The Joint Stock Company Cat Lai Port (code: CLL) announces that September 4 will be the record date for the 2023 cash dividend payment, with a ratio of 26% (1 share will receive VND 2,600). The expected payment date is September 16, 2024. With 34 million shares currently in circulation, Cat Lai Port is expected to pay out over VND 88 billion in dividends.

According to the CLL shareholder structure disclosed in the Q2/2024 financial statements, the two largest shareholders are Tan Cang Sai Gon One Member Limited Company and the Youth Volunteer Public Service One Member Co., Ltd., holding 25.6% and 22.1% of the shares, respectively. These state-owned enterprises, which are also the founding shareholders of Cat Lai Port, are expected to receive nearly VND 23 billion and over VND 19 billion from the upcoming dividend payout.

On the market, Cat Lai Port’s share price has witnessed a positive upward trend. Currently, CLL is trading at VND 42,300 per share, slightly down from the previous session but still near its historical peak. Since the beginning of the year, CLL has gained approximately 11% in value.

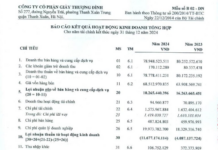

In terms of business performance for Q2/2024, Cat Lai Port recorded a slight increase of 1% in revenue compared to the same period last year, amounting to over VND 78 billion. However, a significant rise of 85% in management expenses led to a 20% decline in net profit, resulting in VND 20 billion for the quarter. For the first half of 2024, the company achieved nearly VND 155 billion in revenue, a 6% increase year-over-year, while net profit reached almost VND 46 billion, an 11% decrease.

For the full year 2024, the port business has set a target of nearly VND 323 billion in total revenue and a net profit of nearly VND 98 billion. With the results from the first half, the company has accomplished 48% of the revenue target and 47% of the profit goal for the entire year.