton and a major investor in many large garment factories in Bangladesh. For Vietnam, manufacturers that mainly produce for the European market and process for brands may benefit as it is easier for buyers to shift orders.

Mr. Pham Van Viet, Chairman of the Board of Directors of Vietnam Jean Joint Stock Company and Vice Chairman of the Ho Chi Minh City Textile, Embroidery, Knitting Association, analyzed that, on average, Bangladesh exports about $3.8-4 billion worth of textiles and garments to the EU, UK, and US markets each month. With the current situation, it is difficult to resolve the unrest in Bangladesh quickly, so disruptions to the global textile supply chain are inevitable.

In terms of market share, before the protests and riots, Bangladesh was a direct competitor of Vietnam’s textile and garment industry. Therefore, in theory, Vietnam’s textile and garment industry will benefit from the interruption of production in Bangladesh. Vietnamese enterprises can receive additional short-term orders from Bangladesh’s customers to accelerate recovery after a challenging period.

Export garment production at Tinh Loi Garment Company, Hai Duong province. (Photo: Tran Viet/VNA)

|

However, according to Mr. Pham Van Viet, accepting more garment processing orders is not the primary goal of Vietnam’s textile and garment industry because Vietnam’s development strategy differs from Bangladesh.

While Bangladesh relies heavily on processing orders for labels and brands and competes based on cheap labor, Vietnam aims to develop its textile and garment industry with higher value-added products, focusing on fashion.

Vietnamese enterprises have invested in machinery, technology, and automation to reduce labor costs and pay attention to research and development in design and brand building to target higher-end market segments.

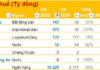

In reality, before the unrest in Bangladesh, Vietnam’s textile and garment exports were recovering well. In July alone, export turnover reached nearly US$4.3 billion. For the first seven months of the year, textile and garment exports reached US$23.9 billion, up 5.9% over the same period last year.

Businesses forecast that Vietnam’s textile and garment exports will continue to improve in the coming months, as demand for goods usually increases towards the end of the year, following a cyclical pattern.

Exports to key markets such as the US, Japan, South Korea, and China are growing well. The target of exporting $44 billion worth of goods this year is within reach, and if favorable conditions persist, exports may even reach $46 billion.

Currently, most enterprises have orders until the end of this year, and some have already negotiated orders for the first half of 2025.

Xuan Anh

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.

Vietnam’s Irresistible ‘Specialty’ That China Desperately Wants to Revive: Highly Popular from the US to Asia, Bringing in Millions of Dollars

Vietnam is one of the largest exporting countries in the world, along with China and the Philippines.