The real estate sector unexpectedly led the market higher by over 10 points in the afternoon session of August 20. Several large-cap stocks in this sector, such as PDR and DXG, surged by 7% with strong buying pressure. Other well-known names like NVL, VHM, DIG, CEO, KDH, and HDG also witnessed significant gains, albeit slightly less impressive.

It’s worth noting that the real estate industry has been facing challenges in 2024, and many stocks in this sector have been trading at discounted prices due to the overall industry landscape. The recent rebound could be attributed to the fact that many of these stocks have fallen significantly towards their lows.

According to SSI Research, the real estate industry has shown a remarkable recovery in revenue, with a 78% increase compared to the previous quarter, only 9% lower than the peak in Q2 2023. However, net profits in the industry decreased by 7.1% year-on-year, mainly due to a loss of VND 3,400 billion by Vingroup, largely related to their electric vehicle business.

Excluding Vingroup, the industry’s profit increased by 17.6% year-on-year, reaching its highest level since Q4 2022. However, excluding financial and other income, profits declined by 16% year-on-year. Some familiar names like Novaland, Phat Dat, and Nam Long recorded profits thanks to their financial activities.

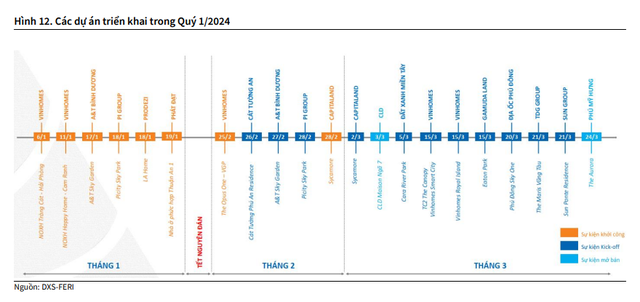

In a mid-July report by KBSV Securities, they noted that after a sluggish 2023 and the first two months of 2024 due to the Lunar New Year, the market has become more active since March 2024, with several projects being launched, introduced, and sold. KBSV observed that several projects introduced to the market in April and May achieved impressive absorption rates, including Lumi Hanoi by CapitaLand (selling ~2,000 units with a 100% absorption rate), The Canopy – TC2 by Vinhomes and GIC Singapore (selling ~390 units with a 90% absorption rate), The Zurich 3 by CapitaLand (selling ~2,000 units with a 100% absorption rate), The Canopy – TC2 by Vinhomes and Mitsubishi (selling ~425 units with a 95% absorption rate), and Eaton Park by Gamuda Land (selling ~840 units with a 70% absorption rate)

KBSV attributed the successful sales to the scarcity of new supply, favorable locations, and the reputation of the developers. Additionally, attractive sales policies and high discounts played a significant role. These positive sales results indicate an improvement in market confidence.

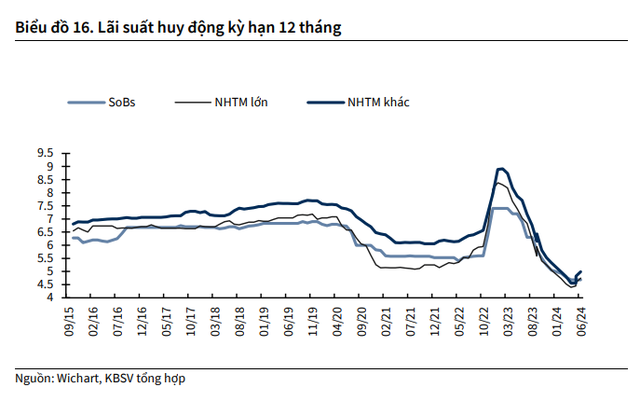

KBSV also observed that deposit interest rates at some banks have increased by 10-30 bps compared to the lows in the short-term 1-12-month tenors. They believe that lending rates are unlikely to decrease further and may see a slight increase in the second half of 2024, but this won’t significantly impact home loan demand. Firstly, current lending rates are still lower compared to the 2021-2022 period. Secondly, the State Bank of Vietnam maintains its policy of keeping lending rates low to support the economy.

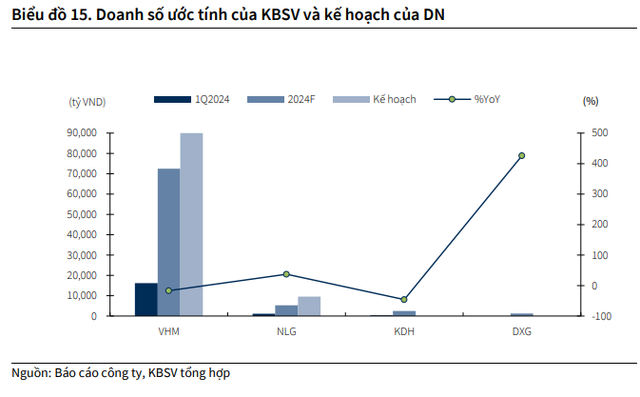

KBSV expects a recovery in the sales performance of real estate enterprises in the second half of the year. Improved market confidence, along with expectations of low lending rates, will motivate developers to launch new projects or continue with subsequent phases of existing projects in the upcoming quarters.

Listed companies in their watchlist have plans to launch new projects or continue sales in the latter half of 2024, including Wonder Park and Co Loa (Vinhomes), Clarita and Emeria (Khang Dien), Gem Sky World and Gem Riverside (Dat Xanh), Akari City, Mizuki Park, Southgate, and Central Lake (Nam Long). Many companies have set relatively high sales targets for 2024, but KBSV remains cautious in their estimates, believing that while the apartment segment will witness a noticeable recovery, other segments will require more time.

In the context of challenges in raising capital through credit and bond channels, real estate businesses are focusing on equity issuance to restructure their debt and fund project development. Additionally, the完善 of the legal corridor is expected to ensure the industry’s growth in the medium and long term. At the 6th session and the 5th extraordinary session of the 15th National Assembly, the revised Law on Real Estate Business, Law on Housing, and Law on Land were officially passed and will come into effect on January 1, 2025. However, the government has proposed that the Standing Committee of the National Assembly allow these laws to take effect from August 1, 2024. KBSV believes that the early enforcement of these laws demonstrates the government’s efforts to address the difficulties and obstacles in the real estate market, fostering its sustainable development in the long run.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.