The Management Board of REE Corporation (stock code: REE) has recently approved Platinum Victory Pte.ltd’s proposal to tender offer for 4 million REE shares. Platinum Victory reserves the right to cancel the public offer at any time if it leads to a violation of foreign ownership regulations at REE.

Currently, Platinum Victory is REE’s largest shareholder, holding over 164 million shares, representing 34.8% of the company. If the tender offer is successful, Platinum Victory will increase its holdings to over 168 million shares, or 35.7% of the company’s capital.

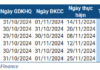

In early July 2024, Platinum Victory registered to publicly offer to purchase 4 million REE shares, representing 0.85% of the capital, at a proposed price of 80,000 VND per share. The expected amount of money is equivalent to 320 billion VND. This price is slightly higher than the historical peak of 74,000 VND that REE reached in mid-July. The current market price is fluctuating around 70,000 VND.

Platinum Victory is a subsidiary of Jardine Cycle & Carriage (JC&C), a leading company in Singapore in the field of automobile distribution in Southeast Asia, with member companies in Singapore, Malaysia, Indonesia, and Vietnam.

Jardine Cycle & Carriage is also a familiar name in the Vietnamese stock market. The company became a shareholder of REE in 2012 by purchasing bonds worth more than 557 billion VND from the company of “female general” Nguyen Thi Mai Thanh through Platinum Victory PTE Ltd.

Subsequently, the total amount of bonds was converted into 18.58% of REE’s shares, and JC&C gradually increased its ownership to nearly 35% as of today, becoming REE’s largest shareholder.

In addition to REE, Jardine Cycle & Carriage has also invested billions of dollars to own 10.6% of Vinamilk’s capital and 26.6% of THACO.

Based on market value, the REE and VNM shares held by JC&C are currently worth more than 28,200 billion VND.

According to our understanding, Jardine Cycle & Carriage was established in 1899 from a grocery store in Kuala Lumpur, selling everything from soap and screwdrivers to bicycles and later automobiles. In 1926, the company expanded to Singapore. By 2011, JC&C was acquired by the giant conglomerate Jardine Matherson, which currently owns 75% of JC&C.

In 2023, JC&C achieved revenue of over 22.2 billion USD (approximately 547,000 billion VND), a 3% increase compared to the same period last year. Net profit increased significantly by 64%, reaching over 1.2 billion USD.

The Retail Giant’s Chairman Makes a Move: Unveiling a Strategic Vision

On August 12, a multitude of listed companies submitted documents to the Ho Chi Minh City Stock Exchange (HoSE) and the Hanoi Stock Exchange (HNX) to disclose information as per regulations.