HOSE floor liquidity fell slightly today, but bank stocks saw a significant 51% increase compared to yesterday. Foreign investors also heavily bought leading stocks such as CTG, VCB, and BID. Capital inflows into this group are creating strong momentum for the VN-Index, which closed at 1,284.05 points, just a small distance away from the historical peak of 1300.

The market fluctuated during the morning session, with the VN-Index alternating between green and red, and a poor breadth. However, the situation improved considerably in the afternoon, with the index climbing steadily and closing at the highest level of the day, up 0.9% (+11.5 points), while the morning session saw almost no significant gains.

The market breadth also improved significantly. By the end of the morning session, the VN-Index had 127 gainers and 248 losers, but by the close, there were 241 gainers and 174 losers. Surprisingly, HOSE floor liquidity fell slightly by 92.1 billion VND compared to yesterday, but trading in bank stocks rose by more than 1,612 billion VND to a 12-session high.

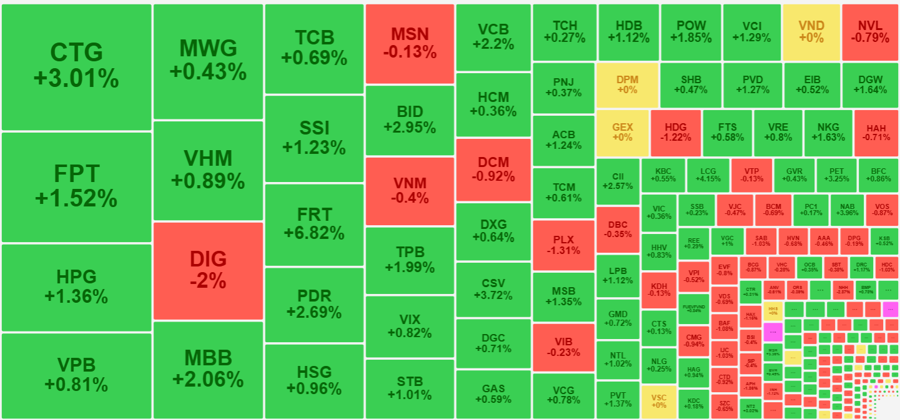

Bank stocks attracted impressive inflows and were the main driver of the VN-Index’s strong recovery in the afternoon, as well as the catalyst for the positive breadth. In the VN30 basket, banks were the most improved stocks in the afternoon, with CTG gaining an additional 2.7% and closing 3.01% above the reference price. MBB also rose 2.48% in the afternoon compared to its morning closing price, reversing the trend and ending 2.06% higher than the reference price. ACB, BID, STB, TCB, TPB, VCB, and VPB also rose by more than 1% in the afternoon compared to the morning session.

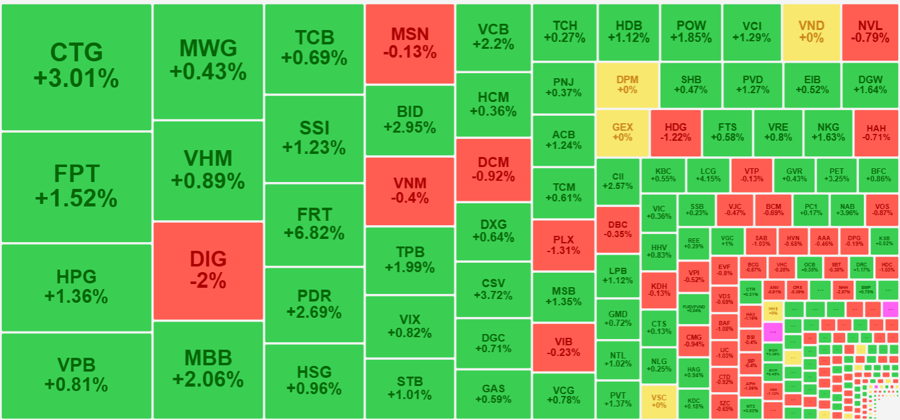

Out of the 27 bank stocks, only VIB fell slightly by 0.23%, while 16 stocks rose by more than 1% at the close. Among the blue chips, BID rose 2.95%, CTG 3.01%, VCB 2.2%, MBB 2.06%, and TPB 1.99%. These stocks were the main contributors to the VN-Index, along with FPT, HPG, and VHM, which had smaller gains but higher market capitalization. The VN30-Index closed up 0.95%.

Out of the 24 stocks with liquidity exceeding 200 billion VND, banks accounted for 8, with CTG leading the market with 928 billion VND, and VPB ranking fourth with 631.7 billion VND. Today’s strong gains have pushed many bank stocks into the group with the best growth in the market since the explosive session on August 16, such as VCB up 5.94%, CTG up 7.38%, and MBB up 6.45%…

The strength in bank stocks comes at a crucial time as the VN-Index approaches the historical peak of around 1,300 points. Out of the 11.5-point gain in the index today, the top five bank stocks, VCB, BID, CTG, MBB, and ACB, contributed more than 7 points. While pillars like VHM, VIC, GAS, and VNM are losing steam, bank stocks are the only hope for the index to break through to new highs. In previous failures, the weakness in bank stocks was also the reason why the VN-Index missed the opportunity to reach new peaks.

In addition to bank stocks, the upward momentum in yesterday’s session also spread widely in the afternoon, similar to previous sessions. It appears that money flowed out in the morning and only strengthened in the afternoon. However, liquidity on the HOSE and HNX floors in the afternoon only increased slightly by 6.7% compared to the morning session, including the increase in transaction value due to rising prices. Nevertheless, the change in prices was positive, reflected in the significant improvement in breadth. So, the lack of increase in liquidity also indicates a clear reduction in selling pressure.

The entire HOSE floor ended the session with 241 gainers, including 70 stocks rising more than 1%. This group accounted for approximately 42% of the floor’s total matched value, confirming a high concentration of capital. Bank stocks, of course, were among this group, but there were also FPT, up 1.52%; SSI, up 1.23%; FRT, up 6.82%; PDR, up 2.69%; CSV, up 3.72%; VCI, up 1.29%; and POW, up 1.85%… The VN30 basket saw a significant 20.3% increase in liquidity compared to yesterday, while Midcap and Smallcap transactions fell by 17% and 14%, respectively.

The reduction in capital inflows caused mid- and small-cap stocks to generally rise weakly. The Midcap index closed up 0.49%, while the Smallcap index rose 0.19%. However, there were always strong individual stocks like SGR, VNE, and SMC, which hit the ceiling, and FRT, TVS, CSM, LCG, CSV, TLH, PET, and NT2, which rose between 3% and 6%.

Thanks to the positive afternoon recovery, the group of reversing stocks still had 174 losers, but the number of stocks falling sharply was very small. At the close, only 53 stocks fell by more than 1%, most of which had small liquidity. NHH fell 2.87% with a match of 23 billion VND; DIG fell 2% with a match of 527.1 billion; APH fell 1.86% with a match of 25.2 billion; PLX fell 1.31% with 158 billion; HDG fell 1.22% with 120.9 billion; HAX fell 1.15% with 27.1 billion; and BAF fell 1.08% with 36.7 billion were the most notable.