Illustrative image

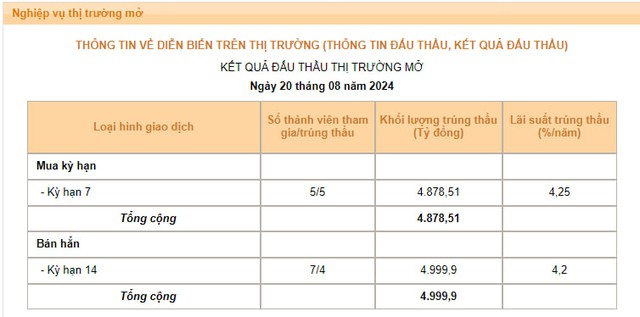

The trading session on August 20 witnessed a notable development as the State Bank of Vietnam (SBV) lowered the successful bid interest rate for treasury bills from 4.25%/year in the previous session to 4.2%/year. Specifically, the SBV issued a total of nearly VND 5,000 billion 14-day treasury bills to 4 market members.

This is the second time the SBV has cut the treasury bill interest rate since the beginning of August. Previously, in the August 5 session, the SBV reduced the treasury bill interest rate from 4.5%/year to 4.25%/year. At the same time, it lowered the lending rate for repurchase agreements from 4.5%/year to 4.25%/year.

Source: SBV

Analysts believe that the SBV’s move to cut the treasury bill interest rate is to support the liquidity of the banking system and establish a lower interbank interest rate level in the future.

On the other hand, the SBV’s move to cut the treasury bill interest rate comes as the exchange rate has weakened in recent days.

In the interbank market, the exchange rate closed yesterday’s session (August 19) at 24,974 VND/USD, down sharply by 87 VND compared to the end of the previous week. This is the first time since April 2024 that the USD exchange rate in the interbank market has traded below the 25,000 VND mark. Since the beginning of August, the interbank USD exchange rate has fallen by more than 1.3%.

The USD exchange rate listed at domestic banks also fell sharply this morning, with adjustments mostly in the range of around 100 VND/USD. Since the beginning of August, the USD exchange rate at this bank has decreased by about 350 VND, equivalent to 1.3%.

The exchange rate in the free market has also continuously dropped deeply and is currently trading at 25,350 – 25,430 VND/USD. This is the lowest level since March. The free-market exchange rate began to fall sharply in the past month, especially in the first half of August. Compared to the peak of nearly 26,000 VND set at the end of June, the current free-market USD exchange rate is lower by 600 VND, equivalent to a decrease of about 2.3%.

The quick cooling-down of the exchange rate will create favorable conditions for the State Bank to implement a looser monetary policy to support liquidity for the banking system and the economy.

Previously, in the second quarter and the first half of the third quarter, the SBV had to continuously maintain tight measures to curb the rising exchange rate, such as increasing OMO interest rates, increasing treasury bill interest rates, and selling foreign currencies. This has put pressure on the liquidity of the banking system and the interest rate environment in recent months.

Therefore, the SBV’s move to cut interest rates in the open market is considered necessary as credit growth is showing signs of acceleration and deposit interest rates have continuously increased in recent months.

“In the context of positive macroeconomic signals and the SBV’s orientation, liquidity is expected to stabilize and become more abundant, and interbank interest rates may fall again,” said Vietcombank Securities (VCBS) in a recent macroeconomic report.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.