The morning trading session on August 19 witnessed a positive trend as the VN-Index sustained its upward momentum above the 1,260-point resistance level. This achievement can be largely attributed to the outstanding performance of a particular stock within the VN30 basket.

Specifically, PNJ shares of Phu Nhuan Jewelry Company witnessed a surprising surge, reaching the ceiling price of VND 104,900 per share, reflecting a remarkable 6.93% increase compared to the previous session. Notably, the trading volume of this stock witnessed a sudden spike, with more than 4.6 million shares changing hands just in the morning session. The share price of PNJ also hit a new peak, reaching its highest level in the past five years. The company’s market capitalization on the stock market exceeded VND 32,000 billion.

In another development, the prices of 24K gold rings and jewelry also climbed to new highs this morning. Currently, PNJ Company is purchasing gold rings and jewelry at VND 76.85 million per tael and selling them at VND 78.2 million per tael, a decrease of about VND 200,000 per tael compared to yesterday.

The surge in gold ring prices by over 24% since the beginning of the year has contributed to the revenue of companies, including PNJ.

Since the beginning of the year, gold ring prices have increased by a total of VND 15 million per tael (+24.1%). This significant increase in gold ring prices within a year has positively impacted the revenue of gold enterprises.

PNJ’s business results for the first six months of 2024 revealed a gross revenue of VND 22,113 billion and an after-tax profit of VND 1,167 billion, marking a respective rise of 34.3% and 7.4% compared to the same period last year.

For the full year of 2024, PNJ targets an after-tax profit of over VND 2,000 billion, making it one of the rare enterprises in the gold market to report profits in the billions.

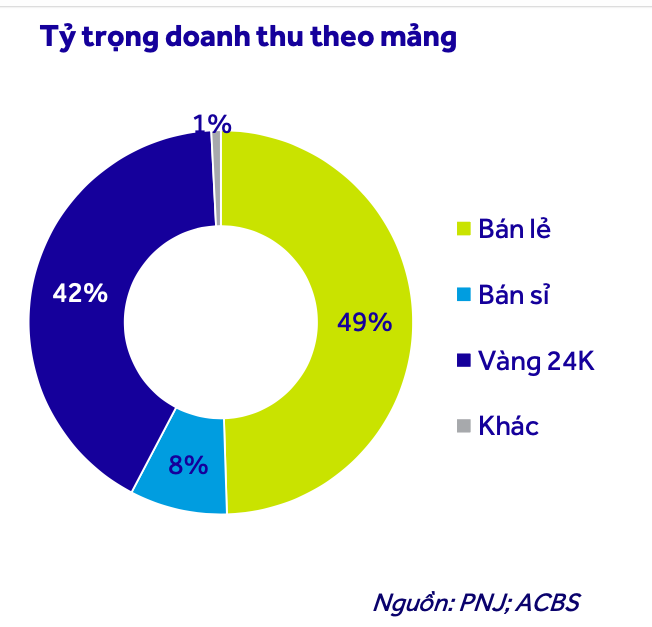

In terms of revenue structure, PNJ’s business performance witnessed harmonious growth across all channels. Retail revenue in the first six months rose by 14% year-on-year, contributing 49.5% to total revenue. Meanwhile, wholesale revenue from jewelry during the same period also increased by 20% compared to the previous year.

Revenue from 24K gold accounted for 42% of PNJ’s total revenue in the first six months.

In its explanation for the impressive business results in the first six months, submitted to the State Securities Commission of Vietnam, PNJ attributed the remarkable growth in revenue and profit to the company’s agile marketing strategies and efficient operational optimization in production and business activities.

According to ACBS Securities Company, PNJ is expected to maintain its growth trajectory in the second half of this year and into 2025, buoyed by the festive season, year-end shopping sprees, and anticipated improvements in consumer spending as the economic outlook brightens.

However, the growth in 2025 may not witness the extraordinary contribution of the 24K gold segment as seen this year, due to measures taken to narrow the gold price gap and stricter requirements in gold business operations to curb speculation in the market.

PNJ share price surpassed VND 100,000 this morning, marking a five-year high.

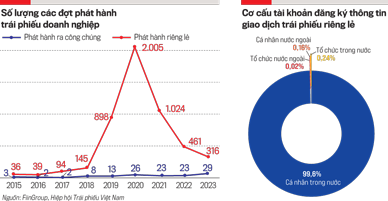

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.