Hapaco plans to increase its ownership in Green International Hospital to 84.8%. Illustration

The Board of Directors of Hapaco Joint Stock Group Company (HAP on HoSE) has passed a resolution to contribute additional capital to Green International Hospital Joint Stock Company (a subsidiary of Hapaco)

Specifically, the total amount of capital that Hapaco intends to contribute to Green International Hospital is 35.31%, equivalent to 21.19 million shares. Of this, Hapaco will contribute 32.33% or 19.4 million shares, and Hai Phong Paper Joint Stock Company (a subsidiary of Hapaco) will contribute 2.98%, equivalent to 1.79 million shares.

With a share value of no less than VND 20,000/share, Hapaco and its subsidiary are expected to spend approximately VND 423 billion on this transaction.

As of the end of June 2024, Hapaco has invested VND 443.5 billion in Green International Hospital, holding 49.5% of its capital.

If this transaction is successful, Hapaco will increase its ownership in Green International Hospital to 84.81%.

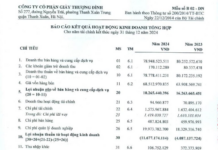

In terms of business results, according to the consolidated financial statements for Q2 2024, HAP’s net revenue for the period was VND 98.4 billion, up 32.6% over the same period; cost of goods sold also increased significantly from nearly VND 65 billion to over VND 85.7 billion. Gross profit was over VND 12.7 billion.

In this quarter, financial revenue was nearly VND 5.3 billion, and profit from joint ventures and associates was over VND 2.4 billion.

HAP’s expenses for Q2 2024 also increased, with interest expenses rising to over VND 449.4 million; selling expenses increasing from VND 2.6 billion to VND 3.8 billion; and management expenses amounting to VND 12.3 billion.

After deducting expenses, HAP’s net income was nearly VND 2.8 billion, a decrease of 44% compared to the same period in 2023.

For the first six months of the year, Hapaco recorded VND 169 billion in net revenue and a net income of over VND 4.9 billion.

As of June 30, 2024, HAP’s asset size was nearly VND 1,280 billion, slightly higher than at the beginning of the year. Of this, payables were over VND 70.6 billion, mainly short-term debt (over VND 70 billion)

PV